Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PARTS OF THE FINANCIAL STATEMENTS<br />

Notes to and forming parts <strong>of</strong> the Financial Statements<br />

for the year ended 30 June <strong>2005</strong><br />

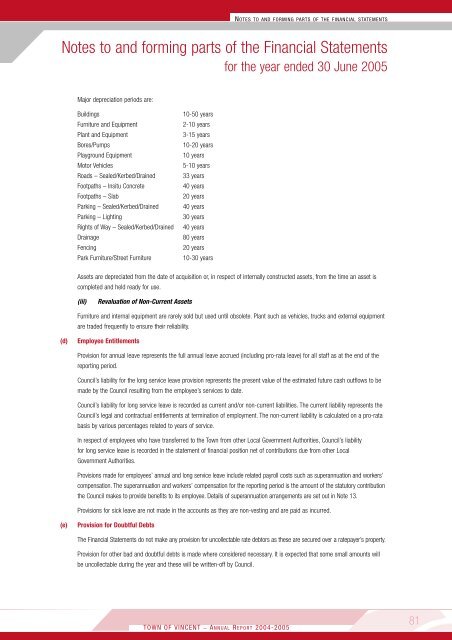

Major depreciation periods are:<br />

Buildings<br />

Furniture and Equipment<br />

Plant and Equipment<br />

Bores/Pumps<br />

Playground Equipment<br />

Motor Vehicles<br />

Roads – Sealed/Kerbed/Drained<br />

Footpaths – Insitu Concrete<br />

Footpaths – Slab<br />

Parking – Sealed/Kerbed/Drained<br />

Parking – Lighting<br />

Rights <strong>of</strong> Way – Sealed/Kerbed/Drained<br />

Drainage<br />

Fencing<br />

Park Furniture/Street Furniture<br />

10-50 years<br />

2-10 years<br />

3-15 years<br />

10-20 years<br />

10 years<br />

5-10 years<br />

33 years<br />

40 years<br />

20 years<br />

40 years<br />

30 years<br />

40 years<br />

80 years<br />

20 years<br />

10-30 years<br />

Assets are depreciated from the date <strong>of</strong> acquisition or, in respect <strong>of</strong> internally constructed assets, from the time an asset is<br />

completed and held ready for use.<br />

(iii)<br />

Revaluation <strong>of</strong> Non-Current Assets<br />

Furniture and internal equipment are rarely sold but used until obsolete. Plant such as vehicles, trucks and external equipment<br />

are traded frequently to ensure their reliability.<br />

(d)<br />

Employee Entitlements<br />

Provision for annual leave represents the full annual leave accrued (including pro-rata leave) for all staff as at the end <strong>of</strong> the<br />

reporting period.<br />

Council’s liability for the long service leave provision represents the present value <strong>of</strong> the estimated future cash outflows to be<br />

made by the Council resulting from the employee’s services to date.<br />

Council’s liability for long service leave is recorded as current and/or non-current liabilities. The current liability represents the<br />

Council’s legal and contractual entitlements at termination <strong>of</strong> employment. The non-current liability is calculated on a pro-rata<br />

basis by various percentages related to years <strong>of</strong> service.<br />

In respect <strong>of</strong> employees who have transferred to the Town from other Local Government Authorities, Council’s liability<br />

for long service leave is recorded in the statement <strong>of</strong> financial position net <strong>of</strong> contributions due from other Local<br />

Government Authorities.<br />

Provisions made for employees’ annual and long service leave include related payroll costs such as superannuation and workers’<br />

compensation. The superannuation and workers’ compensation for the reporting period is the amount <strong>of</strong> the statutory contribution<br />

the Council makes to provide benefits to its employee. Details <strong>of</strong> superannuation arrangements are set out in Note 13.<br />

Provisions for sick leave are not made in the accounts as they are non-vesting and are paid as incurred.<br />

(e)<br />

Provision for Doubtful Debts<br />

The Financial Statements do not make any provision for uncollectable rate debtors as these are secured over a ratepayer’s property.<br />

Provision for other bad and doubtful debts is made where considered necessary. It is expected that some small amounts will<br />

be uncollectable during the year and these will be written-<strong>of</strong>f by Council.<br />

TOWN OF VINCENT _ A NNUAL R EPORT <strong>2004</strong>-<strong>2005</strong><br />

81