ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

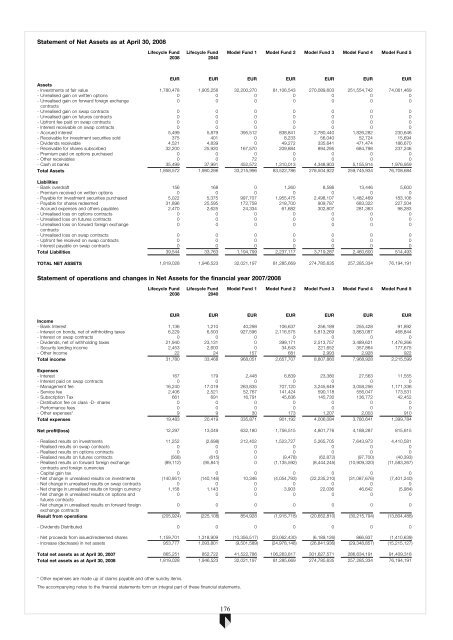

Statement of Net Assets as at April 30, 2008<br />

Lifecycle Fund<br />

2038<br />

Lifecycle Fund<br />

2040<br />

Model Fund 1 Model Fund 2 Model Fund 3 Model Fund 4 Model Fund 5<br />

EUR EUR EUR EUR EUR EUR EUR<br />

Assets<br />

- Investments at fair value 1,780,478 1,905,256 32,200,270 81,106,543 270,089,603 251,554,742 74,061,469<br />

- Unrealised gain on written options 0 0 0 0 0 0 0<br />

- Unrealised gain on forward foreign exchange<br />

0 0 0 0 0 0 0<br />

contracts<br />

- Unrealised gain on swap contracts 0 0 0 0 0 0 0<br />

- Unrealised gain on futures contracts 0 0 0 0 0 0 0<br />

- Upfront fee paid on swap contracts 0 0 0 0 0 0 0<br />

- Interest receivable on swap contracts 0 0 0 0 0 0 0<br />

- Accrued interest 5,499 5,879 395,512 838,841 2,780,440 1,826,282 230,646<br />

- Receivable for investment securities sold 375 401 0 8,233 56,040 52,724 15,694<br />

- Dividends receivable 4,521 4,839 0 49,272 335,641 471,474 186,670<br />

- Receivable for shares subscribed 32,200 25,920 167,570 209,884 894,295 684,798 237,246<br />

- Premium paid on options purchased 0 0 0 0 0 0 0<br />

- Other receivables 0 0 72 0 0 0 0<br />

- Cash at banks 35,499 37,991 452,572 1,310,013 4,348,903 5,155,914 1,976,959<br />

Total Assets 1,858,572 1,980,286 33,215,996 83,522,786 278,504,922 259,745,934 76,708,684<br />

Liabilities<br />

- Bank overdraft 156 168 0 1,260 8,586 13,446 5,600<br />

- Premium received on written options 0 0 0 0 0 0 0<br />

- Payable for investment securities purchased 5,022 5,375 997,707 1,955,475 2,498,107 1,482,469 183,106<br />

- Payable for shares redeemed 31,896 25,595 172,758 218,700 909,787 683,322 227,504<br />

- Accrued expenses and others payables 2,470 2,625 24,334 61,682 302,807 281,363 98,283<br />

- Unrealised loss on options contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on futures contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on forward foreign exchange<br />

0 0 0 0 0 0 0<br />

contracts<br />

- Unrealised loss on swap contracts 0 0 0 0 0 0 0<br />

- Upfront fee received on swap contracts 0 0 0 0 0 0 0<br />

- Interest payable on swap contracts 0 0 0 0 0 0 0<br />

Total Liabilities 39,544 33,763 1,194,799 2,237,117 3,719,287 2,460,600 514,493<br />

TOTAL NET ASSETS 1,819,028 1,946,523 32,021,197 81,285,669 274,785,635 257,285,334 76,194,191<br />

Statement of operations and changes in Net Assets for the financial year 2007/2008<br />

Lifecycle Fund<br />

2038<br />

Lifecycle Fund<br />

2040<br />

Model Fund 1 Model Fund 2 Model Fund 3 Model Fund 4 Model Fund 5<br />

EUR EUR EUR EUR EUR EUR EUR<br />

In<strong>com</strong>e<br />

- Bank Interest 1,136 1,210 40,298 106,637 256,189 255,428 91,892<br />

- Interest on bonds, net of withholding taxes 6,229 6,503 927,596 2,116,575 5,813,269 3,863,087 468,844<br />

- Interest on swap contracts 0 0 0 0 0 0 0<br />

- Dividends, net of withholding taxes 21,940 23,131 0 399,171 2,513,757 3,489,621 1,476,266<br />

- Security lending in<strong>com</strong>e 2,453 2,600 0 34,643 221,652 357,864 177,675<br />

- Other In<strong>com</strong>e 22 24 157 681 2,993 2,928 922<br />

Total in<strong>com</strong>e 31,780 33,468 968,051 2,657,707 8,807,860 7,968,928 2,215,599<br />

Expenses<br />

- Interest 167 179 2,448 6,839 23,380 27,563 11,555<br />

- Interest paid on swap contracts 0 0 0 0 0 0 0<br />

- Management fee 16,240 17,019 263,835 707,120 3,245,649 3,058,256 1,171,336<br />

- Service fee 2,406 2,521 52,767 141,424 590,118 556,047 173,531<br />

- Subscription Tax 661 691 16,791 45,636 145,730 136,772 42,452<br />

- Distribution fee on class -D- shares 0 0 0 0 0 0 0<br />

- Performance fees 0 0 0 0 0 0 0<br />

- Other expenses* 9 9 30 173 1,207 2,003 910<br />

Total expenses 19,483 20,419 335,871 901,192 4,006,084 3,780,641 1,399,784<br />

Net profit(loss) 12,297 13,049 632,180 1,756,515 4,801,776 4,188,287 815,815<br />

- Realised results on investments 11,252 (2,698) 212,402 1,523,727 5,265,705 7,643,973 4,410,581<br />

- Realised results on swap contracts 0 0 0 0 0 0 0<br />

- Realised results on options contracts 0 0 0 0 0 0 0<br />

- Realised results on futures contracts (568) (615) 0 (9,478) (62,872) (97,700) (40,393)<br />

- Realised results on forward foreign exchange<br />

(89,112) (95,841) 0 (1,135,592) (8,444,245) (10,909,320) (11,583,267)<br />

contracts and foreign currencies<br />

- Capital gain tax 0 0 0 0 0 0 0<br />

- Net change in unrealised results on investments (140,951) (140,146) 10,346 (4,054,793) (22,235,210) (31,087,676) (7,401,240)<br />

- Net change in unrealised results on swap contracts 0 0 0 0 0 0 0<br />

- Net change in unrealised results on foreign currency 1,158 1,143 0 3,903 22,036 46,642 (5,984)<br />

- Net change in unrealised results on options and<br />

0 0 0 0 0 0 0<br />

futures contracts<br />

- Net change in unrealised results on forward foreign<br />

0 0 0 0 0 0 0<br />

exchange contracts<br />

Result from operations (205,924) (225,108) 854,928 (1,915,718) (20,652,810) (30,215,794) (13,804,488)<br />

- Dividends Distributed 0 0 0 0 0 0 0<br />

- Net proceeds from issued/redeemed shares 1,159,701 1,318,909 (10,356,517) (23,062,430) (6,189,126) 866,937 (1,410,639)<br />

- Increase (decrease) in net assets 953,777 1,093,801 (9,501,589) (24,978,148) (26,841,936) (29,348,857) (15,215,127)<br />

Total Exchange net assets Difference as at April 30, 2007 865,251 852,722 41,522,786 106,263,817 301,627,571 286,634,191 91,409,318<br />

Total net assets as at April 30, 2008 1,819,028 1,946,523 32,021,197 81,285,669 274,785,635 257,285,334 76,194,191<br />

* Other expenses are made up of claims payable and other sundry items.<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

176