Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

collection of the receivables assigned. A backup credit line is also provided by Credit Lyonnais in connection with<br />

the securitization program to be used for the financing of purchases of senior notes in the event they cannot be sold,<br />

or to reimburse any purchasers if the program is cancelled.<br />

Following the sale of <strong>IT</strong>F S.p.A. as part of the disposal of our fragrance business, we reached an agreement with<br />

Credit Lyonnais for the termination of the securitization program with respect to such company. Under the<br />

agreement, Credit Lyonnais granted to <strong>IT</strong>F S.p.A. the right to continue to act as servicer of the trade receivables<br />

assigned to the Purchasers up to the date of the closing of the sale. On the other hand, we guaranteed to the<br />

Purchasers the performance by <strong>IT</strong>F S.p.A. of its obligations as servicer. Under a separate agreement, <strong>IT</strong>F S.p.A.<br />

agreed to indemnify us with respect to any cost, expense damage or liability which we may incur as a consequence<br />

of a breach by <strong>IT</strong>F S.p.A. of its obligations to service the trade receivables and to pay the amounts collected by it to<br />

Credit Lyonnais.<br />

We are in the process of finalizing similar arrangements with respect to the termination of the securitization<br />

program for Allison S.p.A. following its sale and exit from the Group.<br />

Bilateral Loan Facilities and Overdraft Facilities<br />

As of December 31, 2004, our Uncommitted Bilateral Loan Facilities provided for total borrowings of up to €133.4<br />

million. As of December 31, 2004, approximately €90.1 million was available and €43.2 million was outstanding<br />

under the Uncommitted Bilateral Loan Facilities (including €5.5 million of factoring). Borrowings under these<br />

facilities may be denominated in a number of different currencies.<br />

These Uncommitted Bilateral Loan Facilities and overdraft facilities are uncommitted and short term in nature and<br />

are subject to termination by the bilateral lender at any time. Any termination or withdrawal of these facilities<br />

could lead to, or further exacerbate any existing liquidity problems and could decrease our stability.<br />

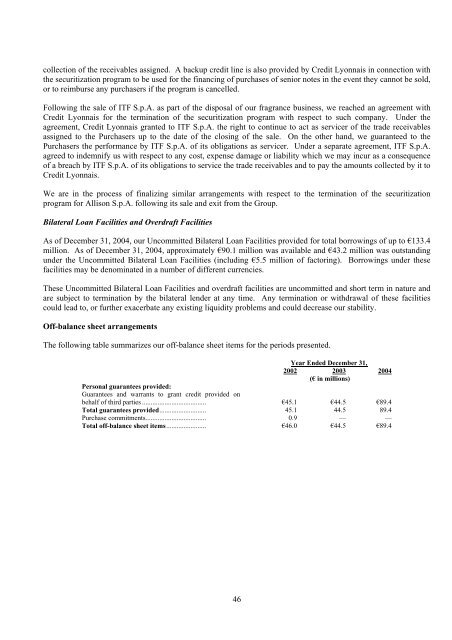

Off-balance sheet arrangements<br />

The following table summarizes our off-balance sheet items for the periods presented.<br />

Year Ended December 31,<br />

2002 2003 2004<br />

(€ in millions)<br />

Personal guarantees provided:<br />

Guarantees and warrants to grant credit provided on<br />

behalf of third parties ..................................... €45.1 €44.5 €89.4<br />

Total guarantees provided........................... 45.1 44.5 89.4<br />

Purchase commitments................................... 0.9 — —<br />

Total off-balance sheet items....................... €46.0 €44.5 €89.4<br />

46