A N N U A L R E P O R T A N D A C C O U N T S - CMVM

A N N U A L R E P O R T A N D A C C O U N T S - CMVM

A N N U A L R E P O R T A N D A C C O U N T S - CMVM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

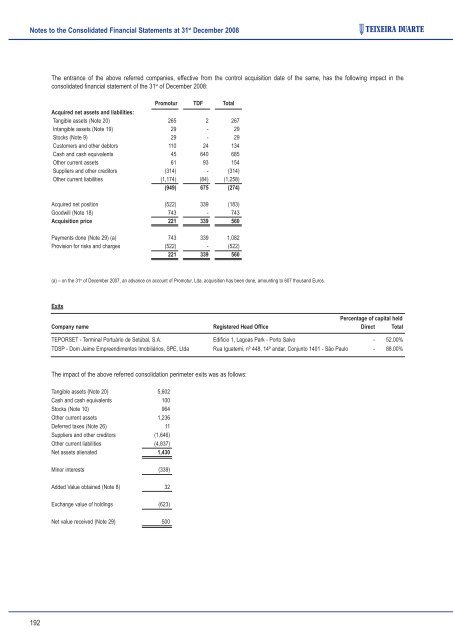

Notes to the Consolidated Financial Statements at 31 st December 2008<br />

The entrance of the above referred companies, effective from the control acquisition date of the same, has the following impact in the<br />

consolidated financial statement of the 31 st of December 2008:<br />

Promotur TDF Total<br />

Acquired net assets and liabilities:<br />

Tangible assets (Note 20) 265 2 267<br />

Intangible assets (Note 19) 29 - 29<br />

Stocks (Note 9) 29 - 29<br />

Customers and other debtors 110 24 134<br />

Cash and cash equivalents 45 640 685<br />

Other current assets 61 93 154<br />

Suppliers and other creditors (314) - (314)<br />

Other current liabilities (1,174) (84) (1,258)<br />

(949) 675 (274)<br />

Acquired net position (522) 339 (183)<br />

Goodwill (Note 18) 743 - 743<br />

Acquisition price 221 339 560<br />

Payments done (Note 29) (a) 743 339 1,082<br />

Provision for risks and charges (522) - (522)<br />

221 339 560<br />

(a) – on the 31 st of December 2007, an advance on account of Promotur, Lda. acquisition has been done, amounting to 607 thousand Euros.<br />

Exits<br />

Percentage of capital held<br />

Company name Registered Head Office Direct Total<br />

TEPORSET - Terminal Portuário de Setúbal, S.A. Edificio 1, Lagoas Park - Porto Salvo - 52.00%<br />

TDSP - Dom Jaime Empreendimentos Imobiliários, SPE, Ltda Rua Iguatemi, nº 448, 14º andar, Conjunto 1401 - São Paulo - 88.00%<br />

The impact of the above referred consolidation perimeter exits was as follows:<br />

Tangible assets (Note 20) 5,602<br />

Cash and cash equivalents 100<br />

Stocks (Note 10) 964<br />

Other current assets 1,236<br />

Deferred taxes (Note 26) 11<br />

Suppliers and other creditors (1,646)<br />

Other current liabilities (4,837)<br />

Net assets alienated 1,430<br />

Minor interests (339)<br />

Added Value obtained (Note 8) 32<br />

Exchange value of holdings (623)<br />

Net value received (Note 29) 500<br />

192