You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

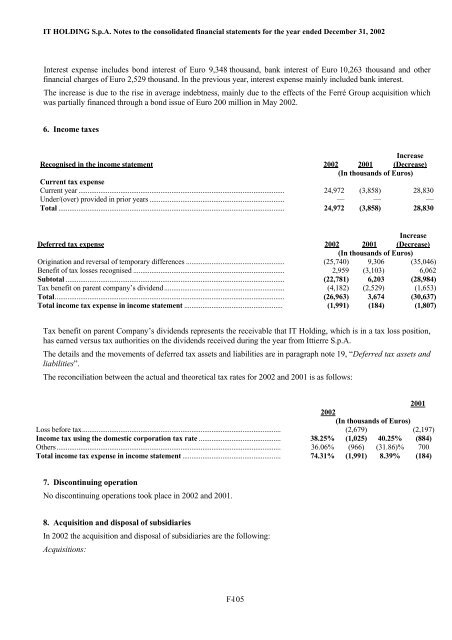

<strong>IT</strong> HOLDING S.p.A. Notes to the consolidated financial statements for the year ended December 31, 2002<br />

Interest expense includes bond interest of Euro 9,348 thousand, bank interest of Euro 10,263 thousand and other<br />

financial charges of Euro 2,529 thousand. In the previous year, interest expense mainly included bank interest.<br />

The increase is due to the rise in average indebtness, mainly due to the effects of the Ferré Group acquisition which<br />

was partially financed through a bond issue of Euro 200 million in May 2002.<br />

6. Income taxes<br />

Recognised in the income statement 2002 2001<br />

Increase<br />

(Decrease)<br />

(In thousands of Euros)<br />

Current tax expense<br />

Current year ................................................................................................................. 24,972 (3,858) 28,830<br />

Under/(over) provided in prior years .......................................................................... — — —<br />

Total ............................................................................................................................ 24,972 (3,858) 28,830<br />

Deferred tax expense 2002 2001<br />

Increase<br />

(Decrease)<br />

(In thousands of Euros)<br />

Origination and reversal of temporary differences ...................................................... (25,740) 9,306 (35,046)<br />

Benefit of tax losses recognised ................................................................................... 2,959 (3,103) 6,062<br />

Subtotal ........................................................................................................................ (22,781) 6,203 (28,984)<br />

Tax benefit on parent company’s dividend.................................................................. (4,182) (2,529) (1,653)<br />

Total.............................................................................................................................. (26,963) 3,674 (30,637)<br />

Total income tax expense in income statement ...................................................... (1,991) (184) (1,807)<br />

Tax benefit on parent Company’s dividends represents the receivable that <strong>IT</strong> <strong>Holding</strong>, which is in a tax loss position,<br />

has earned versus tax authorities on the dividends received during the year from Ittierre S.p.A.<br />

The details and the movements of deferred tax assets and liabilities are in paragraph note 19, “Deferred tax assets and<br />

liabilities”.<br />

The reconciliation between the actual and theoretical tax rates for 2002 and 2001 is as follows:<br />

2001<br />

2002<br />

(In thousands of Euros)<br />

Loss before tax............................................................................................................. (2,679) (2,197)<br />

Income tax using the domestic corporation tax rate ............................................. 38.25% (1,025) 40.25% (884)<br />

Others........................................................................................................................... 36.06% (966) (31.86)% 700<br />

Total income tax expense in income statement ...................................................... 74.31% (1,991) 8.39% (184)<br />

7. Discontinuing operation<br />

No discontinuing operations took place in 2002 and 2001.<br />

8. Acquisition and disposal of subsidiaries<br />

In 2002 the acquisition and disposal of subsidiaries are the following:<br />

Acquisitions:<br />

F- 105