100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62<br />

There was a significant, EUR 19.4 million, year-on-year improvement in the financial result. This<br />

increase in financial income resulted mainly from the earnings-effective reporting of the “Banks’ Loan<br />

Waiver (Part)” of EUR 10.0 million pursuant to the Restructuring Agreement of April 23, 2010, since<br />

the company was successful in implementing the suspensive conditions arising from this restructuring<br />

agreement for this portion of the banking waiver. The marked decline in interest expenses is attributable<br />

to lower interest charges negotiated as part of this restructuring agreement. This item was also<br />

affected in the previous year by interest payments arising from several shareholder loans, expenses<br />

arising from the planned capital increase that was finally postponed, and expenses arising from<br />

derivative financial instruments. Impairment losses of EUR 2.8 million will also apply to participating<br />

interests in associated companies (previously: EUR 7.6 million). There was a EUR 3.7 million improvement<br />

in the net balance of income and expenses arising from profit-and-loss transfer agreements.<br />

The extraordinary result deteriorated by EUR 10.9 million year-on-year, which is attributable to workforce<br />

reduction expenses of EUR 7.5 million at the Pfullendorf site, consultancy costs of EUR 0.7<br />

million connected with the restructuring, and EUR 0.2 million of expenses incurred as part of the<br />

liquidation of subsidiaries. In addition, the transition to the German Accounting Law Modernization<br />

Act (“BilMoG”) as of January 1, 2010 resulted in an extremely charge of EUR 3.2 million.<br />

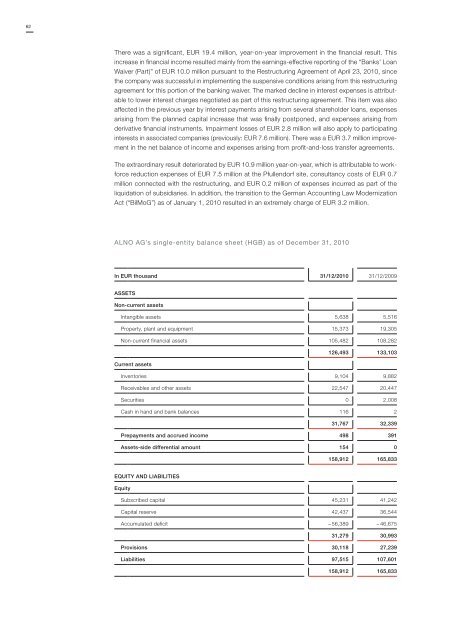

<strong>ALNO</strong> AG’s single-entity balance sheet (HGB) as of December 31, 2010<br />

In EUR thousand 31/12/2010 31/12/2009<br />

ASSETS<br />

Non-current assets<br />

Intangible assets 5,638 5,516<br />

Property, plant and equipment 15,373 19,305<br />

Non-current financial assets 105,482 108,282<br />

126,493 133,103<br />

Current assets<br />

Inventories 9,104 9,882<br />

Receivables and other assets 22,547 20,447<br />

Securities 0 2,008<br />

Cash in hand and bank balances 116 2<br />

31,767 32,339<br />

Prepayments and accrued income 498 391<br />

Assets-side differential amount 154 0<br />

158,912 165,833<br />

EQUITY AND LIABILITIES<br />

Equity<br />

Subscribed capital 45,231 41,242<br />

Capital reserve 42,437 36,544<br />

Accumulated deficit – 56,389 – 46,675<br />

31,279 30,993<br />

Provisions 30,118 27,239<br />

Liabilities 97,515 107,601<br />

158,912 165,833