Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

Annual Report 2004-2005 - City of Vincent

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

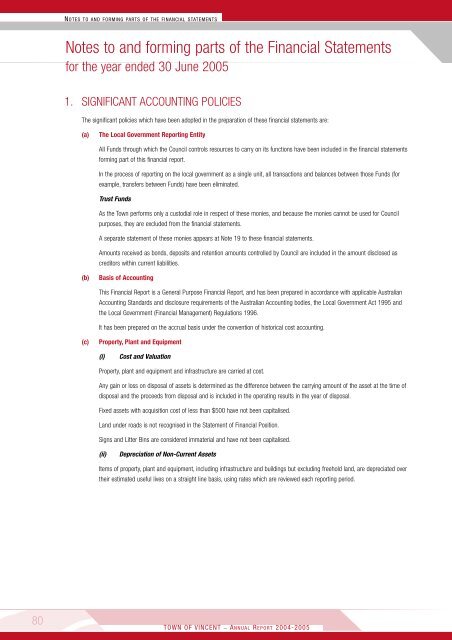

NOTES TO AND FORMING PARTS OF THE FINANCIAL STATEMENTS<br />

Notes to and forming parts <strong>of</strong> the Financial Statements<br />

for the year ended 30 June <strong>2005</strong><br />

1. SIGNIFICANT ACCOUNTING POLICIES<br />

The significant policies which have been adopted in the preparation <strong>of</strong> these financial statements are:<br />

(a)<br />

The Local Government <strong>Report</strong>ing Entity<br />

All Funds through which the Council controls resources to carry on its functions have been included in the financial statements<br />

forming part <strong>of</strong> this financial report.<br />

In the process <strong>of</strong> reporting on the local government as a single unit, all transactions and balances between those Funds (for<br />

example, transfers between Funds) have been eliminated.<br />

Trust Funds<br />

As the Town performs only a custodial role in respect <strong>of</strong> these monies, and because the monies cannot be used for Council<br />

purposes, they are excluded from the financial statements.<br />

A separate statement <strong>of</strong> these monies appears at Note 19 to these financial statements.<br />

Amounts received as bonds, deposits and retention amounts controlled by Council are included in the amount disclosed as<br />

creditors within current liabilities.<br />

(b)<br />

Basis <strong>of</strong> Accounting<br />

This Financial <strong>Report</strong> is a General Purpose Financial <strong>Report</strong>, and has been prepared in accordance with applicable Australian<br />

Accounting Standards and disclosure requirements <strong>of</strong> the Australian Accounting bodies, the Local Government Act 1995 and<br />

the Local Government (Financial Management) Regulations 1996.<br />

It has been prepared on the accrual basis under the convention <strong>of</strong> historical cost accounting.<br />

(c)<br />

Property, Plant and Equipment<br />

(i)<br />

Cost and Valuation<br />

Property, plant and equipment and infrastructure are carried at cost.<br />

Any gain or loss on disposal <strong>of</strong> assets is determined as the difference between the carrying amount <strong>of</strong> the asset at the time <strong>of</strong><br />

disposal and the proceeds from disposal and is included in the operating results in the year <strong>of</strong> disposal.<br />

Fixed assets with acquisition cost <strong>of</strong> less than $500 have not been capitalised.<br />

Land under roads is not recognised in the Statement <strong>of</strong> Financial Position.<br />

Signs and Litter Bins are considered immaterial and have not been capitalised.<br />

(ii)<br />

Depreciation <strong>of</strong> Non-Current Assets<br />

Items <strong>of</strong> property, plant and equipment, including infrastructure and buildings but excluding freehold land, are depreciated over<br />

their estimated useful lives on a straight line basis, using rates which are reviewed each reporting period.<br />

80<br />

TOWN OF VINCENT _ A NNUAL R EPORT <strong>2004</strong>-<strong>2005</strong>