100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

111<br />

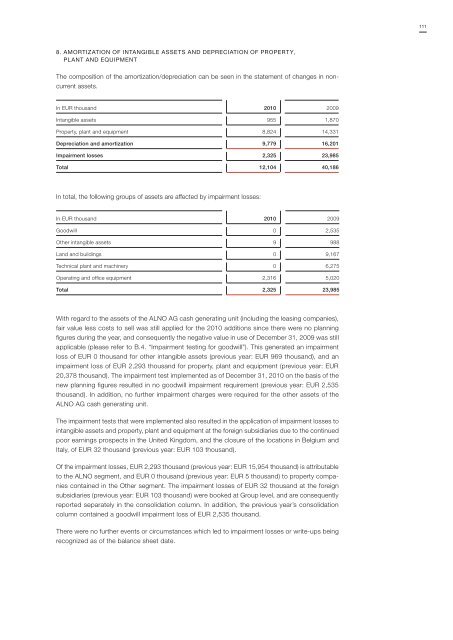

8. AMORTIZATION OF INTANGIBLE ASSETS AND DEPRECIATION OF PROPERTY,<br />

PLANT AND EQUIPMENT<br />

The composition of the amortization/depreciation can be seen in the statement of changes in noncurrent<br />

assets.<br />

In EUR thousand 2010 2009<br />

Intangible assets 955 1,870<br />

Property, plant and equipment 8,824 14,331<br />

Depreciation and amortization 9,779 16,201<br />

Impairment losses 2,325 23,985<br />

Total 12,104 40,186<br />

In total, the following groups of assets are affected by impairment losses:<br />

In EUR thousand 2010 2009<br />

Goodwill 0 2,535<br />

Other intangible assets 9 988<br />

Land and buildings 0 9,167<br />

Technical plant and machinery 0 6,275<br />

Operating and office equipment 2,316 5,020<br />

Total 2,325 23,985<br />

With regard to the assets of the <strong>ALNO</strong> AG cash generating unit (including the leasing companies),<br />

fair value less costs to sell was still applied for the 2010 additions since there were no planning<br />

figures during the year, and consequently the negative value in use of December 31, 2009 was still<br />

applicable (please refer to B.4. “Impairment testing for goodwill”). This generated an impairment<br />

loss of EUR 0 thousand for other intangible assets (previous year: EUR 969 thousand), and an<br />

impairment loss of EUR 2,293 thousand for property, plant and equipment (previous year: EUR<br />

20,378 thousand). The impairment test implemented as of December 31, 2010 on the basis of the<br />

new planning figures resulted in no goodwill impairment requirement (previous year: EUR 2,535<br />

thousand). In addition, no further impairment charges were required for the other assets of the<br />

<strong>ALNO</strong> AG cash generating unit.<br />

The impairment tests that were implemented also resulted in the application of impairment losses to<br />

intangible assets and property, plant and equipment at the foreign subsidiaries due to the continued<br />

poor earnings prospects in the United Kingdom, and the closure of the locations in Belgium and<br />

Italy, of EUR 32 thousand (previous year: EUR 103 thousand).<br />

Of the impairment losses, EUR 2,293 thousand (previous year: EUR 15,954 thousand) is attributable<br />

to the <strong>ALNO</strong> segment, and EUR 0 thousand (previous year: EUR 5 thousand) to property companies<br />

contained in the Other segment. The impairment losses of EUR 32 thousand at the foreign<br />

subsidiaries (previous year: EUR 103 thousand) were booked at Group level, and are consequently<br />

reported separately in the consolidation column. In addition, the previous year’s consolidation<br />

column contained a goodwill impairment loss of EUR 2,535 thousand.<br />

There were no further events or circumstances which led to impairment losses or write-ups being<br />

recognized as of the balance sheet date.