ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

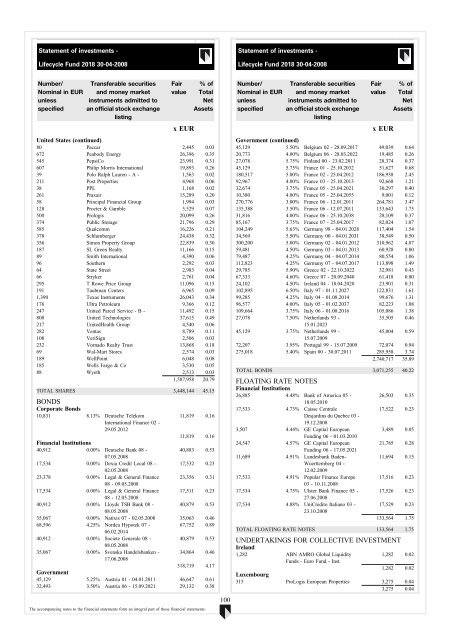

Statement of investments -<br />

Lifecycle Fund 2018 30-04-2008<br />

Statement of investments -<br />

Lifecycle Fund 2018 30-04-2008<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

80 Paccar 2,445 0.03<br />

672 Peabody Energy 26,396 0.35<br />

545 PepsiCo 23,991 0.31<br />

607 Philip Morris International 19,893 0.26<br />

39 Polo Ralph Lauren - A - 1,563 0.02<br />

211 Post Properties 4,968 0.06<br />

38 PPL 1,168 0.02<br />

261 Praxair 15,289 0.20<br />

58 Principal Financial Group 1,994 0.03<br />

128 Procter & Gamble 5,529 0.07<br />

500 Prologis 20,099 0.26<br />

374 Public Storage 21,796 0.29<br />

585 Qual<strong>com</strong>m 16,226 0.21<br />

378 Schlumberger 24,438 0.32<br />

356 Simon Property Group 22,839 0.30<br />

187 SL Green Realty 11,166 0.15<br />

89 Smith International 4,390 0.06<br />

96 Southern 2,292 0.03<br />

64 State Street 2,983 0.04<br />

66 Stryker 2,761 0.04<br />

295 T Rowe Price Group 11,096 0.15<br />

191 Taubman Centers 6,965 0.09<br />

1,390 Texas Instruments 26,043 0.34<br />

176 Ultra Petroleum 9,366 0.12<br />

247 United Parcel Service - B - 11,492 0.15<br />

808 United Technologies 37,615 0.49<br />

217 UnitedHealth Group 4,540 0.06<br />

282 Ventas 8,789 0.11<br />

108 VeriSign 2,506 0.03<br />

232 Vornado Realty Trust 13,868 0.18<br />

69 Wal-Mart Stores 2,574 0.03<br />

189 WellPoint 6,048 0.08<br />

185 Wells Fargo & Co 3,530 0.05<br />

88 Wyeth 2,513 0.03<br />

1,587,958 20.79<br />

TOTAL SHARES 3,448,144 45.15<br />

BONDS<br />

Corporate Bonds<br />

10,831 8.13% Deutsche Telekom<br />

11,819 0.16<br />

International Finance 02 -<br />

29.05.2012<br />

11,819 0.16<br />

Financial Institutions<br />

40,912 0.00% Deutsche Bank 08 -<br />

40,883 0.53<br />

07.05.2008<br />

17,534 0.00% Dexia Credit Local 08 - 17,532 0.23<br />

02.05.2008<br />

23,378 0.00% Legal & General Finance 23,356 0.31<br />

08 - 09.05.2008<br />

17,534 0.00% Legal & General Finance 17,511 0.23<br />

08 - 12.05.2008<br />

40,912 0.00% Lloyds TSB Bank 08 - 40,879 0.53<br />

08.05.2008<br />

35,067 0.00% Natixis 07 - 02.05.2008 35,063 0.46<br />

68,596 4.25% Nordea Hypotek 07 -<br />

67,752 0.89<br />

06.02.2014<br />

40,912 0.00% Societe Generale 08 -<br />

40,879 0.53<br />

08.05.2008<br />

35,067 0.00% Svenska Handelsbanken - 34,864 0.46<br />

17.06.2008<br />

318,719 4.17<br />

Government<br />

45,129 5.25% Austria 01 - 04.01.2011 46,647 0.61<br />

32,493 3.50% Austria 06 - 15.09.2021 29,132 0.38<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Government (continued)<br />

45,129 5.50% Belgium 02 - 28.09.2017 49,039 0.64<br />

20,773 4.00% Belgium 06 - 28.03.2022 19,485 0.26<br />

27,078 5.75% Finland 00 - 23.02.2011 28,374 0.37<br />

45,129 5.75% France 01 - 25.10.2032 51,627 0.68<br />

180,517 5.00% France 02 - 25.04.2012 186,938 2.45<br />

92,967 4.00% France 03 - 25.10.2013 92,668 1.21<br />

32,674 3.75% France 05 - 25.04.2021 30,297 0.40<br />

10,380 4.00% France 05 - 25.04.2055 9,001 0.12<br />

270,776 3.00% France 06 - 12.01.2011 264,781 3.47<br />

135,388 3.50% France 06 - 12.07.2011 133,643 1.75<br />

31,816 4.00% France 06 - 25.10.2038 28,109 0.37<br />

85,167 3.75% France 07 - 25.04.2017 82,024 1.07<br />

104,249 5.63% Germany 98 - 04.01.2028 117,404 1.54<br />

34,569 5.50% Germany 00 - 04.01.2031 38,549 0.50<br />

300,200 5.00% Germany 02 - 04.01.2012 310,962 4.07<br />

59,481 4.50% Germany 03 - 04.01.2013 60,928 0.80<br />

79,487 4.25% Germany 04 - 04.07.2014 80,554 1.06<br />

112,823 4.25% Germany 07 - 04.07.2017 113,898 1.49<br />

29,785 5.90% Greece 02 - 22.10.2022 32,981 0.43<br />

67,333 4.60% Greece 07 - 20.09.2040 61,418 0.80<br />

24,102 4.50% Ireland 04 - 18.04.2020 23,901 0.31<br />

102,895 6.50% Italy 97 - 01.11.2027 122,831 1.61<br />

99,285 4.25% Italy 04 - 01.08.2014 99,676 1.31<br />

96,577 4.00% Italy 05 - 01.02.2037 82,223 1.08<br />

109,664 3.75% Italy 06 - 01.08.2016 105,086 1.38<br />

27,078 7.50% Netherlands 93 -<br />

35,505 0.46<br />

15.01.2023<br />

45,129 3.75% Netherlands 99 -<br />

45,004 0.59<br />

15.07.2009<br />

72,207 3.95% Portugal 99 - 15.07.2009 72,074 0.94<br />

275,018 5.40% Spain 00 - 30.07.2011 285,958 3.74<br />

2,740,717 35.89<br />

TOTAL BONDS 3,071,255 40.22<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

26,885 4.48% Bank of America 05 -<br />

18.05.2010<br />

17,533 4.73% Caisse Centrale<br />

Desjardins du Quebec 03 -<br />

19.12.2008<br />

3,507 4.44% GE Capital European<br />

Funding 06 - 01.03.2010<br />

24,547 4.57% GE Capital European<br />

Funding 06 - 17.05.2021<br />

11,689 4.91% Landesbank Baden-<br />

Wuerttemberg 04 -<br />

12.02.2009<br />

17,533 4.91% Popular Finance Europe<br />

03 - 10.11.2008<br />

17,534 4.75% Ulster Bank Finance 05 -<br />

27.06.2008<br />

17,534 4.88% UniCredito Italiano 03 -<br />

23.10.2008<br />

26,503 0.35<br />

17,522 0.23<br />

3,489 0.05<br />

21,785 0.28<br />

11,694 0.15<br />

17,516 0.23<br />

17,526 0.23<br />

17,529 0.23<br />

133,564 1.75<br />

TOTAL FLOATING RATE NOTES 133,564 1.75<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Ireland<br />

1,282 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

1,282 0.02<br />

<strong>Funds</strong> - Euro Fund - Inst.<br />

1,282 0.02<br />

Luxembourg<br />

315 ProLogis European Properties 3,275 0.04<br />

3,275 0.04<br />

100