Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>IT</strong> HOLDING S.p.A. Notes to the consolidated financial statements for the year ended December 31, 2002<br />

They mainly refer to the following.<br />

(a) Consolidation and Investment in Subsidiaries<br />

Under Italian Accounting Principles, a subsidiary with activities dissimilar to that of the parent or in liquidation can<br />

be excluded from consolidation if such exclusion is essential for the consolidated financial statements to present a true<br />

and fair view of the state of affairs of the parent. Subsidiaries excluded from the consolidation are accounted for using<br />

the equity method or at cost.<br />

Under IFRS, dissimilar activities between a parent and subsidiary are not grounds for excluding the subsidiary from<br />

consolidation.<br />

(b) Intangible assets<br />

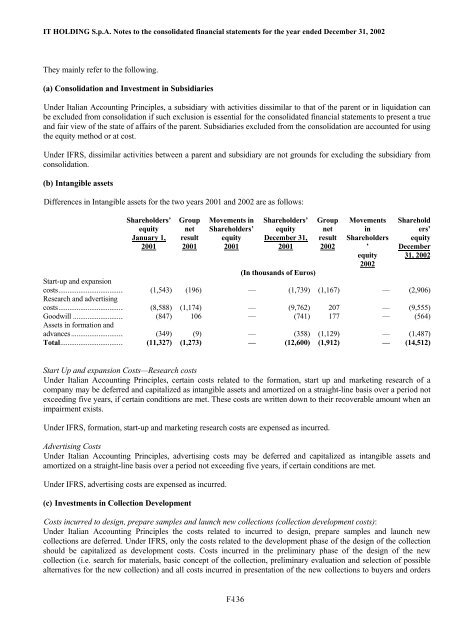

Differences in Intangible assets for the two years 2001 and 2002 are as follows:<br />

Shareholders’<br />

equity<br />

January 1,<br />

2001<br />

Group<br />

net<br />

result<br />

2001<br />

Movements in<br />

Shareholders’<br />

equity<br />

2001<br />

F- 136<br />

Shareholders’<br />

equity<br />

December 31,<br />

2001<br />

(In thousands of Euros)<br />

Group<br />

net<br />

result<br />

2002<br />

Movements<br />

in<br />

Shareholders<br />

’<br />

equity<br />

2002<br />

Sharehold<br />

ers’<br />

equity<br />

December<br />

31, 2002<br />

Start-up and expansion<br />

costs....................................... (1,543) (196) — (1,739) (1,167) — (2,906)<br />

Research and advertising<br />

costs....................................... (8,588) (1,174) — (9,762) 207 — (9,555)<br />

Goodwill ............................... (847) 106 — (741) 177 — (564)<br />

Assets in formation and<br />

advances................................ (349) (9) — (358) (1,129) — (1,487)<br />

Total...................................... (11,327) (1,273) — (12,600) (1,912) — (14,512)<br />

Start Up and expansion Costs—Research costs<br />

Under Italian Accounting Principles, certain costs related to the formation, start up and marketing research of a<br />

company may be deferred and capitalized as intangible assets and amortized on a straight-line basis over a period not<br />

exceeding five years, if certain conditions are met. These costs are written down to their recoverable amount when an<br />

impairment exists.<br />

Under IFRS, formation, start-up and marketing research costs are expensed as incurred.<br />

Advertising Costs<br />

Under Italian Accounting Principles, advertising costs may be deferred and capitalized as intangible assets and<br />

amortized on a straight-line basis over a period not exceeding five years, if certain conditions are met.<br />

Under IFRS, advertising costs are expensed as incurred.<br />

(c) Investments in Collection Development<br />

Costs incurred to design, prepare samples and launch new collections (collection development costs):<br />

Under Italian Accounting Principles the costs related to incurred to design, prepare samples and launch new<br />

collections are deferred. Under IFRS, only the costs related to the development phase of the design of the collection<br />

should be capitalized as development costs. Costs incurred in the preliminary phase of the design of the new<br />

collection (i.e. search for materials, basic concept of the collection, preliminary evaluation and selection of possible<br />

alternatives for the new collection) and all costs incurred in presentation of the new collections to buyers and orders