100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

the period under review with the successful placing of the capital increase, and the conclusion of<br />

a further restructuring agreement (please see “B. Report on events after the balance sheet date”).<br />

Non-current liabilities amounted to EUR 34.9 million as of the end of 2010, compared with EUR 36.8<br />

million. Pension provisions rose from EUR 16.2 million to EUR 17.0 million due to general interest-rate<br />

adjustments. Other non-current financial liabilities, which primarily include bank borrowings, fell from<br />

EUR 14.1 million as of December 31, 2009 to EUR 13.1 million.<br />

Current liabilities, by contrast, were reduced from EUR 199.4 million to EUR 192.5 million. Among<br />

other factors, this was due to a loan waiver on the part of the four consortium banks in an amount of<br />

EUR 10.0 million. Other financing liabilities fell in this connection from EUR 87.4 million to EUR 73.1<br />

million. The largest item in this context reflects bank borrowings of EUR 67.7 million (previous year:<br />

EUR 80.3 million). Current trade payables and other liabilities increased from EUR 102.0 million to<br />

EUR 111.1 million due to the greater utilization of supplier loans over the course of 2010.<br />

Liquidity and financial position<br />

Cash flow from operating activities amounted to EUR 11.5 million in 2010, compared with EUR 21.2<br />

million in the previous year. This was particularly due to the lower balance on interest payments,<br />

and the financial result.<br />

Net funds of EUR 14.3 million were deployed for investments (previous year: EUR 16.0 million),<br />

which were almost fully attributable to investments in property, plant and equipment.<br />

Cash flow from financing activities stood at EUR 2.5 million (previous year: EUR – 5.3 million). This<br />

item is mainly composed of inflows from capital increases (EUR 10.0 million), and from the drawing<br />

down of financial liabilities (EUR 1.5 million). This was offset by the redemption of financial liabilities<br />

(EUR – 7.5 million), and outgoing payments for financing costs (EUR – 1.5 million).<br />

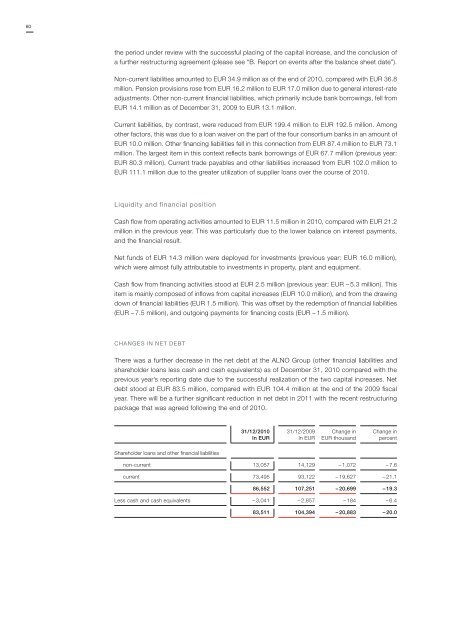

CHANGES IN NET DEBT<br />

There was a further decrease in the net debt at the <strong>ALNO</strong> Group (other financial liabilities and<br />

shareholder loans less cash and cash equivalents) as of December 31, 2010 compared with the<br />

previous year’s reporting date due to the successful realization of the two capital increases. Net<br />

debt stood at EUR 83.5 million, compared with EUR 104.4 million at the end of the 2009 fiscal<br />

year. There will be a further significant reduction in net debt in 2011 with the recent restructuring<br />

package that was agreed following the end of 2010.<br />

31/12/2010<br />

In EUR<br />

31/12/2009<br />

In EUR<br />

Change in<br />

EUR thousand<br />

Change in<br />

percent<br />

Shareholder loans and other financial liabilities<br />

non-current 13,057 14,129 – 1,072 – 7.6<br />

current 73,495 93,122 – 19,627 – 21.1<br />

86,552 107,251 – 20,699 – 19.3<br />

Less cash and cash equivalents – 3,041 – 2,857 – 184 – 6.4<br />

83,511 104,394 – 20,883 – 20.0