ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

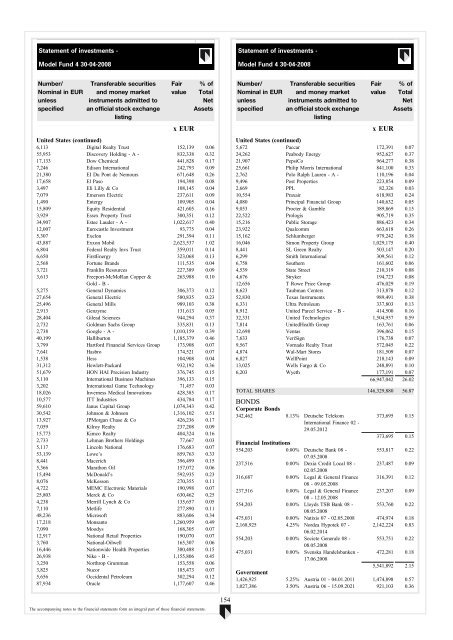

Statement of investments -<br />

Model Fund 4 30-04-2008<br />

Statement of investments -<br />

Model Fund 4 30-04-2008<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

6,113 Digital Realty Trust 152,139 0.06<br />

55,953 Discovery Holding - A - 832,338 0.32<br />

17,133 Dow Chemical 441,828 0.17<br />

7,246 Edison International 242,793 0.09<br />

21,380 EI Du Pont de Nemours 671,648 0.26<br />

17,658 El Paso 194,398 0.08<br />

3,497 Eli Lilly & Co 108,145 0.04<br />

7,079 Emerson Electric 237,611 0.09<br />

1,490 Entergy 109,905 0.04<br />

15,809 Equity Residential 421,605 0.16<br />

3,929 Essex Property Trust 300,351 0.12<br />

34,907 Estee Lauder - A - 1,022,617 0.40<br />

12,007 Eurocastle Investment 93,775 0.04<br />

5,307 Exelon 291,394 0.11<br />

43,887 Exxon Mobil 2,623,537 1.02<br />

6,804 Federal Realty Invs Trust 359,011 0.14<br />

6,650 FirstEnergy 323,068 0.13<br />

2,568 Fortune Brands 111,535 0.04<br />

3,721 Franklin Resources 227,389 0.09<br />

3,613 Freeport-McMoRan Copper & 263,988 0.10<br />

Gold - B -<br />

5,275 General Dynamics 306,373 0.12<br />

27,654 General Electric 580,835 0.23<br />

25,496 General Mills 989,103 0.38<br />

2,913 Genzyme 131,613 0.05<br />

28,404 Gilead Sciences 944,294 0.37<br />

2,732 Goldman Sachs Group 335,831 0.13<br />

2,738 Google - A - 1,010,159 0.39<br />

40,199 Halliburton 1,185,379 0.46<br />

3,799 Hartford Financial Services Group 173,908 0.07<br />

7,641 Hasbro 174,521 0.07<br />

1,538 Hess 104,908 0.04<br />

31,312 Hewlett-Packard 932,192 0.36<br />

51,679 HON HAI Precision Industry 376,745 0.15<br />

5,110 International Business Machines 396,133 0.15<br />

3,202 International Game Technology 71,457 0.03<br />

18,026 Inverness Medical Innovations 428,385 0.17<br />

10,577 ITT Industries 434,784 0.17<br />

59,610 Janus Capital Group 1,074,343 0.42<br />

30,542 Johnson & Johnson 1,316,102 0.51<br />

13,927 JPMorgan Chase & Co 426,236 0.17<br />

7,059 Kilroy Realty 237,208 0.09<br />

15,773 Kimco Realty 404,324 0.16<br />

2,733 Lehman Brothers Holdings 77,667 0.03<br />

5,117 Lincoln National 176,683 0.07<br />

53,139 Lowe’s 859,763 0.33<br />

8,441 Macerich 396,499 0.15<br />

5,366 Marathon Oil 157,072 0.06<br />

15,494 McDonald’s 592,935 0.23<br />

8,076 McKesson 270,355 0.11<br />

4,722 MEMC Electronic Materials 190,998 0.07<br />

25,803 Merck & Co 630,462 0.25<br />

4,238 Merrill Lynch & Co 135,657 0.05<br />

7,110 Metlife 277,890 0.11<br />

48,236 Microsoft 883,606 0.34<br />

17,218 Monsanto 1,260,959 0.49<br />

7,090 Moodys 168,305 0.07<br />

12,917 National Retail Properties 190,070 0.07<br />

3,760 National-Oilwell 165,307 0.06<br />

16,446 Nationwide Health Properties 380,488 0.15<br />

26,938 Nike - B - 1,155,806 0.45<br />

3,250 Northrop Grumman 153,558 0.06<br />

3,825 Nucor 185,473 0.07<br />

5,656 Occidental Petroleum 302,294 0.12<br />

87,934 Oracle 1,177,607 0.46<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

5,672 Paccar 172,391 0.07<br />

24,262 Peabody Energy 952,627 0.37<br />

21,907 PepsiCo 964,277 0.38<br />

25,661 Philip Morris International 841,100 0.33<br />

2,762 Polo Ralph Lauren - A - 110,196 0.04<br />

9,496 Post Properties 223,854 0.09<br />

2,669 PPL 82,326 0.03<br />

10,554 Praxair 618,983 0.24<br />

4,080 Principal Financial Group 140,632 0.05<br />

9,053 Procter & Gamble 389,869 0.15<br />

22,522 Prologis 905,719 0.35<br />

15,216 Public Storage 886,423 0.34<br />

23,922 Qual<strong>com</strong>m 663,618 0.26<br />

15,162 Schlumberger 979,242 0.38<br />

16,046 Simon Property Group 1,029,175 0.40<br />

8,441 SL Green Realty 503,147 0.20<br />

6,299 Smith International 309,561 0.12<br />

6,758 Southern 161,602 0.06<br />

4,539 State Street 210,319 0.08<br />

4,676 Stryker 194,723 0.08<br />

12,656 T Rowe Price Group 476,029 0.19<br />

8,623 Taubman Centers 313,878 0.12<br />

52,830 Texas Instruments 989,491 0.38<br />

6,331 Ultra Petroleum 337,803 0.13<br />

8,912 United Parcel Service - B - 414,500 0.16<br />

32,331 United Technologies 1,504,957 0.59<br />

7,814 UnitedHealth Group 163,761 0.06<br />

12,698 Ventas 396,062 0.15<br />

7,633 VeriSign 176,738 0.07<br />

9,567 Vornado Realty Trust 572,045 0.22<br />

4,874 Wal-Mart Stores 181,509 0.07<br />

6,827 WellPoint 218,143 0.09<br />

13,025 Wells Fargo & Co 248,891 0.10<br />

6,203 Wyeth 177,191 0.07<br />

66,947,042 26.02<br />

TOTAL SHARES 146,329,880 56.87<br />

BONDS<br />

Corporate Bonds<br />

342,462 8.13% Deutsche Telekom<br />

373,695 0.15<br />

International Finance 02 -<br />

29.05.2012<br />

373,695 0.15<br />

Financial Institutions<br />

554,203 0.00% Deutsche Bank 08 -<br />

553,817 0.22<br />

07.05.2008<br />

237,516 0.00% Dexia Credit Local 08 - 237,487 0.09<br />

02.05.2008<br />

316,687 0.00% Legal & General Finance 316,391 0.12<br />

08 - 09.05.2008<br />

237,516 0.00% Legal & General Finance 237,207 0.09<br />

08 - 12.05.2008<br />

554,203 0.00% Lloyds TSB Bank 08 - 553,760 0.22<br />

08.05.2008<br />

475,031 0.00% Natixis 07 - 02.05.2008 474,974 0.18<br />

2,168,925 4.25% Nordea Hypotek 07 - 2,142,224 0.83<br />

06.02.2014<br />

554,203 0.00% Societe Generale 08 - 553,751 0.22<br />

08.05.2008<br />

475,031 0.00% Svenska Handelsbanken - 472,281 0.18<br />

17.06.2008<br />

5,541,892 2.15<br />

Government<br />

1,426,925 5.25% Austria 01 - 04.01.2011 1,474,898 0.57<br />

1,027,386 3.50% Austria 06 - 15.09.2021 921,103 0.36<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

154