You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Facilities and bank overdraft facilities. In 2004 we also generated cash from the disposal of our former eyewear<br />

and fragrance businesses and our Gentryportofino brand.<br />

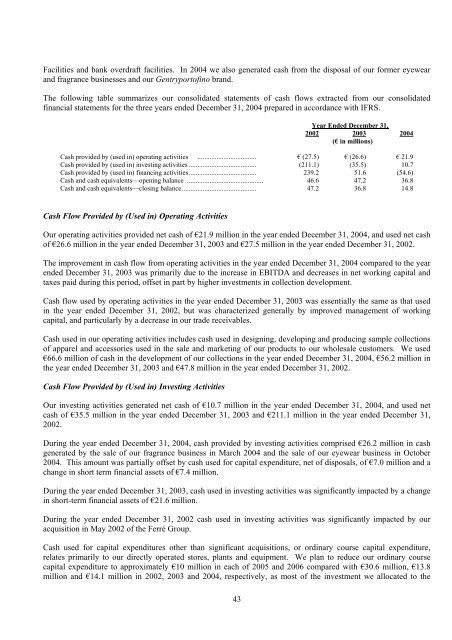

The following table summarizes our consolidated statements of cash flows extracted from our consolidated<br />

financial statements for the three years ended December 31, 2004 prepared in accordance with IFRS.<br />

43<br />

Year Ended December 31,<br />

2002 2003 2004<br />

(€ in millions)<br />

Cash provided by (used in) operating activities .................................. € (27.5) € (26.6) € 21.9<br />

Cash provided by (used in) investing activities ....................................... (211.1) (35.5) 10.7<br />

Cash provided by (used in) financing activities....................................... 239.2 51.6 (54.6)<br />

Cash and cash equivalents—opening balance ............................................ 46.6 47.2 36.8<br />

Cash and cash equivalents—closing balance........................................... 47.2 36.8 14.8<br />

Cash Flow Provided by (Used in) Operating Activities<br />

Our operating activities provided net cash of €21.9 million in the year ended December 31, 2004, and used net cash<br />

of €26.6 million in the year ended December 31, 2003 and €27.5 million in the year ended December 31, 2002.<br />

The improvement in cash flow from operating activities in the year ended December 31, 2004 compared to the year<br />

ended December 31, 2003 was primarily due to the increase in EB<strong>IT</strong>DA and decreases in net working capital and<br />

taxes paid during this period, offset in part by higher investments in collection development.<br />

Cash flow used by operating activities in the year ended December 31, 2003 was essentially the same as that used<br />

in the year ended December 31, 2002, but was characterized generally by improved management of working<br />

capital, and particularly by a decrease in our trade receivables.<br />

Cash used in our operating activities includes cash used in designing, developing and producing sample collections<br />

of apparel and accessories used in the sale and marketing of our products to our wholesale customers. We used<br />

€66.6 million of cash in the development of our collections in the year ended December 31, 2004, €56.2 million in<br />

the year ended December 31, 2003 and €47.8 million in the year ended December 31, 2002.<br />

Cash Flow Provided by (Used in) Investing Activities<br />

Our investing activities generated net cash of €10.7 million in the year ended December 31, 2004, and used net<br />

cash of €35.5 million in the year ended December 31, 2003 and €211.1 million in the year ended December 31,<br />

2002.<br />

During the year ended December 31, 2004, cash provided by investing activities comprised €26.2 million in cash<br />

generated by the sale of our fragrance business in March 2004 and the sale of our eyewear business in October<br />

2004. This amount was partially offset by cash used for capital expenditure, net of disposals, of €7.0 million and a<br />

change in short term financial assets of €7.4 million.<br />

During the year ended December 31, 2003, cash used in investing activities was significantly impacted by a change<br />

in short-term financial assets of €21.6 million.<br />

During the year ended December 31, 2002 cash used in investing activities was significantly impacted by our<br />

acquisition in May 2002 of the Ferré Group.<br />

Cash used for capital expenditures other than significant acquisitions, or ordinary course capital expenditure,<br />

relates primarily to our directly operated stores, plants and equipment. We plan to reduce our ordinary course<br />

capital expenditure to approximately €10 million in each of 2005 and 2006 compared with €30.6 million, €13.8<br />

million and €14.1 million in 2002, 2003 and 2004, respectively, as most of the investment we allocated to the