ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

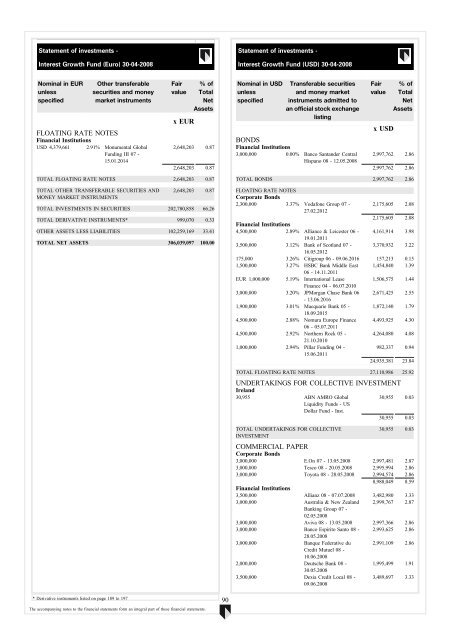

Statement of investments -<br />

Statement of investments -<br />

Interest Growth Fund (Euro) 30-04-2008<br />

Interest Growth Fund (USD) 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Other transferable<br />

securities and money<br />

market instruments<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

USD 4,379,661 2.91% Monumental Global<br />

Funding III 07 -<br />

15.01.2014<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

2,648,203 0.87<br />

2,648,203 0.87<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

BONDS<br />

Financial Institutions<br />

3,000,000 0.00% Banco Santander Central<br />

Hispano 08 - 12.05.2008<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

2,997,762 2.86<br />

2,997,762 2.86<br />

TOTAL FLOATING RATE NOTES 2,648,203 0.87<br />

TOTAL OTHER TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS<br />

2,648,203 0.87<br />

TOTAL INVESTMENTS IN SECURITIES 202,780,858 66.26<br />

TOTAL DERIVATIVE INSTRUMENTS* 999,070 0.33<br />

OTHER ASSETS LESS LIABILITIES 102,259,169 33.41<br />

TOTAL NET ASSETS 306,039,097 100.00<br />

TOTAL BONDS 2,997,762 2.86<br />

FLOATING RATE NOTES<br />

Corporate Bonds<br />

2,300,000 3.37% Vodafone Group 07 - 2,175,605 2.08<br />

27.02.2012<br />

2,175,605 2.08<br />

Financial Institutions<br />

4,500,000 2.89% Alliance & Leicester 06 - 4,161,914 3.98<br />

19.01.2011<br />

3,500,000 3.12% Bank of Scotland 07 - 3,370,932 3.22<br />

16.05.2012<br />

175,000 3.26% Citigroup 06 - 09.06.2016 157,213 0.15<br />

1,500,000 3.27% HSBC Bank Middle East 1,454,840 1.39<br />

06 - 14.11.2011<br />

EUR 1,000,000 5.19% International Lease<br />

1,506,575 1.44<br />

Finance 04 - 06.07.2010<br />

3,000,000 3.20% JPMorgan Chase Bank 06 2,671,425 2.55<br />

- 13.06.2016<br />

1,900,000 3.01% Macquarie Bank 05 - 1,872,140 1.79<br />

18.09.2015<br />

4,500,000 2.88% Nomura Europe Finance 4,493,925 4.30<br />

06 - 05.07.2011<br />

4,500,000 2.92% Northern Rock 05 - 4,264,080 4.08<br />

21.10.2010<br />

1,000,000 2.94% Pillar Funding 04 -<br />

982,337 0.94<br />

15.06.2011<br />

24,935,381 23.84<br />

TOTAL FLOATING RATE NOTES 27,110,986 25.92<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Ireland<br />

30,955 <strong>ABN</strong> <strong>AMRO</strong> Global<br />

Liquidity <strong>Funds</strong> - US<br />

Dollar Fund - Inst.<br />

TOTAL UNDERTAKINGS FOR COLLECTIVE<br />

INVESTMENT<br />

30,955 0.03<br />

30,955 0.03<br />

30,955 0.03<br />

COMMERCIAL PAPER<br />

Corporate Bonds<br />

3,000,000 E.On 07 - 13.05.2008 2,997,481 2.87<br />

3,000,000 Tesco 08 - 20.05.2008 2,995,994 2.86<br />

3,000,000 Toyota 08 - 28.05.2008 2,994,574 2.86<br />

8,988,049 8.59<br />

Financial Institutions<br />

3,500,000 Allianz 08 - 07.07.2008 3,482,980 3.33<br />

3,000,000 Australia & New Zealand 2,999,767 2.87<br />

Banking Group 07 -<br />

02.05.2008<br />

3,000,000 Aviva 08 - 13.05.2008 2,997,366 2.86<br />

3,000,000 Banco Espirito Santo 08 - 2,993,625 2.86<br />

28.05.2008<br />

3,000,000 Banque Federative du 2,991,109 2.86<br />

Credit Mutuel 08 -<br />

10.06.2008<br />

2,000,000 Deutsche Bank 08 - 1,995,499 1.91<br />

30.05.2008<br />

3,500,000 Dexia Credit Local 08 -<br />

09.06.2008<br />

3,489,697 3.33<br />

* Derivative instruments listed on page 189 to 197<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

90