Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PARTS OF THE FINANCIAL STATEMENTS<br />

Notes to and forming parts <strong>of</strong> the Financial Statements<br />

for the year ended 30 June <strong>2005</strong><br />

13 SUPERANNUATION<br />

The Town <strong>of</strong> <strong>Vincent</strong> complies with the minimum obligations under federal law and contributes in respect <strong>of</strong> its employees to one <strong>of</strong><br />

the following superannuation plans:<br />

WA LOCAL GOVERNMENT SUPERANNUATION PLAN<br />

The Council contributes in respect <strong>of</strong> certain <strong>of</strong> its employees to an accumulated benefit superannuation fund established in respect<br />

<strong>of</strong> all Councils in the State. In accordance with statutory requirements, the Council contributes to the WA Local Government<br />

Superannuation Plan (“the plan”) amounts nominated by the Council. As such, assets are accumulated in the plan to meet members’<br />

benefits as they accrue. The audited financial report <strong>of</strong> the plan as at 30 June <strong>2004</strong>, which was not subject to audit qualification,<br />

indicates that the assets <strong>of</strong> the plan are sufficient to meet accrued benefits. No liability <strong>of</strong> the Council has been recognised as at the<br />

reporting date in respect <strong>of</strong> superannuation benefits for its employees.<br />

CITY OF PERTH SUPERANNUATION FUND<br />

The Council contributes in respect <strong>of</strong> certain former <strong>City</strong> <strong>of</strong> Perth employees to a defined benefit superannuation plan. In accordance<br />

with statutory requirements, the Council contributes to the <strong>City</strong> <strong>of</strong> Perth Superannuation Fund (“the plan”) amounts determined by the<br />

plan actuary in respect <strong>of</strong> contributory members. In respect <strong>of</strong> non-contributory members, the Council contributes at the minimum<br />

Award/SGC contribution rate. As such, assets are accumulated in the plan to meet members’ benefits as they accrue. The latest<br />

available audited financial report <strong>of</strong> the plan as at 30 June <strong>2004</strong>, which was not subject to audit qualification, indicated that the<br />

assets <strong>of</strong> the plan are sufficient to meet accrued benefits. The last full actuarial assessment <strong>of</strong> the plan was undertaken as at<br />

30 June 2002 by Mercer Human Resource Consulting Pty Ltd.<br />

The employer contribution rate for contributory members is 14% <strong>of</strong> salary.<br />

The amount <strong>of</strong> statutory superannuation contributions paid by the Council during the reporting period was $747,102. During the<br />

2003/04 year the contributions were $688,951.<br />

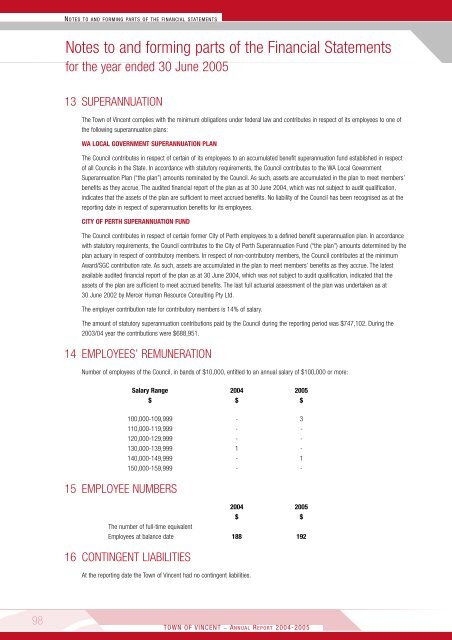

14 EMPLOYEES’ REMUNERATION<br />

Number <strong>of</strong> employees <strong>of</strong> the Council, in bands <strong>of</strong> $10,000, entitled to an annual salary <strong>of</strong> $100,000 or more:<br />

Salary Range <strong>2004</strong> <strong>2005</strong><br />

$ $ $<br />

15 EMPLOYEE NUMBERS<br />

100,000-109,999 - 3<br />

110,000-119,999 - -<br />

120,000-129,999 - -<br />

130,000-139,999 1 -<br />

140,000-149,999 - 1<br />

150,000-159,999 - -<br />

<strong>2004</strong> <strong>2005</strong><br />

$ $<br />

The number <strong>of</strong> full-time equivalent<br />

Employees at balance date 188 192<br />

16 CONTINGENT LIABILITIES<br />

At the reporting date the Town <strong>of</strong> <strong>Vincent</strong> had no contingent liabilities.<br />

98<br />

TOWN OF VINCENT _ A NNUAL R EPORT <strong>2004</strong>-<strong>2005</strong>