100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

126<br />

The Managing Board is authorized, with the Supervisory Board’s assent, to utilize the company’s<br />

shares, which are acquired on the basis of this authorization or on the basis of an authorization that<br />

was issued at an earlier time, for the following purposes:<br />

The shares may also be sold in another manner than through the stock market or by offer to all<br />

shareholders, if the shares are sold in return for cash payment at a price that is not significantly less<br />

than the company’s stock market price at the time of disposal. This authorization applies only to the<br />

extent, however, that shares sold on the basis of this authorization may not exceed a proportional<br />

amount equivalent to a total of 10 % of the share capital, neither on the date when this authorization<br />

becomes effective, nor on the date when this authorization is exercised. The maximum 10 % limit<br />

reduces by the proportional amount of the share capital attributable to those shares that are issued<br />

during the duration of this authorization as part of a capital increase under exclusion of subscription<br />

rights pursuant to Section 186 (3) Sentence 4 of the German Stock Corporation Act (AktG). The<br />

10 % maximum limit is also reduced by the proportional amount of the share capital attributable to<br />

those shares that were issued to service bonds with conversion or option rights, or which are to<br />

be issued, to the extent that the bonds were issued during the period of this authorization under<br />

exclusion of subscription rights in corresponding application of Section 186 (3) Sentence 4 of the<br />

German Stock Corporation Act (AktG).<br />

The shares may be sold in return for non-cash payment, particularly also in connection with the<br />

business combinations, and the acquisition of companies, parts of companies, and participating<br />

interests in companies.<br />

The shares may be offered for purchase to individuals who are employed by the company or by its<br />

associated companies.<br />

The shares may be utilized to satisfy the company’s obligation arising from bonds with warrants<br />

and/or convertible bonds that are issued or guaranteed by it in the future.<br />

The authorization may be exercised either wholly or in partial amounts, once or on several occasions,<br />

and in the pursuit of one or several purposes by the company. Shareholders’ subscription rights<br />

to these treasury shares are excluded to this extent. Above and beyond this, the Managing Board,<br />

with Supervisory Board assent, may exclude subscription rights for fractional amounts when selling<br />

treasury shares as part of an offer to all of the company’s shareholders.<br />

The Managing Board is also authorized to withdraw and cancel the acquired treasury shares, with<br />

the Supervisory Board’s assent, and without a further resolution being required to be passed by<br />

the Shareholders’ General Meeting.<br />

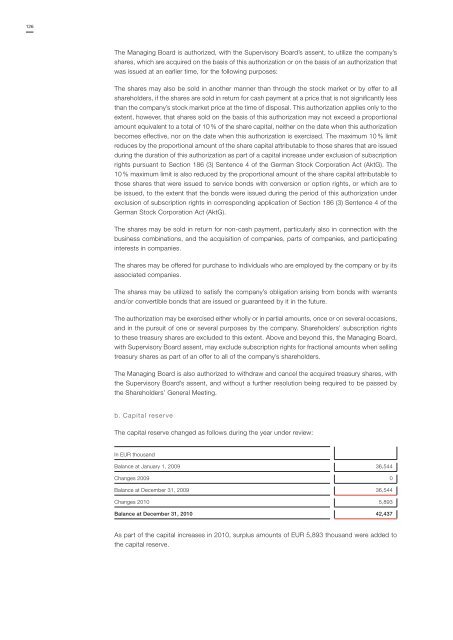

b. Capital reserve<br />

The capital reserve changed as follows during the year under review:<br />

In EUR thousand<br />

Balance at January 1, 2009 36,544<br />

Changes 2009 0<br />

Balance at December 31, 2009 36,544<br />

Changes 2010 5,893<br />

Balance at December 31, 2010 42,437<br />

As part of the capital increases in 2010, surplus amounts of EUR 5,893 thousand were added to<br />

the capital reserve.