Download sector_report1.pdf - Microfinance and Development ...

Download sector_report1.pdf - Microfinance and Development ...

Download sector_report1.pdf - Microfinance and Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

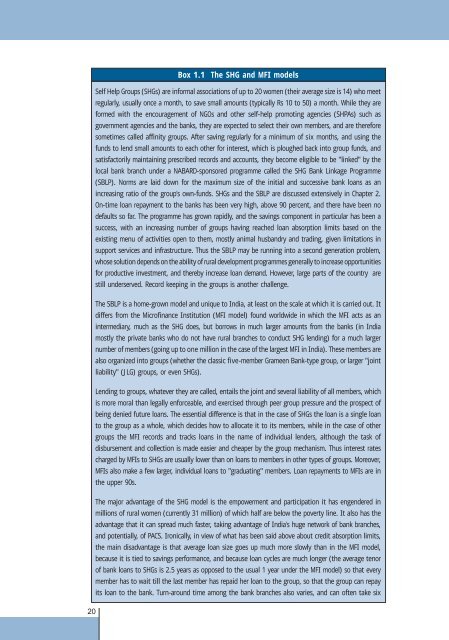

Box 1.1 The SHG <strong>and</strong> MFI models<br />

Self Help Groups (SHGs) are informal associations of up to 20 women (their average size is 14) who meet<br />

regularly, usually once a month, to save small amounts (typically Rs 10 to 50) a month. While they are<br />

formed with the encouragement of NGOs <strong>and</strong> other self-help promoting agencies (SHPAs) such as<br />

government agencies <strong>and</strong> the banks, they are expected to select their own members, <strong>and</strong> are therefore<br />

sometimes called affinity groups. After saving regularly for a minimum of six months, <strong>and</strong> using the<br />

funds to lend small amounts to each other for interest, which is ploughed back into group funds, <strong>and</strong><br />

satisfactorily maintaining prescribed records <strong>and</strong> accounts, they become eligible to be "linked" by the<br />

local bank branch under a NABARD-sponsored programme called the SHG Bank Linkage Programme<br />

(SBLP). Norms are laid down for the maximum size of the initial <strong>and</strong> successive bank loans as an<br />

increasing ratio of the group's own-funds. SHGs <strong>and</strong> the SBLP are discussed extensively in Chapter 2.<br />

On-time loan repayment to the banks has been very high, above 90 percent, <strong>and</strong> there have been no<br />

defaults so far. The programme has grown rapidly, <strong>and</strong> the savings component in particular has been a<br />

success, with an increasing number of groups having reached loan absorption limits based on the<br />

existing menu of activities open to them, mostly animal husb<strong>and</strong>ry <strong>and</strong> trading, given limitations in<br />

support services <strong>and</strong> infrastructure. Thus the SBLP may be running into a second generation problem,<br />

whose solution depends on the ability of rural development programmes generally to increase opportunities<br />

for productive investment, <strong>and</strong> thereby increase loan dem<strong>and</strong>. However, large parts of the country are<br />

still underserved. Record keeping in the groups is another challenge.<br />

The SBLP is a home-grown model <strong>and</strong> unique to India, at least on the scale at which it is carried out. It<br />

differs from the <strong>Microfinance</strong> Institution (MFI model) found worldwide in which the MFI acts as an<br />

intermediary, much as the SHG does, but borrows in much larger amounts from the banks (in India<br />

mostly the private banks who do not have rural branches to conduct SHG lending) for a much larger<br />

number of members (going up to one million in the case of the largest MFI in India). These members are<br />

also organized into groups (whether the classic five-member Grameen Bank-type group, or larger "joint<br />

liability" (JLG) groups, or even SHGs).<br />

Lending to groups, whatever they are called, entails the joint <strong>and</strong> several liability of all members, which<br />

is more moral than legally enforceable, <strong>and</strong> exercised through peer group pressure <strong>and</strong> the prospect of<br />

being denied future loans. The essential difference is that in the case of SHGs the loan is a single loan<br />

to the group as a whole, which decides how to allocate it to its members, while in the case of other<br />

groups the MFI records <strong>and</strong> tracks loans in the name of individual lenders, although the task of<br />

disbursement <strong>and</strong> collection is made easier <strong>and</strong> cheaper by the group mechanism. Thus interest rates<br />

charged by MFIs to SHGs are usually lower than on loans to members in other types of groups. Moreover,<br />

MFIs also make a few larger, individual loans to "graduating" members. Loan repayments to MFIs are in<br />

the upper 90s.<br />

The major advantage of the SHG model is the empowerment <strong>and</strong> participation it has engendered in<br />

millions of rural women (currently 31 million) of which half are below the poverty line. It also has the<br />

advantage that it can spread much faster, taking advantage of India's huge network of bank branches,<br />

<strong>and</strong> potentially, of PACS. Ironically, in view of what has been said above about credit absorption limits,<br />

the main disadvantage is that average loan size goes up much more slowly than in the MFI model,<br />

because it is tied to savings performance, <strong>and</strong> because loan cycles are much longer (the average tenor<br />

of bank loans to SHGs is 2.5 years as opposed to the usual 1 year under the MFI model) so that every<br />

member has to wait till the last member has repaid her loan to the group, so that the group can repay<br />

its loan to the bank. Turn-around time among the bank branches also varies, <strong>and</strong> can often take six<br />

20