100 % FUTURE - ALNO

100 % FUTURE - ALNO

100 % FUTURE - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

141<br />

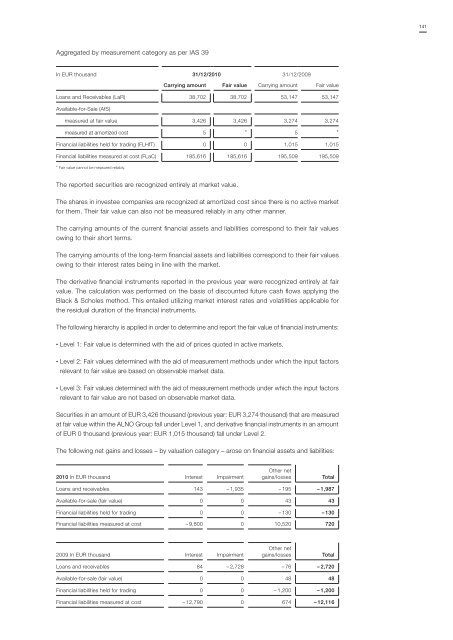

Aggregated by measurement category as per IAS 39<br />

In EUR thousand 31/12/2010 31/12/2009<br />

Carrying amount Fair value Carrying amount Fair value<br />

Loans and Receivables (LaR) 38,702 38,702 53,147 53,147<br />

Available-for-Sale (AfS)<br />

measured at fair value 3,426 3,426 3,274 3,274<br />

measured at amortized cost 5 * 5 *<br />

Financial liabilities held for trading (FLHfT) 0 0 1,015 1,015<br />

Financial liabilities measured at cost (FLaC) 185,616 185,616 195,509 195,509<br />

* Fair value cannot be measured reliably.<br />

The reported securities are recognized entirely at market value.<br />

The shares in investee companies are recognized at amortized cost since there is no active market<br />

for them. Their fair value can also not be measured reliably in any other manner.<br />

The carrying amounts of the current financial assets and liabilities correspond to their fair values<br />

owing to their short terms.<br />

The carrying amounts of the long-term financial assets and liabilities correspond to their fair values<br />

owing to their interest rates being in line with the market.<br />

The derivative financial instruments reported in the previous year were recognized entirely at fair<br />

value. The calculation was performed on the basis of discounted future cash flows applying the<br />

Black & Scholes method. This entailed utilizing market interest rates and volatilities applicable for<br />

the residual duration of the financial instruments.<br />

The following hierarchy is applied in order to determine and report the fair value of financial instruments:<br />

• Level 1: Fair value is determined with the aid of prices quoted in active markets.<br />

• Level 2: Fair values determined with the aid of measurement methods under which the input factors<br />

relevant to fair value are based on observable market data.<br />

• Level 3: Fair values determined with the aid of measurement methods under which the input factors<br />

relevant to fair value are not based on observable market data.<br />

Securities in an amount of EUR 3,426 thousand (previous year: EUR 3,274 thousand) that are measured<br />

at fair value within the <strong>ALNO</strong> Group fall under Level 1, and derivative financial instruments in an amount<br />

of EUR 0 thousand (previous year: EUR 1,015 thousand) fall under Level 2.<br />

The following net gains and losses – by valuation category – arose on financial assets and liabilities:<br />

2010 In EUR thousand Interest Impairment<br />

Other net<br />

gains/losses<br />

Total<br />

Loans and receivables 143 – 1,935 – 195 – 1,987<br />

Available-for-sale (fair value) 0 0 43 43<br />

Financial liabilities held for trading 0 0 – 130 – 130<br />

Financial liabilities measured at cost – 9,800 0 10,520 720<br />

2009 In EUR thousand Interest Impairment<br />

Other net<br />

gains/losses<br />

Total<br />

Loans and receivables 84 – 2,728 – 76 – 2,720<br />

Available-for-sale (fair value) 0 0 48 48<br />

Financial liabilities held for trading 0 0 – 1,200 – 1,200<br />

Financial liabilities measured at cost – 12,790 0 674 – 12,116