100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

79<br />

Further details on the members of the Managing and Supervisory boards, and on the remuneration<br />

paid to the Managing Board, are provided in this annual report in the notes to the consolidated<br />

financial statements under point K.<br />

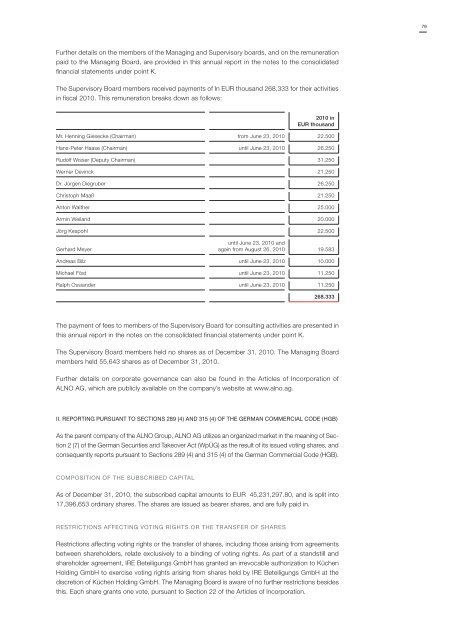

The Supervisory Board members received payments of In EUR thousand 268,333 for their activities<br />

in fiscal 2010. This remuneration breaks down as follows:<br />

2010 in<br />

EUR thousand<br />

Mr. Henning Giesecke (Chairman) from June 23, 2010 22.500<br />

Hans-Peter Haase (Chairman) until June 23, 2010 26.250<br />

Rudolf Wisser (Deputy Chairman) 31.250<br />

Werner Devinck 21.250<br />

Dr. Jürgen Diegruber 26.250<br />

Christoph Maaß 21.250<br />

Anton Walther 25.000<br />

Armin Weiland 20.000<br />

Jörg Kespohl 22.500<br />

Gerhard Meyer<br />

until June 23, 2010 and<br />

again from August 26, 2010 19.583<br />

Andreas Bilz until June 23, 2010 10.000<br />

Michael Föst until June 23, 2010 11.250<br />

Ralph Ossiander until June 23, 2010 11.250<br />

268.333<br />

The payment of fees to members of the Supervisory Board for consulting activities are presented in<br />

this annual report in the notes on the consolidated financial statements under point K.<br />

The Supervisory Board members held no shares as of December 31, 2010. The Managing Board<br />

members held 55,643 shares as of December 31, 2010.<br />

Further details on corporate governance can also be found in the Articles of Incorporation of<br />

<strong>ALNO</strong> AG, which are publicly available on the company’s website at www.alno.ag.<br />

II. REPORTING PURSUANT TO SECTIONS 289 (4) AND 315 (4) OF THE GERMAN COMMERCIAL CODE (HGB)<br />

As the parent company of the <strong>ALNO</strong> Group, <strong>ALNO</strong> AG utilizes an organized market in the meaning of Section<br />

2 (7) of the German Securities and Takeover Act (WpÜG) as the result of its issued voting shares, and<br />

consequently reports pursuant to Sections 289 (4) and 315 (4) of the German Commercial Code (HGB).<br />

COMPOSITION OF THE SUBSCRIBED CAPITAL<br />

As of December 31, 2010, the subscribed capital amounts to EUR 45,231,297.80, and is split into<br />

17,396,653 ordinary shares. The shares are issued as bearer shares, and are fully paid in.<br />

RESTRICTIONS AFFECTING VOTING RIGHTS OR THE TRANSFER OF SHARES<br />

Restrictions affecting voting rights or the transfer of shares, including those arising from agreements<br />

between shareholders, relate exclusively to a binding of voting rights. As part of a standstill and<br />

shareholder agreement, IRE Beteiligungs GmbH has granted an irrevocable authorization to Küchen<br />

Holding GmbH to exercise voting rights arising from shares held by IRE Beteiligungs GmbH at the<br />

discretion of Küchen Holding GmbH. The Managing Board is aware of no further restrictions besides<br />

this. Each share grants one vote, pursuant to Section 22 of the Articles of Incorporation.