ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

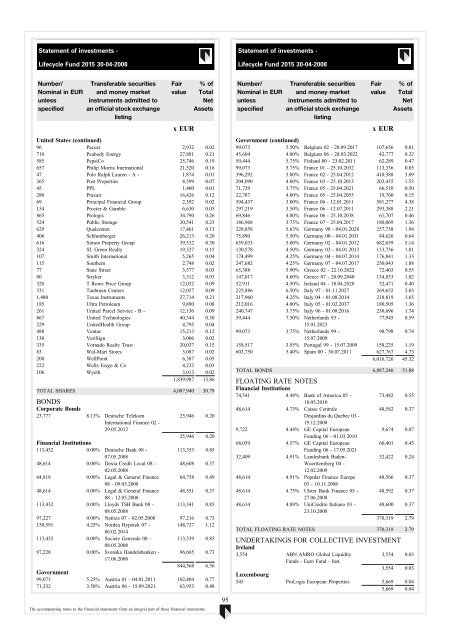

Statement of investments -<br />

Lifecycle Fund 2015 30-04-2008<br />

Statement of investments -<br />

Lifecycle Fund 2015 30-04-2008<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

96 Paccar 2,932 0.02<br />

710 Peabody Energy 27,881 0.21<br />

585 PepsiCo 25,746 0.19<br />

657 Philip Morris International 21,520 0.16<br />

47 Polo Ralph Lauren - A - 1,874 0.01<br />

365 Post Properties 8,599 0.07<br />

45 PPL 1,400 0.01<br />

280 Praxair 16,426 0.12<br />

69 Principal Financial Group 2,392 0.02<br />

154 Procter & Gamble 6,630 0.05<br />

865 Prologis 34,790 0.26<br />

524 Public Storage 30,541 0.23<br />

629 Qual<strong>com</strong>m 17,461 0.13<br />

406 Schlumberger 26,213 0.20<br />

616 Simon Property Group 39,532 0.30<br />

324 SL Green Realty 19,327 0.15<br />

107 Smith International 5,265 0.04<br />

115 Southern 2,748 0.02<br />

77 State Street 3,577 0.03<br />

80 Stryker 3,312 0.03<br />

320 T Rowe Price Group 12,032 0.09<br />

331 Taubman Centers 12,057 0.09<br />

1,480 Texas Instruments 27,714 0.21<br />

185 Ultra Petroleum 9,890 0.08<br />

261 United Parcel Service - B - 12,136 0.09<br />

867 United Technologies 40,344 0.30<br />

229 UnitedHealth Group 4,795 0.04<br />

488 Ventas 15,213 0.12<br />

130 VeriSign 3,006 0.02<br />

335 Vornado Realty Trust 20,037 0.15<br />

83 Wal-Mart Stores 3,087 0.02<br />

200 WellPoint 6,387 0.05<br />

222 Wells Fargo & Co 4,233 0.03<br />

106 Wyeth 3,013 0.02<br />

1,839,987 13.86<br />

TOTAL SHARES 4,087,940 30.79<br />

BONDS<br />

Corporate Bonds<br />

23,777 8.13% Deutsche Telekom<br />

25,946 0.20<br />

International Finance 02 -<br />

29.05.2012<br />

25,946 0.20<br />

Financial Institutions<br />

113,432 0.00% Deutsche Bank 08 -<br />

113,353 0.85<br />

07.05.2008<br />

48,614 0.00% Dexia Credit Local 08 - 48,608 0.37<br />

02.05.2008<br />

64,818 0.00% Legal & General Finance 64,758 0.49<br />

08 - 09.05.2008<br />

48,614 0.00% Legal & General Finance 48,551 0.37<br />

08 - 12.05.2008<br />

113,432 0.00% Lloyds TSB Bank 08 - 113,341 0.85<br />

08.05.2008<br />

97,227 0.00% Natixis 07 - 02.05.2008 97,216 0.73<br />

150,591 4.25% Nordea Hypotek 07 -<br />

148,737 1.12<br />

06.02.2014<br />

113,432 0.00% Societe Generale 08 - 113,339 0.85<br />

08.05.2008<br />

97,228 0.00% Svenska Handelsbanken - 96,665 0.73<br />

17.06.2008<br />

844,568 6.36<br />

Government<br />

99,073 5.25% Austria 01 - 04.01.2011 102,404 0.77<br />

71,332 3.50% Austria 06 - 15.09.2021 63,953 0.48<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

95<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Government (continued)<br />

99,073 5.50% Belgium 02 - 28.09.2017 107,656 0.81<br />

45,604 4.00% Belgium 06 - 28.03.2022 42,777 0.32<br />

59,444 5.75% Finland 00 - 23.02.2011 62,289 0.47<br />

99,073 5.75% France 01 - 25.10.2032 113,336 0.85<br />

396,292 5.00% France 02 - 25.04.2012 410,388 3.09<br />

204,090 4.00% France 03 - 25.10.2013 203,435 1.53<br />

71,729 3.75% France 05 - 25.04.2021 66,510 0.50<br />

22,787 4.00% France 05 - 25.04.2055 19,760 0.15<br />

594,437 3.00% France 06 - 12.01.2011 581,277 4.38<br />

297,219 3.50% France 06 - 12.07.2011 293,388 2.21<br />

69,846 4.00% France 06 - 25.10.2038 61,707 0.46<br />

186,968 3.75% France 07 - 25.04.2017 180,069 1.36<br />

228,858 5.63% Germany 98 - 04.01.2028 257,738 1.94<br />

75,890 5.50% Germany 00 - 04.01.2031 84,626 0.64<br />

659,033 5.00% Germany 02 - 04.01.2012 682,659 5.14<br />

130,578 4.50% Germany 03 - 04.01.2013 133,756 1.01<br />

174,499 4.25% Germany 04 - 04.07.2014 176,841 1.33<br />

247,682 4.25% Germany 07 - 04.07.2017 250,043 1.88<br />

65,388 5.90% Greece 02 - 22.10.2022 72,403 0.55<br />

147,817 4.60% Greece 07 - 20.09.2040 134,833 1.02<br />

52,911 4.50% Ireland 04 - 18.04.2020 52,471 0.40<br />

225,886 6.50% Italy 97 - 01.11.2027 269,652 2.03<br />

217,960 4.25% Italy 04 - 01.08.2014 218,819 1.65<br />

212,016 4.00% Italy 05 - 01.02.2037 180,505 1.36<br />

240,747 3.75% Italy 06 - 01.08.2016 230,696 1.74<br />

59,444 7.50% Netherlands 93 -<br />

77,945 0.59<br />

15.01.2023<br />

99,073 3.75% Netherlands 99 -<br />

98,798 0.74<br />

15.07.2009<br />

158,517 3.95% Portugal 99 - 15.07.2009 158,225 1.19<br />

603,750 5.40% Spain 00 - 30.07.2011 627,767 4.73<br />

6,016,726 45.32<br />

TOTAL BONDS 6,887,240 51.88<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

74,541 4.48% Bank of America 05 -<br />

18.05.2010<br />

48,614 4.73% Caisse Centrale<br />

Desjardins du Quebec 03 -<br />

19.12.2008<br />

9,722 4.44% GE Capital European<br />

Funding 06 - 01.03.2010<br />

68,059 4.57% GE Capital European<br />

Funding 06 - 17.05.2021<br />

32,409 4.91% Landesbank Baden-<br />

Wuerttemberg 04 -<br />

12.02.2009<br />

48,614 4.91% Popular Finance Europe<br />

03 - 10.11.2008<br />

48,614 4.75% Ulster Bank Finance 05 -<br />

27.06.2008<br />

48,614 4.88% UniCredito Italiano 03 -<br />

23.10.2008<br />

73,482 0.55<br />

48,582 0.37<br />

9,674 0.07<br />

60,401 0.45<br />

32,422 0.24<br />

48,566 0.37<br />

48,592 0.37<br />

48,600 0.37<br />

370,319 2.79<br />

TOTAL FLOATING RATE NOTES 370,319 2.79<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Ireland<br />

3,554 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

3,554 0.03<br />

<strong>Funds</strong> - Euro Fund - Inst.<br />

3,554 0.03<br />

Luxembourg<br />

545 ProLogis European Properties 5,669 0.04<br />

5,669 0.04