100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

127<br />

c. Accumulated other comprehensive income<br />

With regard to the changes in accumulated other comprehensive income, please refer to the statement of<br />

changes in consolidated equity, and the consolidated statement of comprehensive income.<br />

Accumulated other comprehensive income includes consolidated retained earnings, the IPO costs taken<br />

directly to equity, the currency translation reserve, and other transactions taken directly to equity.<br />

Consolidated retained earnings include the accumulated consolidated earnings for the reporting period,<br />

IPO costs taken directly to equity, and the reserve arising from re-measurements applied as of the date of<br />

first-time application of IFRS. The receivables waiver of EUR 4,909 thousand (previous year: EUR 5,000<br />

thousand) that was issued by the shareholders was also carried under this item in the year under review.<br />

The other transactions taken directly to equity relate to the actuarial gains and losses from the pension<br />

provisions, changes in the fair value of securities, and the respective associated deferred taxes. The<br />

amounts reported in 2010 are presented in the consolidated statement of comprehensive income.<br />

d. Capital management<br />

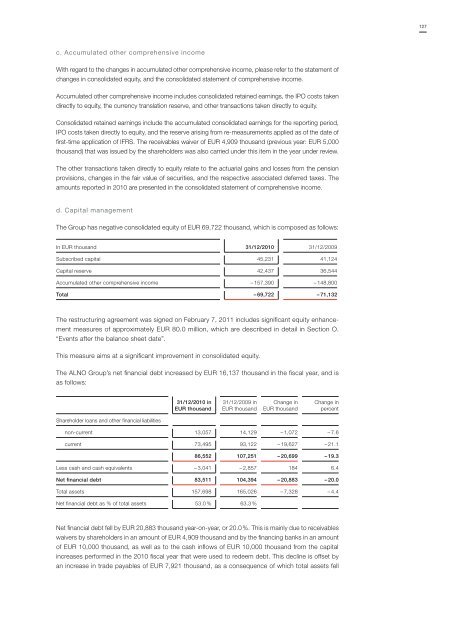

The Group has negative consolidated equity of EUR 69,722 thousand, which is composed as follows:<br />

In EUR thousand 31/12/2010 31/12/2009<br />

Subscribed capital 45,231 41,124<br />

Capital reserve 42,437 36,544<br />

Accumulated other comprehensive income – 157,390 – 148,800<br />

Total – 69,722 – 71,132<br />

The restructuring agreement was signed on February 7, 2011 includes significant equity enhancement<br />

measures of approximately EUR 80.0 million, which are described in detail in Section O.<br />

“Events after the balance sheet date”.<br />

This measure aims at a significant improvement in consolidated equity.<br />

The <strong>ALNO</strong> Group’s net financial debt increased by EUR 16,137 thousand in the fiscal year, and is<br />

as follows:<br />

31/12/2010 in<br />

EUR thousand<br />

31/12/2009 in<br />

EUR thousand<br />

Change in<br />

EUR thousand<br />

Change in<br />

percent<br />

Shareholder loans and other financial liabilities<br />

non-current 13,057 14,129 – 1,072 – 7.6<br />

current 73,495 93,122 – 19,627 – 21.1<br />

86,552 107,251 – 20,699 – 19.3<br />

Less cash and cash equivalents – 3,041 – 2,857 184 6.4<br />

Net financial debt 83,511 104,394 – 20,883 – 20.0<br />

Total assets 157,698 165,026 – 7,328 – 4.4<br />

Net financial debt as % of total assets 53.0 % 63.3 %<br />

Net financial debt fell by EUR 20,883 thousand year-on-year, or 20.0 %. This is mainly due to receivables<br />

waivers by shareholders in an amount of EUR 4,909 thousand and by the financing banks in an amount<br />

of EUR 10,000 thousand, as well as to the cash inflows of EUR 10,000 thousand from the capital<br />

increases performed in the 2010 fiscal year that were used to redeem debt. This decline is offset by<br />

an increase in trade payables of EUR 7,921 thousand, as a consequence of which total assets fell