Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

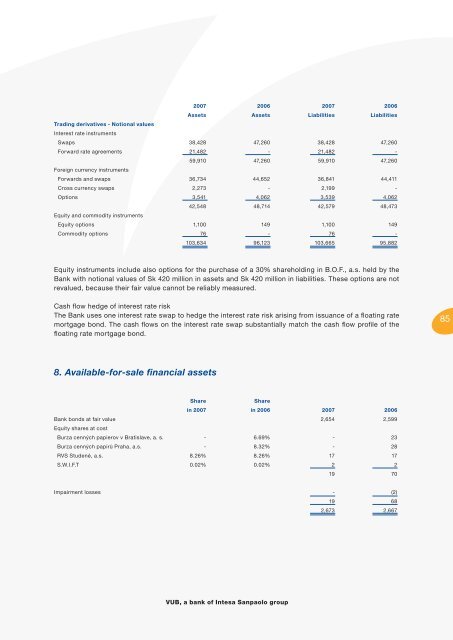

2007 2006 2007 2006<br />

Assets Assets Liabilities Liabilities<br />

Trading derivatives - Notional values<br />

Interest rate instruments<br />

Swaps 38,428 47,260 38,428 47,260<br />

Forward rate agreements 21,482 - 21,482 -<br />

59,910 47,260 59,910 47,260<br />

Foreign currency instruments<br />

Forwards and swaps 36,734 44,652 36,841 44,411<br />

Cross currency swaps 2,273 - 2,199 -<br />

Options 3,541 4,062 3,539 4,062<br />

42,548 48,714 42,579 48,473<br />

Equity and commodity instruments<br />

Equity options 1,100 149 1,100 149<br />

Commodity options 76 - 76 -<br />

103,634 96,123 103,665 95,882<br />

Equity instruments include also options for the purchase of a 30% shareholding in B.O.F., a.s. held by the<br />

Bank with notional values of Sk 420 million in assets and Sk 420 million in liabilities. These options are not<br />

revalued, because their fair value cannot be reliably measured.<br />

Cash fl ow hedge of interest rate risk<br />

The Bank uses one interest rate swap to hedge the interest rate risk arising from issuance of a fl oating rate<br />

mortgage bond. The cash fl ows on the interest rate swap substantially match the cash fl ow profi le of the<br />

fl oating rate mortgage bond.<br />

85<br />

8. Available-for-sale financial assets<br />

Share<br />

Share<br />

in 2007 in 2006 2007 2006<br />

Bank bonds at fair value 2,654 2,599<br />

Equity shares at cost<br />

Burza cenných papierov v Bratislave, a. s. - 6.69% - 23<br />

Burza cenných papirů Praha, a.s. - 8.32% - 28<br />

RVS Studené, a.s. 8.26% 8.26% 17 17<br />

S.W.I.F.T 0.02% 0.02% 2 2<br />

19 70<br />

Impairment losses - (2)<br />

19 68<br />

2,673 2,667<br />

VUB, a bank of Intesa Sanpaolo group