100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

113<br />

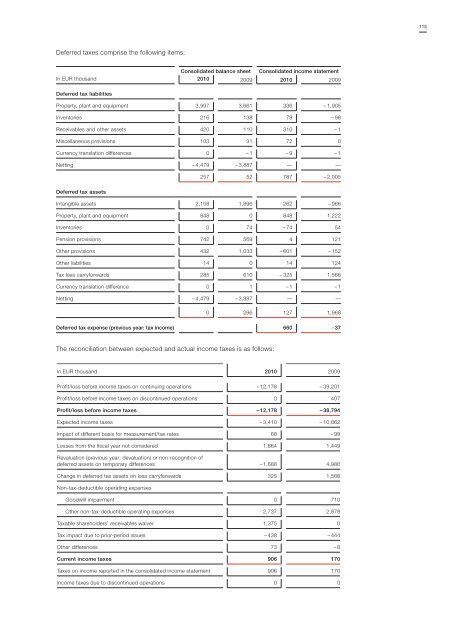

Deferred taxes comprise the following items:<br />

In EUR thousand<br />

Consolidated balance sheet Consolidated income statement<br />

2010 2009 2010 2009<br />

Deferred tax liabilities<br />

Property, plant and equipment 3,997 3,661 336 – 1,905<br />

Inventories 216 138 78 – 98<br />

Receivables and other assets 420 110 310 – 1<br />

Miscellaneous provisions 103 31 72 0<br />

Currency translation differences 0 – 1 – 9 – 1<br />

Netting – 4,479 – 3,887 — —<br />

257 52 787 – 2,005<br />

Deferred tax assets<br />

Intangible assets 2,158 1,896 262 – 966<br />

Property, plant and equipment 848 0 848 1,222<br />

Inventories 0 74 – 74 54<br />

Pension provisions 742 569 4 121<br />

Other provisions 432 1,033 – 601 – 152<br />

Other liabilities 14 0 14 124<br />

Tax loss carryforwards 285 610 – 325 1,566<br />

Currency translation difference 0 1 – 1 – 1<br />

Netting – 4,479 – 3,887 — —<br />

0 296 127 1,968<br />

Deferred tax expense (previous year: tax income) 660 – 37<br />

The reconciliation between expected and actual income taxes is as follows:<br />

In EUR thousand 2010 2009<br />

Profit/loss before income taxes on continuing operations – 12,178 – 39,201<br />

Profit/loss before income taxes on discontinued operations 0 407<br />

Profit/loss before income taxes – 12,178 – 38,794<br />

Expected income taxes – 3,410 – 10,862<br />

Impact of different basis for measurement/tax rates 68 – 99<br />

Losses from the fiscal year not considered 1,864 1,449<br />

Revaluation (previous year: devaluation) or non-recognition of<br />

deferred assets on temporary differences – 1,688 4,980<br />

Change in deferred tax assets on loss carryforwards 325 1,566<br />

Non-tax-deductible operating expenses<br />

Goodwill impairment 0 710<br />

Other non-tax-deductible operating expenses 2,737 2,878<br />

Taxable shareholders’ receivables waiver 1,375 0<br />

Tax impact due to prior-period issues – 438 – 444<br />

Other differences 73 – 8<br />

Current income taxes 906 170<br />

Taxes on income reported in the consolidated income statement 906 170<br />

Income taxes due to discontinued operations 0 0