100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

101<br />

Property, plant and equipment<br />

Property, plant and equipment is measured at cost less depreciation and impairment losses within<br />

the meaning of IAS 16.<br />

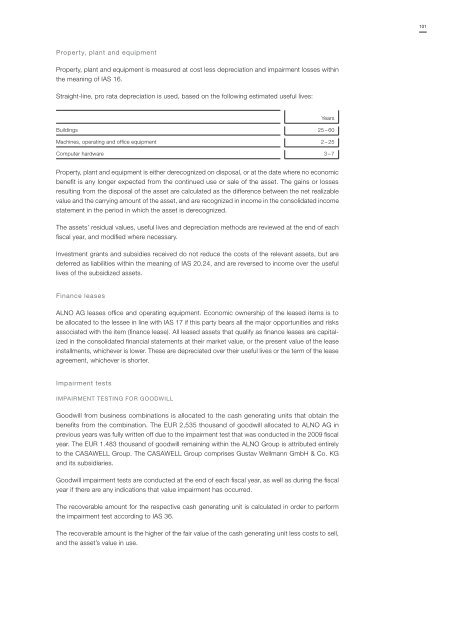

Straight-line, pro rata depreciation is used, based on the following estimated useful lives:<br />

Years<br />

Buildings 25 – 60<br />

Machines, operating and office equipment 2 – 25<br />

Computer hardware 3 – 7<br />

Property, plant and equipment is either derecognized on disposal, or at the date where no economic<br />

benefit is any longer expected from the continued use or sale of the asset. The gains or losses<br />

resulting from the disposal of the asset are calculated as the difference between the net realizable<br />

value and the carrying amount of the asset, and are recognized in income in the consolidated income<br />

statement in the period in which the asset is derecognized.<br />

The assets’ residual values, useful lives and depreciation methods are reviewed at the end of each<br />

fiscal year, and modified where necessary.<br />

Investment grants and subsidies received do not reduce the costs of the relevant assets, but are<br />

deferred as liabilities within the meaning of IAS 20.24, and are reversed to income over the useful<br />

lives of the subsidized assets.<br />

Finance leases<br />

<strong>ALNO</strong> AG leases office and operating equipment. Economic ownership of the leased items is to<br />

be allocated to the lessee in line with IAS 17 if this party bears all the major opportunities and risks<br />

associated with the item (finance lease). All leased assets that qualify as finance leases are capitalized<br />

in the consolidated financial statements at their market value, or the present value of the lease<br />

installments, whichever is lower. These are depreciated over their useful lives or the term of the lease<br />

agreement, whichever is shorter.<br />

Impairment tests<br />

IMPAIRMENT TESTING FOR GOODwILL<br />

Goodwill from business combinations is allocated to the cash generating units that obtain the<br />

benefits from the combination. The EUR 2,535 thousand of goodwill allocated to <strong>ALNO</strong> AG in<br />

previous years was fully written off due to the impairment test that was conducted in the 2009 fiscal<br />

year. The EUR 1.483 thousand of goodwill remaining within the <strong>ALNO</strong> Group is attributed entirely<br />

to the CASAWELL Group. The CASAWELL Group comprises Gustav Wellmann GmbH & Co. KG<br />

and its subsidiaries.<br />

Goodwill impairment tests are conducted at the end of each fiscal year, as well as during the fiscal<br />

year if there are any indications that value impairment has occurred.<br />

The recoverable amount for the respective cash generating unit is calculated in order to perform<br />

the impairment test according to IAS 36.<br />

The recoverable amount is the higher of the fair value of the cash generating unit less costs to sell,<br />

and the asset’s value in use.