100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88<br />

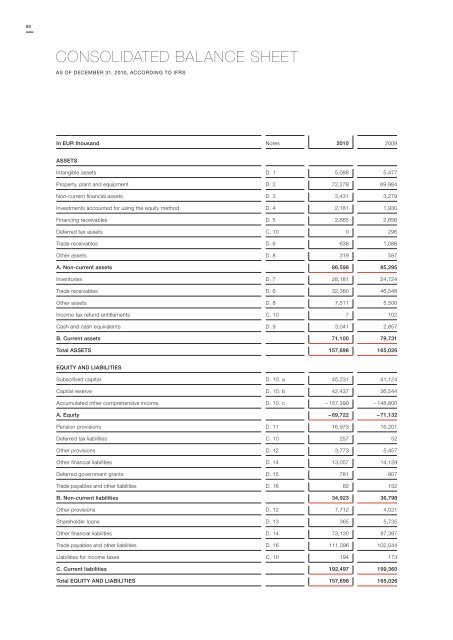

CONSOLIDATED BALANCE SHEET<br />

AS OF DECEMBER 31, 2010, ACCORDING TO IFRS<br />

In EUR thousand Notes 2010 2009<br />

ASSETS<br />

Intangible assets D. 1 5,088 5,477<br />

Property, plant and equipment D. 2 72,278 69,984<br />

Non-current financial assets D. 3 3,431 3,279<br />

Investments accounted for using the equity method D. 4 2,181 1,930<br />

Financing receivables D. 5 2,665 2,656<br />

Deferred tax assets C. 10 0 296<br />

Trade receivables D. 6 636 1,086<br />

Other assets D. 8 319 587<br />

A. Non-current assets 86,598 85,295<br />

Inventories D. 7 28,181 24,724<br />

Trade receivables D. 6 32,360 46,548<br />

Other assets D. 8 7,511 5,500<br />

Income tax refund entitlements C. 10 7 102<br />

Cash and cash equivalents D. 9 3,041 2,857<br />

B. Current assets 71,<strong>100</strong> 79,731<br />

Total ASSETS 157,698 165,026<br />

EqUITy AND LIABILITIES<br />

Subscribed capital D. 10. a 45,231 41,124<br />

Capital reserve D. 10. b 42,437 36,544<br />

Accumulated other comprehensive income D. 10. c – 157,390 – 148,800<br />

A. Equity – 69,722 – 71,132<br />

Pension provisions D. 11 16,973 16,201<br />

Deferred tax liabilities C. 10 257 52<br />

Other provisions D. 12 3,773 5,457<br />

Other financial liabilities D. 14 13,057 14,129<br />

Deferred government grants D. 15 781 807<br />

Trade payables and other liabilities D. 16 82 152<br />

B. Non-current liabilities 34,923 36,798<br />

Other provisions D. 12 7,712 4,021<br />

Shareholder loans D. 13 365 5,735<br />

Other financial liabilities D. 14 73,130 87,387<br />

Trade payables and other liabilities D. 16 111,096 102,044<br />

Liabilities for income taxes C. 10 194 173<br />

C. Current liabilities 192,497 199,360<br />

Total EqUITy AND LIABILITIES 157,698 165,026