100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

142<br />

The impairments on “loans and receivables” relate to the allocation to individual value allowances<br />

on trade receivables. Other net gains and losses include income from the collection of receivables<br />

written off, and from the reversal of individual value allowances, as well as expenses of writing off<br />

receivables.<br />

The other net gains and losses reported in the category “available-for-sale – measured at fair value”<br />

include income from securities investments, and the unrealized value changes recognized in equity.<br />

The other net losses in the “financial liabilities held-for-trading” category relate to the expenses<br />

arising from derivative financial instruments.<br />

Other net gains and losses from “financial liabilities measured cost” include income from derecognized<br />

liabilities, the income from the declared receivables waiver including debtor warrant, and the<br />

expense arising from the reporting date measurement of foreign currency loans.<br />

I. CONTINGENCIES AND OTHER<br />

FINANCIAL OBLIGATIONS<br />

As of December 31, 2010, there are liabilities under guarantee agreements amounting to EUR 406<br />

thousand (previous year: EUR 339 thousand).<br />

The EUR 10,000 thousand loan waiver by the consortium banks includes a debtor warrant whereby<br />

the liabilities are reactivated depending on the achievement of a given key quantity as of December<br />

31, 2013. On the basis of current planning, it is not anticipated that this key quantity will be achieved.<br />

There will also be a full waiver of the liability if the conditions mentioned under Point O. occur. The<br />

last condition was satisfied on March 4, 2011.<br />

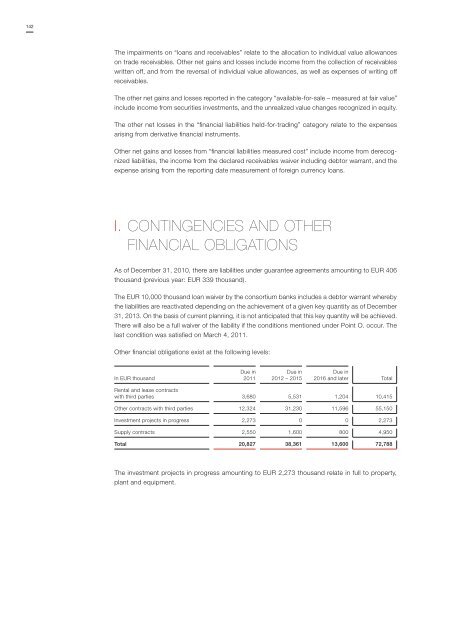

Other financial obligations exist at the following levels:<br />

In EUR thousand<br />

Due in<br />

2011<br />

Due in<br />

2012 – 2015<br />

Due in<br />

2016 and later Total<br />

Rental and lease contracts<br />

with third parties 3,680 5,531 1,204 10,415<br />

Other contracts with third parties 12,324 31,230 11,596 55,150<br />

Investment projects in progress 2,273 0 0 2,273<br />

Supply contracts 2,550 1,600 800 4,950<br />

Total 20,827 38,361 13,600 72,788<br />

The investment projects in progress amounting to EUR 2,273 thousand relate in full to property,<br />

plant and equipment.