You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>IT</strong> HOLDING S.p.A. Notes to the consolidated financial statements for the year ended December 31, 2004<br />

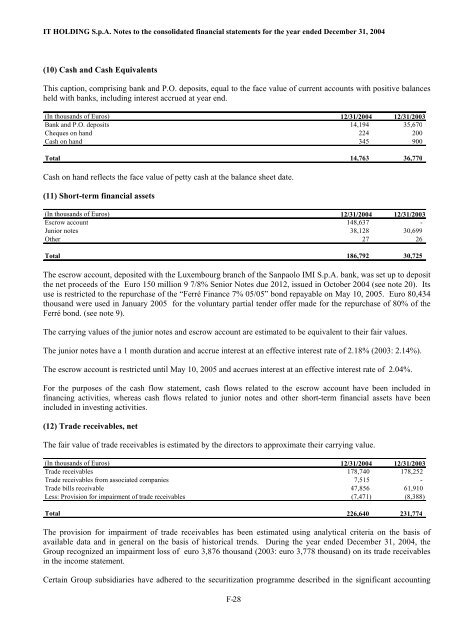

(10) Cash and Cash Equivalents<br />

This caption, comprising bank and P.O. deposits, equal to the face value of current accounts with positive balances<br />

held with banks, including interest accrued at year end.<br />

(In thousands of Euros) 12/31/2004 12/31/2003<br />

Bank and P.O. deposits 14,194 35,670<br />

Cheques on hand 224 200<br />

Cash on hand 345 900<br />

Total 14,763 36,770<br />

Cash on hand reflects the face value of petty cash at the balance sheet date.<br />

(11) Short-term financial assets<br />

(In thousands of Euros) 12/31/2004 12/31/2003<br />

Escrow account 148,637 -<br />

Junior notes 38,128 30,699<br />

Other 27 26<br />

Total 186,792 30,725<br />

The escrow account, deposited with the Luxembourg branch of the Sanpaolo IMI S.p.A. bank, was set up to deposit<br />

the net proceeds of the Euro 150 million 9 7/8% Senior Notes due 2012, issued in October 2004 (see note 20). Its<br />

use is restricted to the repurchase of the “Ferré <strong>Finance</strong> 7% 05/05” bond repayable on May 10, 2005. Euro 80,434<br />

thousand were used in January 2005 for the voluntary partial tender offer made for the repurchase of 80% of the<br />

Ferré bond. (see note 9).<br />

The carrying values of the junior notes and escrow account are estimated to be equivalent to their fair values.<br />

The junior notes have a 1 month duration and accrue interest at an effective interest rate of 2.18% (2003: 2.14%).<br />

The escrow account is restricted until May 10, 2005 and accrues interest at an effective interest rate of 2.04%.<br />

For the purposes of the cash flow statement, cash flows related to the escrow account have been included in<br />

financing activities, whereas cash flows related to junior notes and other short-term financial assets have been<br />

included in investing activities.<br />

(12) Trade receivables, net<br />

The fair value of trade receivables is estimated by the directors to approximate their carrying value.<br />

(In thousands of Euros) 12/31/2004 12/31/2003<br />

Trade receivables 178,740 178,252<br />

Trade receivables from associated companies 7,515 -<br />

Trade bills receivable 47,856 61,910<br />

Less: Provision for impairment of trade receivables (7,471) (8,388)<br />

Total 226,640<br />

F- 28<br />

231,774<br />

The provision for impairment of trade receivables has been estimated using analytical criteria on the basis of<br />

available data and in general on the basis of historical trends. During the year ended December 31, 2004, the<br />

Group recognized an impairment loss of euro 3,876 thousand (2003: euro 3,778 thousand) on its trade receivables<br />

in the income statement.<br />

Certain Group subsidiaries have adhered to the securitization programme described in the significant accounting