You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>IT</strong> HOLDING S.p.A. Notes to the consolidated financial statements for the year ended December 31, 2003<br />

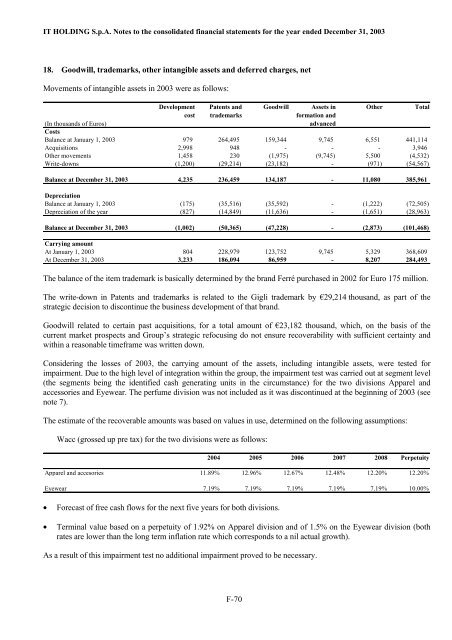

18. Goodwill, trademarks, other intangible assets and deferred charges, net<br />

Movements of intangible assets in 2003 were as follows:<br />

(In thousands of Euros)<br />

Development<br />

cost<br />

Patents and<br />

trademarks<br />

F- 70<br />

Goodwill Assets in<br />

formation and<br />

advanced<br />

Other Total<br />

Costs<br />

Balance at January 1, 2003 979 264,495 159,344 9,745 6,551 441,114<br />

Acquisitions 2,998 948 - - - 3,946<br />

Other movements 1,458 230 (1,975) (9,745) 5,500 (4,532)<br />

Write-downs (1,200) (29,214) (23,182) - (971) (54,567)<br />

Balance at December 31, 2003 4,235 236,459 134,187 - 11,080 385,961<br />

Depreciation<br />

Balance at January 1, 2003 (175) (35,516) (35,592) - (1,222) (72,505)<br />

Depreciation of the year (827) (14,849) (11,636) - (1,651) (28,963)<br />

Balance at December 31, 2003 (1,002) (50,365) (47,228) - (2,873) (101,468)<br />

Carrying amount<br />

At January 1, 2003 804 228,979 123,752 9,745 5,329 368,609<br />

At December 31, 2003 3,233 186,094 86,959 - 8,207 284,493<br />

The balance of the item trademark is basically determined by the brand Ferré purchased in 2002 for Euro 175 million.<br />

The write-down in Patents and trademarks is related to the Gigli trademark by €29,214 thousand, as part of the<br />

strategic decision to discontinue the business development of that brand.<br />

Goodwill related to certain past acquisitions, for a total amount of €23,182 thousand, which, on the basis of the<br />

current market prospects and Group’s strategic refocusing do not ensure recoverability with sufficient certainty and<br />

within a reasonable timeframe was written down.<br />

Considering the losses of 2003, the carrying amount of the assets, including intangible assets, were tested for<br />

impairment. Due to the high level of integration within the group, the impairment test was carried out at segment level<br />

(the segments being the identified cash generating units in the circumstance) for the two divisions Apparel and<br />

accessories and Eyewear. The perfume division was not included as it was discontinued at the beginning of 2003 (see<br />

note 7).<br />

The estimate of the recoverable amounts was based on values in use, determined on the following assumptions:<br />

Wacc (grossed up pre tax) for the two divisions were as follows:<br />

2004 2005 2006 2007 2008 Perpetuity<br />

Apparel and accesories 11.89% 12.96% 12.67% 12.48% 12.20% 12.20%<br />

Eyewear 7.19% 7.19% 7.19% 7.19% 7.19% 10.00%<br />

• Forecast of free cash flows for the next five years for both divisions.<br />

• Terminal value based on a perpetuity of 1.92% on Apparel division and of 1.5% on the Eyewear division (both<br />

rates are lower than the long term inflation rate which corresponds to a nil actual growth).<br />

As a result of this impairment test no additional impairment proved to be necessary.