100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

131<br />

13. SHAREHOLDER LOANS<br />

During the fiscal year, there were financial liabilities of EUR 365 thousand (previous year: EUR 5,375<br />

thousand), which were granted by shareholders of <strong>ALNO</strong> AG.<br />

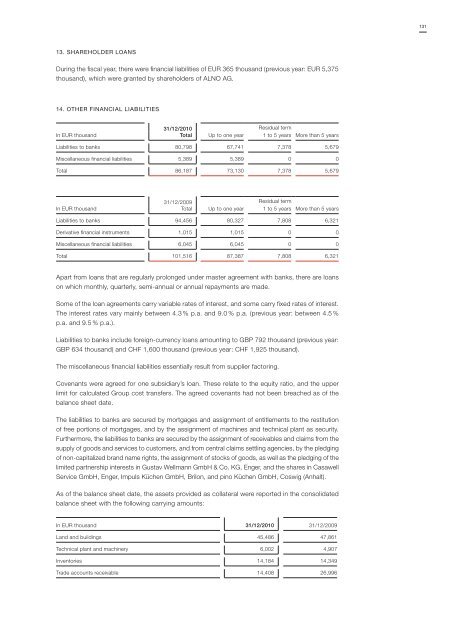

14. OTHER FINANCIAL LIABILITIES<br />

In EUR thousand<br />

31/12/2010<br />

Total<br />

Residual term<br />

Up to one year 1 to 5 years More than 5 years<br />

Liabilities to banks 80,798 67,741 7,378 5,679<br />

Miscellaneous financial liabilities 5,389 5,389 0 0<br />

Total 86,187 73,130 7,378 5,679<br />

In EUR thousand<br />

31/12/2009<br />

Total<br />

Total<br />

Residual term<br />

Up to one year 1 to 5 years More than 5 years<br />

Liabilities to banks 94,456 80,327 7,808 6,321<br />

Derivative financial instruments 1,015 1,015 0 0<br />

Miscellaneous financial liabilities 6,045 6,045 0 0<br />

Total 101,516 87,387 7,808 6,321<br />

Apart from loans that are regularly prolonged under master agreement with banks, there are loans<br />

on which monthly, quarterly, semi-annual or annual repayments are made.<br />

Some of the loan agreements carry variable rates of interest, and some carry fixed rates of interest.<br />

The interest rates vary mainly between 4.3 % p.a. and 9.0 % p.a. (previous year: between 4.5 %<br />

p.a. and 9.5 % p.a.).<br />

Liabilities to banks include foreign-currency loans amounting to GBP 792 thousand (previous year:<br />

GBP 634 thousand) and CHF 1,600 thousand (previous year: CHF 1,925 thousand).<br />

The miscellaneous financial liabilities essentially result from supplier factoring.<br />

Covenants were agreed for one subsidiary’s loan. These relate to the equity ratio, and the upper<br />

limit for calculated Group cost transfers. The agreed covenants had not been breached as of the<br />

balance sheet date.<br />

The liabilities to banks are secured by mortgages and assignment of entitlements to the restitution<br />

of free portions of mortgages, and by the assignment of machines and technical plant as security.<br />

Furthermore, the liabilities to banks are secured by the assignment of receivables and claims from the<br />

supply of goods and services to customers, and from central claims settling agencies, by the pledging<br />

of non-capitalized brand name rights, the assignment of stocks of goods, as well as the pledging of the<br />

limited partnership interests in Gustav Wellmann GmbH & Co. KG, Enger, and the shares in Casawell<br />

Service GmbH, Enger, Impuls Küchen GmbH, Brilon, and pino Küchen GmbH, Coswig (Anhalt).<br />

As of the balance sheet date, the assets provided as collateral were reported in the consolidated<br />

balance sheet with the following carrying amounts:<br />

In EUR thousand 31/12/2010 31/12/2009<br />

Land and buildings 45,486 47,861<br />

Technical plant and machinery 6,002 4,907<br />

Inventories 14,184 14,349<br />

Trade accounts receivable 14,408 26,996