100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

61<br />

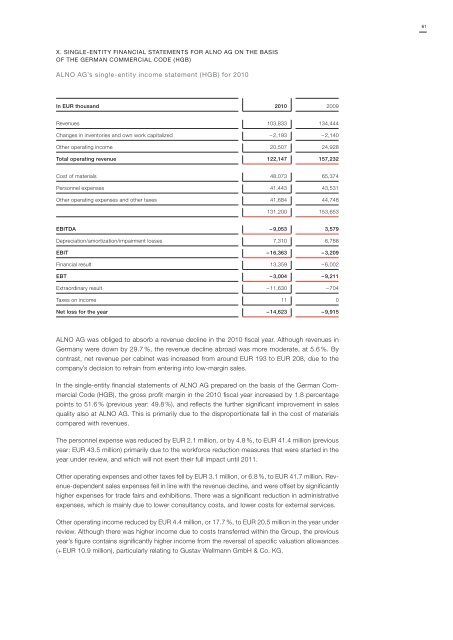

X. SINGLE-ENTITY FINANCIAL STATEMENTS FOR <strong>ALNO</strong> AG ON THE BASIS<br />

OF THE GERMAN COMMERCIAL CODE (HGB)<br />

<strong>ALNO</strong> AG’s single-entity income statement (HGB) for 2010<br />

In EUR thousand 2010 2009<br />

Revenues 103,833 134,444<br />

Changes in inventories and own work capitalized – 2,193 – 2,140<br />

Other operating income 20,507 24,928<br />

Total operating revenue 122,147 157,232<br />

Cost of materials 48,073 65,374<br />

Personnel expenses 41,443 43,531<br />

Other operating expenses and other taxes 41,684 44,748<br />

131,200 153,653<br />

EBITDA – 9,053 3,579<br />

Depreciation/amortization/impairment losses 7,310 6,788<br />

EBIT – 16,363 – 3,209<br />

Financial result 13,359 – 6,002<br />

EBT – 3,004 – 9,211<br />

Extraordinary result – 11,630 – 704<br />

Taxes on income 11 0<br />

Net loss for the year – 14,623 – 9,915<br />

<strong>ALNO</strong> AG was obliged to absorb a revenue decline in the 2010 fiscal year. Although revenues in<br />

Germany were down by 29.7 %, the revenue decline abroad was more moderate, at 5.6 %. By<br />

contrast, net revenue per cabinet was increased from around EUR 193 to EUR 208, due to the<br />

company’s decision to refrain from entering into low-margin sales.<br />

In the single-entity financial statements of <strong>ALNO</strong> AG prepared on the basis of the German Commercial<br />

Code (HGB), the gross profit margin in the 2010 fiscal year increased by 1.8 percentage<br />

points to 51.6 % (previous year: 49.8 %), and reflects the further significant improvement in sales<br />

quality also at <strong>ALNO</strong> AG. This is primarily due to the disproportionate fall in the cost of materials<br />

compared with revenues.<br />

The personnel expense was reduced by EUR 2.1 million, or by 4.8 %, to EUR 41.4 million (previous<br />

year: EUR 43.5 million) primarily due to the workforce reduction measures that were started in the<br />

year under review, and which will not exert their full impact until 2011.<br />

Other operating expenses and other taxes fell by EUR 3.1 million, or 6.8 %, to EUR 41.7 million. Revenue-dependent<br />

sales expenses fell in line with the revenue decline, and were offset by significantly<br />

higher expenses for trade fairs and exhibitions. There was a significant reduction in administrative<br />

expenses, which is mainly due to lower consultancy costs, and lower costs for external services.<br />

Other operating income reduced by EUR 4.4 million, or 17.7 %, to EUR 20.5 million in the year under<br />

review. Although there was higher income due to costs transferred within the Group, the previous<br />

year’s figure contains significantly higher income from the reversal of specific valuation allowances<br />

(+ EUR 10.9 million), particularly relating to Gustav Wellmann GmbH & Co. KG.