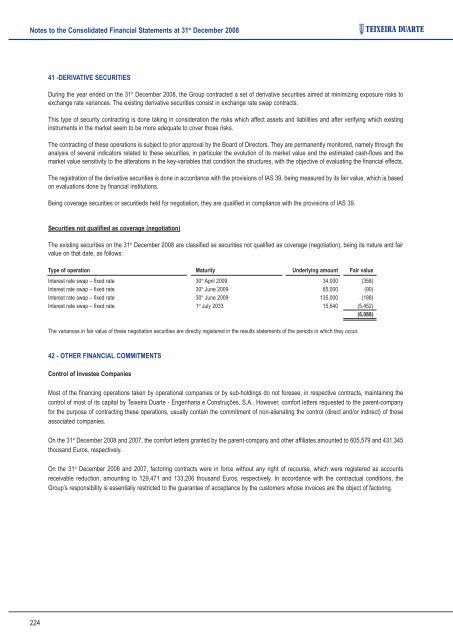

Notes to the Consolidated Financial Statements at 31 st December 2008 41 -DERIVATIVE SECURITIES During the year ended on the 31 st December 2008, the Group contracted a set of derivative securities aimed at minimizing exposure risks to exchange rate variances. The existing derivative securities consist in exchange rate swap contracts. This type of security contracting is done taking in consideration the risks which affect assets and liabilities and after verifying which existing instruments in the market seem to be more adequate to cover those risks. The contracting of these operations is subject to prior approval by the Board of Directors. They are permanently monitored, namely through the analysis of several indicators related to these securities, in particular the evolution of its market value and the estimated cash-flows and the market value sensitivity to the alterations in the key-variables that condition the structures, with the objective of evaluating the financial effects. The registration of the derivative securities is done in accordance with the provisions of IAS 39, being measured by its fair value, which is based on evaluations done by financial institutions. Being coverage securities or securitieds held for negotiation, they are qualified in compliance with the provisions of IAS 39. Securities not qualified as coverage (negotiation) The existing securities on the 31 st December 2008 are classified as securities not qualified as coverage (negotiation), being its nature and fair value on that date, as follows: Type of operation Maturity Underlying amount Fair value Interest rate swap – fixed rate 30 th April 2009 34,000 (358) Interest rate swap – fixed rate 30 th June 2009 65,000 (90) Interest rate swap – fixed rate 30 th June 2009 135,000 (188) Interest rate swap – fixed rate 1 st July 2033 15,640 (5,452) (6,088) The variances in fair value of these negotiation securities are directly registered in the results statements of the periods in which they occur. 42 - OTHER FINANCIAL COMMITMENTS Control of Investee Companies Most of the financing operations taken by operational companies or by sub-holdings do not foresee, in respective contracts, maintaining the control of most of its capital by Teixeira Duarte - Engenharia e Construções, S.A.. However, comfort letters requested to the parent-company for the purpose of contracting these operations, usually contain the commitment of non-alienating the control (direct and/or indirect) of those associated companies. On the 31 st December 2008 and 2007, the comfort letters granted by the parent-company and other affiliates amounted to 605,579 and 431,345 thousand Euros, respectively. On the 31 st December 2008 and 2007, factoring contracts were in force without any right of recourse, which were registered as accounts receivable reduction, amounting to 129,471 and 133,206 thousand Euros, respectively. In accordance with the contractual conditions, the Group’s responsibility is essentially restricted to the guarantee of acceptance by the customers whose invoices are the object of factoring. 224

Notes to the Consolidated Financial Statements at 31 st December 2008 43 - CONTINGENT ASSETS AND LIABILITIES On the 31 st December 2008 and 2007, the set of companies included in the consolidation had provided guarantees to third parties, as follows: 2008 2007 Collateral security provided: Bank 520,586 411,908 Real 371 27 520,957 411,935 Fidelity guarantee insurance 112,398 57,256 Bank guarantees were fundamentally provided for tender purposes, advances received and as guarantee of the good execution of works. Teixeira Duarte - Engenharia e Construções, S.A., BEL-ere - Engenharia e Reabilitação de Estruturas, S.A., EPOS – Empresa Portuguesa de Obras Subterrâneas, S.A., SOMAFEL - Engenharia e Obras Ferroviárias, S.A., OFM - Obras Públicas, Ferroviárias e Marítimas, S.A., RECOLTE - Recolha, Tratamento e Eliminação de Resíduos, S.A., GSC – Compañia General de Servicios y Construccion, S.A., EMPA – Serviços de Engenharia, S.A. and TEGAVEN – Teixeira Duarte y Associados, C.A. have guarantee insurances provided as guarantee of the good execution of the works and of the services rendered. The actual guarantee was provided by EMPA – Serviços de Engenharia, S.A. corresponding to the mortgage of land plots to third parties in its construction activity. In addition to the previously indicated guarantees, the following mortgages were provided: To guarantee the loan contract with Caixa Geral de Depósitos, for the amount of 117,000 thousand Euros, granted by Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., TDCIM - Sociedade Gestora de Participações Sociais, S.A. provided as collateral 26,907,230 shares of CIMPOR - Cimentos de Portugal, S.G.P.S., S.A. and Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., gave as mortgage 30,000,000 shares of Banco Comercial Português, S.A.. To guarantee the loan contract with Caixa Geral de Depósitos, amounting to 342,500 thousand Euros, granted by Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., TEDAL - Sociedade Gestora de Participações Sociais, S.A. and TDCIM - Sociedade Gestora de Participações Sociais, S.A. provided as collateral 22,000,000 and 28,500,000 shares of CIMPOR - Cimentos de Portugal, S.G.P.S., S.A., respectively, and under contract, Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., also provided as collateral 87,250,000 shares of Banco Comercial Português, S.A. and 6,000,000 share units of Fundo Investimento Imobiliário Fechado TDF. To guarantee the loan contract with Banco Bilbao Vizcaya Argentaria, amounting to 75,000 thousand Euros, granted by Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., provided as collateral 98,500,000 shares of Banco Comercial Português, S.A. and TDCIM - Sociedade Gestora de Participações Sociais, S.A. provided as collateral 3,600,000 shares of CIMPOR - Cimentos de Portugal, S.G.P.S., S.A.. To guarantee the loan contract with Banco Caixa Geral, amounting to 20,265 thousand Euros, granted by GSC – Compañia General de Servicios y Construccion, S.A., GSC – Compañia General de Servicios y Construccion, S.A., provided as collateral 2,100,000 shares of Banco Bilbao Vizcaya Argentaria, S.A.. To guarantee the commercial paper contract with Fortis Bank, amounting to 34,000 thousand Euros, granted by Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., a TEDAL - Sociedade Gestora de Participações Sociais, S.A. provided as promise of collateral 5,343,000 shares CIMPOR - Cimentos de Portugal, S.G.P.S., S.A.. To guarantee the commercial paper contract with Banco Espirito Santo, amounting to 100,000 thousand Euros, granted by Teixeira Duarte - Gestão de Participações e Investimentos Imobiliários, S.A., TEDAL - Sociedade Gestora de Participações Sociais, S.A. and TDCIM - Sociedade Gestora de Participações Sociais, S.A. provided as collateral 13,350,000 and 6,850,000 shares of CIMPOR - Cimentos de Portugal, S.G.P.S., S.A., respectively, and TEDAL - Sociedade Gestora de Participações Sociais, S.A. provided as collateral 2,727,500 shares of EPOS – Empresa Portuguesa de Obras Subterrâneas, S.A.. 225

- Page 1 and 2:

A N N U A L R E P O R T A N D A C C

- Page 3:

ANNUAL REPORT AND ACCOUNTS 2 0 0 8

- Page 8 and 9:

TEIXEIRA DUARTE - ENGENHARIA E CONS

- Page 10:

Organisational Chart - 2008 8 9

- Page 13 and 14:

Management Report of the Board of D

- Page 15 and 16:

Management Report of the Board of D

- Page 17 and 18:

Management Report of the Board of D

- Page 19 and 20:

Management Report of the Board of D

- Page 21 and 22:

Management Report of the Board of D

- Page 23 and 24:

Management Report of the Board of D

- Page 25 and 26:

Management Report of the Board of D

- Page 27 and 28:

Management Report of the Board of D

- Page 29 and 30:

Management Report of the Board of D

- Page 31 and 32:

Management Report of the Board of D

- Page 33 and 34:

Management Report of the Board of D

- Page 35 and 36:

Management Report of the Board of D

- Page 37 and 38:

Management Report of the Board of D

- Page 39 and 40:

Management Report of the Board of D

- Page 41 and 42:

Management Report of the Board of D

- Page 43 and 44:

Management Report of the Board of D

- Page 45 and 46:

Management Report of the Board of D

- Page 47 and 48:

Management Report of the Board of D

- Page 49 and 50:

Management Report of the Board of D

- Page 51 and 52:

Management Report of the Board of D

- Page 53 and 54:

Management Report of the Board of D

- Page 55 and 56:

Management Report of the Board of D

- Page 57 and 58:

Management Report of the Board of D

- Page 59 and 60:

Management Report of the Board of D

- Page 61 and 62:

Management Report of the Board of D

- Page 63 and 64:

Management Report of the Board of D

- Page 65 and 66:

Management Report of the Board of D

- Page 67 and 68:

Management Report of the Board of D

- Page 69 and 70:

Management Report of the Board of D

- Page 71 and 72:

Management Report of the Board of D

- Page 73 and 74:

Management Report of the Board of D

- Page 75 and 76:

Management Report of the Board of D

- Page 77 and 78:

Management Report of the Board of D

- Page 79 and 80:

Management Report of the Board of D

- Page 81 and 82:

Management Report of the Board of D

- Page 83 and 84:

Management Report of the Board of D

- Page 85 and 86:

Management Report of the Board of D

- Page 87 and 88:

Management Report of the Board of D

- Page 89 and 90:

Management Report of the Board of D

- Page 91 and 92:

Management Report of the Board of D

- Page 93 and 94:

Management Report of the Board of D

- Page 95 and 96:

Management Report of the Board of D

- Page 97 and 98:

Management Report of the Board of D

- Page 99 and 100:

Management Report of the Board of D

- Page 101 and 102:

Notes to the Report of the Board of

- Page 103 and 104:

Corporate Governance Report 2008

- Page 105 and 106:

Corporate Governance Report - 2008

- Page 107 and 108:

Corporate Governance Report - 2008

- Page 109 and 110:

Corporate Governance Report - 2008

- Page 111 and 112:

Corporate Governance Report - 2008

- Page 113 and 114:

Corporate Governance Report - 2008

- Page 115 and 116:

Corporate Governance Report - 2008

- Page 117 and 118:

Corporate Governance Report - 2008

- Page 119 and 120:

Corporate Governance Report - 2008

- Page 121 and 122:

Corporate Governance Report - 2008

- Page 123 and 124:

Corporate Governance Report - 2008

- Page 125 and 126:

Corporate Governance Report - 2008

- Page 127 and 128:

Corporate Governance Report - 2008

- Page 129 and 130:

Corporate Governance Report - 2008

- Page 131 and 132:

Corporate Governance Report - 2008

- Page 133 and 134:

Corporate Governance Report - 2008

- Page 135 and 136:

Corporate Governance Report - 2008

- Page 137 and 138:

Corporate Governance Report - 2008

- Page 139 and 140:

Corporate Governance Report - 2008

- Page 141 and 142:

Corporate Governance Report - 2008

- Page 143 and 144:

Corporate Governance Report - 2008

- Page 145 and 146:

Individual Financial Statements 200

- Page 147 and 148:

Balance Sheets as at 31 st December

- Page 149 and 150:

Net Income Statements by Nature for

- Page 151 and 152:

Notes to the Financial Statements a

- Page 153 and 154:

Notes to the Financial Statements a

- Page 155 and 156:

Notes to the Financial Statements a

- Page 157 and 158:

Notes to the Financial Statements a

- Page 159 and 160:

Notes to the Financial Statements a

- Page 161 and 162:

Notes to the Financial Statements a

- Page 163 and 164:

Notes to the Financial Statements a

- Page 165 and 166:

Notes to the Financial Statements a

- Page 167 and 168:

Notes to the Financial Statements a

- Page 169 and 170:

Consolidated Financial Statements 2

- Page 171 and 172:

Consolidated Statement of Income at

- Page 173 and 174: Consolidated Cash Flow Statement at

- Page 175 and 176: Notes to the Consolidated Financial

- Page 177 and 178: Notes to the Consolidated Financial

- Page 179 and 180: Notes to the Consolidated Financial

- Page 181 and 182: Notes to the Consolidated Financial

- Page 183 and 184: Notes to the Consolidated Financial

- Page 185 and 186: Notes to the Consolidated Financial

- Page 187 and 188: Notes to the Consolidated Financial

- Page 189 and 190: Notes to the Consolidated Financial

- Page 191 and 192: Notes to the Consolidated Financial

- Page 193 and 194: Notes to the Consolidated Financial

- Page 195 and 196: Notes to the Consolidated Financial

- Page 197 and 198: Notes to the Consolidated Financial

- Page 199 and 200: Notes to the Consolidated Financial

- Page 201 and 202: Notes to the Consolidated Financial

- Page 203 and 204: Notes to the Consolidated Financial

- Page 205 and 206: Notes to the Consolidated Financial

- Page 207 and 208: Notes to the Consolidated Financial

- Page 209 and 210: Notes to the Consolidated Financial

- Page 211 and 212: Notes to the Consolidated Financial

- Page 213 and 214: Notes to the Consolidated Financial

- Page 215 and 216: Notes to the Consolidated Financial

- Page 217 and 218: Notes to the Consolidated Financial

- Page 219 and 220: Notes to the Consolidated Financial

- Page 221 and 222: Notes to the Consolidated Financial

- Page 223: Notes to the Consolidated Financial

- Page 227 and 228: Notes to the Consolidated Financial

- Page 229 and 230: Notes to the Consolidated Financial

- Page 231 and 232: Reports, Advisory Reports and Certi

- Page 238 and 239: Printing and Finishing: FACSIMILE,