Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(c) Liquidity risk<br />

Liquidity risk is a measure of the extent to which<br />

the Group may be required to raise funds to meet<br />

its commitments associated with fi nancial instruments.<br />

The Group maintains its liquidity profi les<br />

in accordance with regulations laid down by the<br />

NBS.<br />

The Group is exposed to daily calls on its available<br />

cash resources from overnight deposits, current<br />

accounts, maturing deposits, loan drawdowns,<br />

guarantees and from margin and other calls on<br />

cash settled derivatives. The Group sets limits on<br />

the minimum proportion of maturing funds available<br />

to meet such calls and on the minimum level of<br />

interbank and other borrowing facilities that should<br />

be in place to cover withdrawals at unexpected levels<br />

of demand.<br />

The daily liquidity position is monitored and regular<br />

liquidity stress-testing is performed. The daily<br />

liquidity position is limited by a set of liquidity limits<br />

for particular time buckets. The Group has approved<br />

the contingency liquidity plan, which defi nes<br />

how to identify potential liquidity problems and<br />

how to act in liquidity crisis situations. All liquidity<br />

policies and procedures are subject to review and<br />

approval by ALCO and Intesa Sanpaolo.<br />

The key measures used by the Group for managing<br />

medium and long term liquidity are two maturity<br />

mismatch rules.<br />

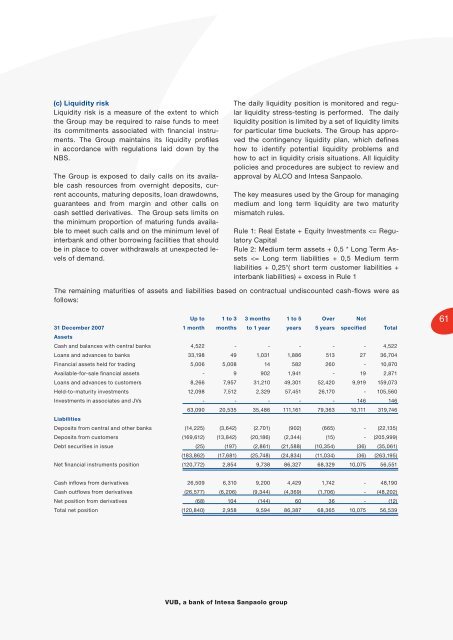

Rule 1: Real Estate + Equity Investments