Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

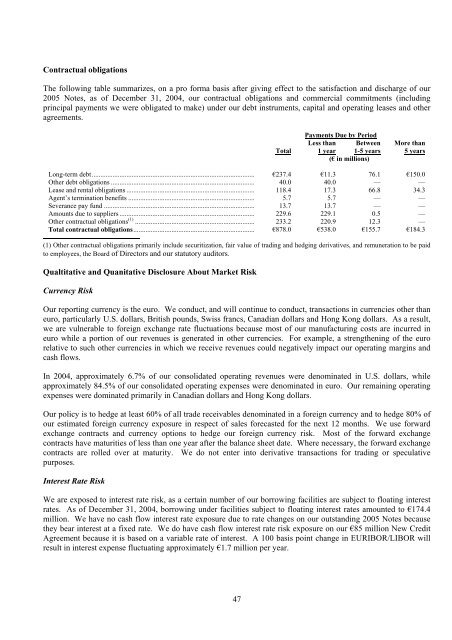

Contractual obligations<br />

The following table summarizes, on a pro forma basis after giving effect to the satisfaction and discharge of our<br />

2005 Notes, as of December 31, 2004, our contractual obligations and commercial commitments (including<br />

principal payments we were obligated to make) under our debt instruments, capital and operating leases and other<br />

agreements.<br />

47<br />

Total<br />

Payments Due by Period<br />

Less than Between<br />

1 year 1-5 years<br />

(€ in millions)<br />

More than<br />

5 years<br />

Long-term debt................................................................................................ €237.4 €11.3 76.1 €150.0<br />

Other debt obligations ............................................................................................ 40.0 40.0 — —<br />

Lease and rental obligations ................................................................................... 118.4 17.3 66.8 34.3<br />

Agent’s termination benefits .................................................................................. 5.7 5.7 — —<br />

Severance pay fund ................................................................................................ 13.7 13.7 — —<br />

Amounts due to suppliers ....................................................................................... 229.6 229.1 0.5 —<br />

Other contractual obligations (1) .............................................................................. 233.2 220.9 12.3 —<br />

Total contractual obligations............................................................................... €878.0 €538.0 €155.7 €184.3<br />

(1) Other contractual obligations primarily include securitization, fair value of trading and hedging derivatives, and remuneration to be paid<br />

to employees, the Board of Directors and our statutory auditors.<br />

Qualtitative and Quanitative Disclosure About Market Risk<br />

Currency Risk<br />

Our reporting currency is the euro. We conduct, and will continue to conduct, transactions in currencies other than<br />

euro, particularly U.S. dollars, British pounds, Swiss francs, Canadian dollars and Hong Kong dollars. As a result,<br />

we are vulnerable to foreign exchange rate fluctuations because most of our manufacturing costs are incurred in<br />

euro while a portion of our revenues is generated in other currencies. For example, a strengthening of the euro<br />

relative to such other currencies in which we receive revenues could negatively impact our operating margins and<br />

cash flows.<br />

In 2004, approximately 6.7% of our consolidated operating revenues were denominated in U.S. dollars, while<br />

approximately 84.5% of our consolidated operating expenses were denominated in euro. Our remaining operating<br />

expenses were dominated primarily in Canadian dollars and Hong Kong dollars.<br />

Our policy is to hedge at least 60% of all trade receivables denominated in a foreign currency and to hedge 80% of<br />

our estimated foreign currency exposure in respect of sales forecasted for the next 12 months. We use forward<br />

exchange contracts and currency options to hedge our foreign currency risk. Most of the forward exchange<br />

contracts have maturities of less than one year after the balance sheet date. Where necessary, the forward exchange<br />

contracts are rolled over at maturity. We do not enter into derivative transactions for trading or speculative<br />

purposes.<br />

Interest Rate Risk<br />

We are exposed to interest rate risk, as a certain number of our borrowing facilities are subject to floating interest<br />

rates. As of December 31, 2004, borrowing under facilities subject to floating interest rates amounted to €174.4<br />

million. We have no cash flow interest rate exposure due to rate changes on our outstanding 2005 Notes because<br />

they bear interest at a fixed rate. We do have cash flow interest rate risk exposure on our €85 million New Credit<br />

Agreement because it is based on a variable rate of interest. A 100 basis point change in EURIBOR/LIBOR will<br />

result in interest expense fluctuating approximately €1.7 million per year.