ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

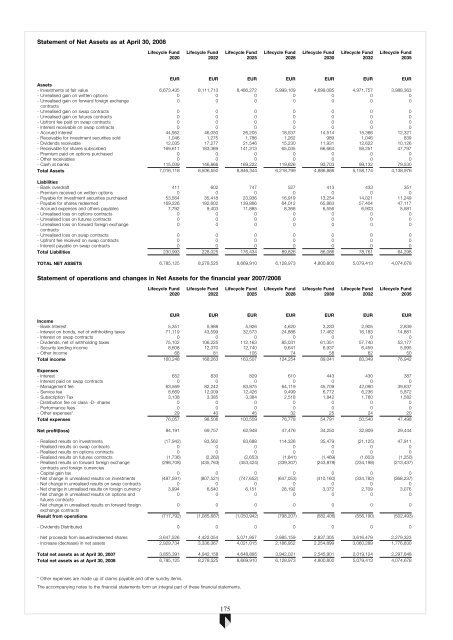

Statement of Net Assets as at April 30, 2008<br />

Lifecycle Fund<br />

2020<br />

Lifecycle Fund<br />

2022<br />

Lifecycle Fund<br />

2025<br />

Lifecycle Fund<br />

2028<br />

Lifecycle Fund<br />

2030<br />

Lifecycle Fund<br />

2032<br />

Lifecycle Fund<br />

2035<br />

EUR EUR EUR EUR EUR EUR EUR<br />

Assets<br />

- Investments at fair value 6,673,435 8,111,713 8,486,272 5,999,109 4,699,085 4,971,757 3,988,363<br />

- Unrealised gain on written options 0 0 0 0 0 0 0<br />

- Unrealised gain on forward foreign exchange<br />

0 0 0 0 0 0 0<br />

contracts<br />

- Unrealised gain on swap contracts 0 0 0 0 0 0 0<br />

- Unrealised gain on futures contracts 0 0 0 0 0 0 0<br />

- Upfront fee paid on swap contracts 0 0 0 0 0 0 0<br />

- Interest receivable on swap contracts 0 0 0 0 0 0 0<br />

- Accrued interest 44,952 46,050 26,205 18,537 14,514 15,366 12,321<br />

- Receivable for investment securities sold 1,046 1,275 1,786 1,262 989 1,046 839<br />

- Dividends receivable 12,035 17,277 21,546 15,230 11,931 12,622 10,126<br />

- Receivable for shares subscribed 169,611 183,369 141,313 65,035 66,664 58,251 47,797<br />

- Premium paid on options purchased 0 0 0 0 0 0 0<br />

- Other receivables 0 0 0 0 0 0 0<br />

- Cash at banks 115,039 146,866 169,222 119,626 93,703 99,132 79,530<br />

Total Assets 7,016,118 8,506,550 8,846,344 6,218,799 4,886,886 5,158,174 4,138,976<br />

Liabilities<br />

- Bank overdraft 411 602 747 527 413 433 351<br />

- Premium received on written options 0 0 0 0 0 0 0<br />

- Payable for investment securities purchased 53,564 35,418 23,936 16,919 13,254 14,021 11,249<br />

- Payable for shares redeemed 169,226 182,602 139,866 64,012 65,863 57,404 47,117<br />

- Accrued expenses and others payables 7,792 9,403 11,885 8,368 6,556 6,903 5,581<br />

- Unrealised loss on options contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on futures contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on forward foreign exchange<br />

0 0 0 0 0 0 0<br />

contracts<br />

- Unrealised loss on swap contracts 0 0 0 0 0 0 0<br />

- Upfront fee received on swap contracts 0 0 0 0 0 0 0<br />

- Interest payable on swap contracts 0 0 0 0 0 0 0<br />

Total Liabilities 230,993 228,025 176,434 89,826 86,086 78,761 64,298<br />

TOTAL NET ASSETS 6,785,125 8,278,525 8,669,910 6,128,973 4,800,800 5,079,413 4,074,678<br />

Statement of operations and changes in Net Assets for the financial year 2007/2008<br />

Lifecycle Fund<br />

2020<br />

Lifecycle Fund<br />

2022<br />

Lifecycle Fund<br />

2025<br />

Lifecycle Fund<br />

2028<br />

Lifecycle Fund<br />

2030<br />

Lifecycle Fund<br />

2032<br />

Lifecycle Fund<br />

2035<br />

EUR EUR EUR EUR EUR EUR EUR<br />

In<strong>com</strong>e<br />

- Bank Interest 5,351 5,988 5,926 4,620 3,233 2,905 2,839<br />

- Interest on bonds, net of withholding taxes 71,119 43,599 32,573 24,888 17,462 16,183 14,881<br />

- Interest on swap contracts 0 0 0 0 0 0 0<br />

- Dividends, net of withholding taxes 75,102 106,225 112,163 85,031 61,351 57,740 53,177<br />

- Security lending in<strong>com</strong>e 8,608 12,370 12,740 9,641 6,937 6,459 5,995<br />

- Other In<strong>com</strong>e 68 81 105 74 58 62 50<br />

Total in<strong>com</strong>e 160,248 168,263 163,507 124,254 89,041 83,349 76,942<br />

Expenses<br />

- Interest 652 830 829 610 443 430 387<br />

- Interest paid on swap contracts 0 0 0 0 0 0 0<br />

- Management fee 63,569 82,242 83,875 64,119 45,709 42,090 39,637<br />

- Service fee 8,669 12,009 12,426 9,499 6,772 6,236 5,872<br />

- Subscription Tax 3,138 3,385 3,384 2,518 1,842 1,760 1,582<br />

- Distribution fee on class -D- shares 0 0 0 0 0 0 0<br />

- Performance fees 0 0 0 0 0 0 0<br />

- Other expenses* 29 40 45 32 25 24 20<br />

Total expenses 76,057 98,506 100,559 76,778 54,791 50,540 47,498<br />

Net profit(loss) 84,191 69,757 62,948 47,476 34,250 32,809 29,444<br />

- Realised results on investments (17,942) 83,562 83,688 114,326 35,479 (21,125) 47,911<br />

- Realised results on swap contracts 0 0 0 0 0 0 0<br />

- Realised results on options contracts 0 0 0 0 0 0 0<br />

- Realised results on futures contracts (1,736) (2,262) (2,653) (1,841) (1,469) (1,603) (1,250)<br />

- Realised results on forward foreign exchange<br />

(298,708) (435,763) (453,424) (339,307) (243,878) (234,198) (213,437)<br />

contracts and foreign currencies<br />

- Capital gain tax 0 0 0 0 0 0 0<br />

- Net change in unrealised results on investments (487,591) (807,521) (747,652) (647,053) (410,160) (334,782) (368,237)<br />

- Net change in unrealised results on swap contracts 0 0 0 0 0 0 0<br />

- Net change in unrealised results on foreign currency 3,994 6,540 6,151 28,192 3,372 2,709 3,076<br />

- Net change in unrealised results on options and<br />

0 0 0 0 0 0 0<br />

futures contracts<br />

- Net change in unrealised results on forward foreign<br />

0 0 0 0 0 0 0<br />

exchange contracts<br />

Result from operations (717,792) (1,085,687) (1,050,942) (798,207) (582,406) (556,190) (502,493)<br />

- Dividends Distributed 0 0 0 0 0 0 0<br />

- Net proceeds from issued/redeemed shares 3,647,526 4,422,054 5,071,957 2,985,159 2,837,305 3,616,479 2,279,323<br />

- Increase (decrease) in net assets 2,929,734 3,336,367 4,021,015 2,186,952 2,254,899 3,060,289 1,776,830<br />

Total Exchange net assets Difference as at April 30, 2007 3,855,391 4,942,158 4,648,895 3,942,021 2,545,901 2,019,124 2,297,848<br />

Total net assets as at April 30, 2008 6,785,125 8,278,525 8,669,910 6,128,973 4,800,800 5,079,413 4,074,678<br />

* Other expenses are made up of claims payable and other sundry items.<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

175