ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

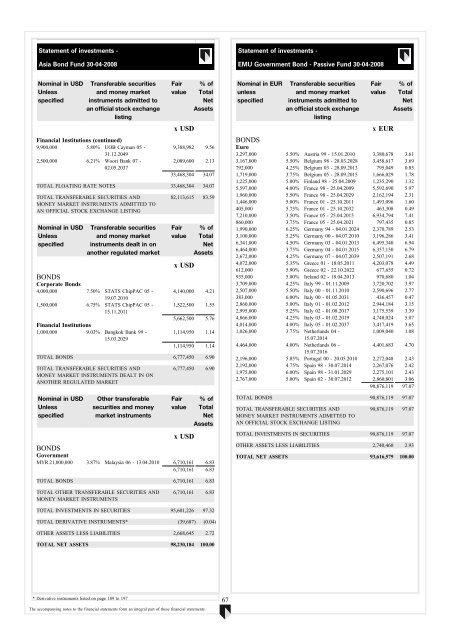

Statement of investments -<br />

Asia Bond Fund 30-04-2008<br />

Statement of investments -<br />

EMU Government Bond - Passive Fund 30-04-2008<br />

Nominal in USD<br />

Unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Financial Institutions (continued)<br />

9,900,000 5.80% UOB Cayman 05 -<br />

31.12.2049<br />

2,500,000 6.21% Woori Bank 07 -<br />

02.05.2037<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

9,388,982 9.56<br />

2,089,600 2.13<br />

33,468,304 34.07<br />

TOTAL FLOATING RATE NOTES 33,468,304 34.07<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in USD<br />

Unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

BONDS<br />

Corporate Bonds<br />

4,000,000 7.50% STATS ChipPAC 05 -<br />

19.07.2010<br />

1,500,000 6.75% STATS ChipPAC 05 -<br />

15.11.2011<br />

Financial Institutions<br />

1,000,000 9.03% Bangkok Bank 99 -<br />

15.03.2029<br />

82,113,615 83.59<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

4,140,000 4.21<br />

1,522,500 1.55<br />

5,662,500 5.76<br />

1,114,950 1.14<br />

1,114,950 1.14<br />

TOTAL BONDS 6,777,450 6.90<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

Nominal in USD<br />

Unless<br />

specified<br />

Other transferable<br />

securities and money<br />

market instruments<br />

6,777,450 6.90<br />

Fair<br />

value<br />

% of<br />

Total<br />

Net<br />

Assets<br />

x USD<br />

BONDS<br />

Government<br />

MYR 21,000,000 3.87% Malaysia 06 - 13.04.2010 6,710,161 6.83<br />

6,710,161 6.83<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

% of<br />

Total<br />

Net<br />

Assets<br />

x EUR<br />

BONDS<br />

Euro<br />

3,297,000 5.50% Austria 99 - 15.01.2010 3,380,678 3.61<br />

3,167,000 5.50% Belgium 98 - 28.03.2028 3,458,617 3.69<br />

792,000 4.25% Belgium 03 - 28.09.2013 795,049 0.85<br />

1,719,000 3.75% Belgium 05 - 28.09.2015 1,666,029 1.78<br />

1,225,000 5.00% Finland 98 - 25.04.2009 1,235,290 1.32<br />

5,597,000 4.00% France 98 - 25.04.2009 5,592,690 5.97<br />

1,960,000 5.50% France 98 - 25.04.2029 2,162,194 2.31<br />

1,446,000 5.00% France 01 - 25.10.2011 1,493,096 1.60<br />

405,000 5.75% France 01 - 25.10.2032 463,308 0.49<br />

7,210,000 3.50% France 05 - 25.04.2015 6,934,794 7.41<br />

860,000 3.75% France 05 - 25.04.2021 797,435 0.85<br />

1,990,000 6.25% Germany 94 - 04.01.2024 2,370,789 2.53<br />

3,100,000 5.25% Germany 00 - 04.07.2010 3,196,286 3.41<br />

6,341,000 4.50% Germany 03 - 04.01.2013 6,495,340 6.94<br />

6,464,000 3.75% Germany 04 - 04.01.2015 6,357,150 6.79<br />

2,672,000 4.25% Germany 07 - 04.07.2039 2,507,191 2.68<br />

4,072,000 5.35% Greece 01 - 18.05.2011 4,203,078 4.49<br />

612,000 5.90% Greece 02 - 22.10.2022 677,655 0.72<br />

935,000 5.00% Ireland 02 - 18.04.2013 970,680 1.04<br />

3,709,000 4.25% Italy 99 - 01.11.2009 3,720,702 3.97<br />

2,507,000 5.50% Italy 00 - 01.11.2010 2,590,696 2.77<br />

383,000 6.00% Italy 00 - 01.05.2031 436,457 0.47<br />

2,860,000 5.00% Italy 01 - 01.02.2012 2,944,184 3.15<br />

2,995,000 5.25% Italy 02 - 01.08.2017 3,175,539 3.39<br />

4,866,000 4.25% Italy 03 - 01.02.2019 4,748,024 5.07<br />

4,014,000 4.00% Italy 05 - 01.02.2037 3,417,419 3.65<br />

1,026,000 3.75% Netherlands 04 -<br />

1,009,040 1.08<br />

15.07.2014<br />

4,464,000 4.00% Netherlands 06 -<br />

4,401,683 4.70<br />

15.07.2016<br />

2,196,000 5.85% Portugal 00 - 20.05.2010 2,272,048 2.43<br />

2,192,000 4.75% Spain 98 - 30.07.2014 2,267,076 2.42<br />

1,975,000 6.00% Spain 98 - 31.01.2029 2,275,101 2.43<br />

2,767,000 5.00% Spain 02 - 30.07.2012 2,860,801 3.06<br />

90,876,119 97.07<br />

TOTAL BONDS 90,876,119 97.07<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

90,876,119 97.07<br />

TOTAL INVESTMENTS IN SECURITIES 90,876,119 97.07<br />

OTHER ASSETS LESS LIABILITIES 2,740,460 2.93<br />

TOTAL NET ASSETS 93,616,579 100.00<br />

TOTAL BONDS 6,710,161 6.83<br />

TOTAL OTHER TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS<br />

6,710,161 6.83<br />

TOTAL INVESTMENTS IN SECURITIES 95,601,226 97.32<br />

TOTAL DERIVATIVE INSTRUMENTS* (39,687) (0.04)<br />

OTHER ASSETS LESS LIABILITIES 2,668,645 2.72<br />

TOTAL NET ASSETS 98,230,184 100.00<br />

* Derivative instruments listed on page 189 to 197<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

67