ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

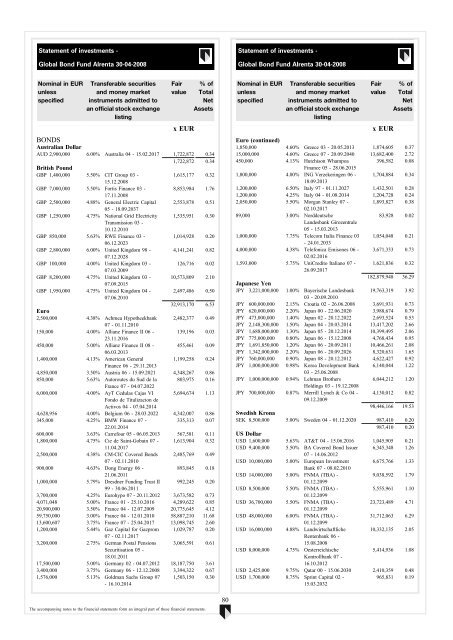

Statement of investments -<br />

Global Bond Fund Alrenta 30-04-2008<br />

Statement of investments -<br />

Global Bond Fund Alrenta 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

BONDS<br />

Australian Dollar<br />

AUD 2,900,000 6.00% Australia 04 - 15.02.2017 1,722,872 0.34<br />

1,722,872 0.34<br />

British Pound<br />

GBP 1,400,000 5.50% CIT Group 03 -<br />

15.12.2008<br />

1,615,177 0.32<br />

GBP 7,000,000 5.50% Fortis Finance 03 -<br />

8,853,984 1.76<br />

17.11.2008<br />

GBP 2,500,000 4.88% General Electric Capital 2,553,878 0.51<br />

05 - 18.09.2037<br />

GBP 1,250,000 4.75% National Grid Electricity 1,535,951 0.30<br />

Transmission 03 -<br />

10.12.2010<br />

GBP 850,000 5.63% RWE Finance 03 -<br />

1,014,928 0.20<br />

06.12.2023<br />

GBP 2,800,000 6.00% United Kingdom 98 - 4,141,241 0.82<br />

07.12.2028<br />

GBP 100,000 4.00% United Kingdom 03 - 126,716 0.02<br />

07.03.2009<br />

GBP 8,200,000 4.75% United Kingdom 03 - 10,573,809 2.10<br />

07.09.2015<br />

GBP 1,950,000 4.75% United Kingdom 04 - 2,497,486 0.50<br />

07.06.2010<br />

32,913,170 6.53<br />

Euro<br />

2,500,000 4.38% Achmea Hypotheekbank 2,482,377 0.49<br />

07 - 01.11.2010<br />

150,000 4.00% Allianz Finance II 06 - 139,196 0.03<br />

23.11.2016<br />

450,000 5.00% Allianz Finance II 08 - 455,461 0.09<br />

06.03.2013<br />

1,400,000 4.13% American General<br />

1,199,258 0.24<br />

Finance 06 - 29.11.2013<br />

4,850,000 3.50% Austria 06 - 15.09.2021 4,348,267 0.86<br />

850,000 5.63% Autoroutes du Sud de la 803,975 0.16<br />

France 07 - 04.07.2022<br />

6,000,000 4.00% AyT Cedulas Cajas VI 5,694,674 1.13<br />

Fondo de Titulizacion de<br />

Activos 04 - 07.04.2014<br />

4,628,956 4.00% Belgium 06 - 28.03.2022 4,342,007 0.86<br />

345,000 4.25% BMW Finance 07 -<br />

335,313 0.07<br />

22.01.2014<br />

600,000 3.63% Carrefour 05 - 06.05.2013 567,581 0.11<br />

1,800,000 4.75% Cie de Saint-Gobain 07 - 1,613,904 0.32<br />

11.04.2017<br />

2,500,000 4.38% CM-CIC Covered Bonds 2,485,769 0.49<br />

07 - 02.11.2010<br />

900,000 4.63% Dong Energy 06 -<br />

893,845 0.18<br />

21.06.2011<br />

1,000,000 5.79% Dresdner Funding Trust II 992,245 0.20<br />

99 - 30.06.2011<br />

3,700,000 4.25% Eurohypo 07 - 20.11.2012 3,673,582 0.73<br />

4,071,048 5.00% France 01 - 25.10.2016 4,289,622 0.85<br />

20,900,000 3.50% France 04 - 12.07.2009 20,775,645 4.12<br />

59,750,000 3.00% France 04 - 12.01.2010 58,887,210 11.68<br />

13,600,607 3.75% France 07 - 25.04.2017 13,098,745 2.60<br />

1,200,000 5.44% Gaz Capital for Gazprom 1,029,787 0.20<br />

07 - 02.11.2017<br />

3,200,000 2.75% German Postal Pensions 3,065,591 0.61<br />

Securitisation 05 -<br />

18.01.2011<br />

17,500,000 5.00% Germany 02 - 04.07.2012 18,187,750 3.61<br />

3,400,000 3.75% Germany 06 - 12.12.2008 3,394,322 0.67<br />

1,576,000 5.13% Goldman Sachs Group 07<br />

- 16.10.2014<br />

1,503,150 0.30<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Euro (continued)<br />

1,850,000 4.60% Greece 03 - 20.05.2013 1,874,605 0.37<br />

15,000,000 4.60% Greece 07 - 20.09.2040 13,682,400 2.72<br />

450,000 4.13% Hutchison Whampoa<br />

396,582 0.08<br />

Finance 05 - 28.06.2015<br />

1,800,000 4.00% ING Verzekeringen 06 - 1,704,884 0.34<br />

18.09.2013<br />

1,200,000 6.50% Italy 97 - 01.11.2027 1,432,501 0.28<br />

1,200,000 4.25% Italy 04 - 01.08.2014 1,204,728 0.24<br />

2,050,000 5.50% Morgan Stanley 07 - 1,893,827 0.38<br />

02.10.2017<br />

89,000 3.00% Norddeutsche<br />

83,928 0.02<br />

Landesbank Girozentrale<br />

05 - 15.03.2013<br />

1,000,000 7.75% Tele<strong>com</strong> Italia Finance 03 1,054,048 0.21<br />

- 24.01.2033<br />

4,000,000 4.38% Telefonica Emisones 06 - 3,671,333 0.73<br />

02.02.2016<br />

1,593,000 5.75% UniCredito Italiano 07 - 1,621,836 0.32<br />

26.09.2017<br />

182,879,948 36.29<br />

Japanese Yen<br />

JPY 3,221,000,000 1.00% Bayerische Landesbank 19,763,319 3.92<br />

03 - 20.09.2010<br />

JPY 600,000,000 2.15% Croatia 02 - 26.06.2008 3,691,931 0.73<br />

JPY 620,000,000 2.20% Japan 00 - 22.06.2020 3,988,674 0.79<br />

JPY 473,000,000 1.40% Japan 02 - 20.12.2022 2,693,524 0.53<br />

JPY 2,148,300,000 1.50% Japan 04 - 20.03.2014 13,417,202 2.66<br />

JPY 1,688,000,000 1.30% Japan 05 - 20.12.2014 10,399,495 2.06<br />

JPY 775,000,000 0.80% Japan 06 - 15.12.2008 4,768,434 0.95<br />

JPY 1,691,850,000 1.20% Japan 06 - 20.09.2011 10,466,261 2.08<br />

JPY 1,342,000,000 2.20% Japan 06 - 20.09.2026 8,320,631 1.65<br />

JPY 760,000,000 0.90% Japan 08 - 20.12.2012 4,622,427 0.92<br />

JPY 1,000,000,000 0.98% Korea Development Bank 6,140,044 1.22<br />

03 - 25.06.2008<br />

JPY 1,000,000,000 0.94% Lehman Brothers<br />

6,044,212 1.20<br />

Holdings 03 - 19.12.2008<br />

JPY 700,000,000 0.87% Merrill Lynch & Co 04 - 4,130,012 0.82<br />

09.12.2009<br />

98,446,166 19.53<br />

Swedish Krona<br />

SEK 8,500,000 5.00% Sweden 04 - 01.12.2020 987,410 0.20<br />

987,410 0.20<br />

US Dollar<br />

USD 1,600,000 5.63% AT&T 04 - 15.06.2016 1,045,905 0.21<br />

USD 9,400,000 5.50% BA Covered Bond Issuer 6,345,348 1.26<br />

07 - 14.06.2012<br />

USD 10,000,000 5.00% European Investment 6,675,766 1.33<br />

Bank 07 - 08.02.2010<br />

USD 14,000,000 5.00% FNMA (TBA) -<br />

9,038,592 1.79<br />

01.12.2099<br />

USD 8,500,000 5.50% FNMA (TBA) -<br />

5,555,961 1.10<br />

01.12.2099<br />

USD 36,700,000 5.50% FNMA (TBA) -<br />

23,723,489 4.71<br />

01.12.2099<br />

USD 48,000,000 6.00% FNMA (TBA) -<br />

31,712,063 6.29<br />

01.12.2099<br />

USD 16,000,000 4.88% Landwirtschaftliche 10,332,135 2.05<br />

Rentenbank 06 -<br />

15.08.2008<br />

USD 8,000,000 4.75% Oesterreichische<br />

5,414,936 1.08<br />

Kontrollbank 07 -<br />

16.10.2012<br />

USD 2,425,000 9.75% Qatar 00 - 15.06.2030 2,410,359 0.48<br />

USD 1,700,000 8.75% Sprint Capital 02 -<br />

15.03.2032<br />

965,831 0.19<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

80