ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

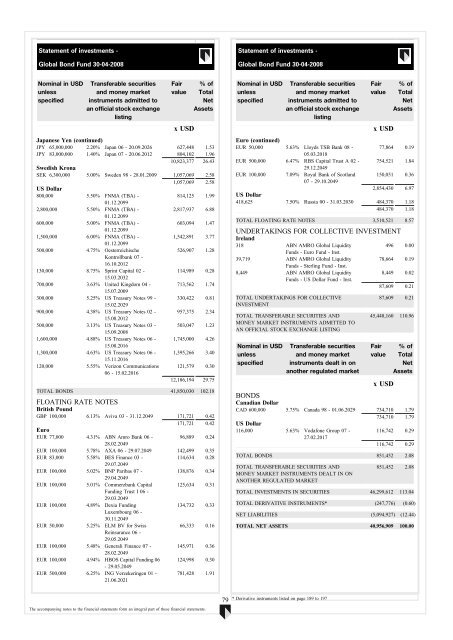

Statement of investments -<br />

Global Bond Fund 30-04-2008<br />

Statement of investments -<br />

Global Bond Fund 30-04-2008<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Japanese Yen (continued)<br />

JPY 65,000,000 2.20% Japan 06 - 20.09.2026 627,448 1.53<br />

JPY 83,000,000 1.40% Japan 07 - 20.06.2012 804,102 1.96<br />

10,823,377 26.43<br />

Swedish Krona<br />

SEK 6,300,000 5.00% Sweden 98 - 28.01.2009 1,057,069 2.58<br />

1,057,069 2.58<br />

US Dollar<br />

800,000 5.50% FNMA (TBA) -<br />

814,125 1.99<br />

01.12.2099<br />

2,800,000 5.50% FNMA (TBA) -<br />

2,817,937 6.88<br />

01.12.2099<br />

600,000 5.00% FNMA (TBA) -<br />

603,094 1.47<br />

01.12.2099<br />

1,500,000 6.00% FNMA (TBA) -<br />

1,542,891 3.77<br />

01.12.2099<br />

500,000 4.75% Oesterreichische<br />

526,907 1.28<br />

Kontrollbank 07 -<br />

16.10.2012<br />

130,000 8.75% Sprint Capital 02 -<br />

114,989 0.28<br />

15.03.2032<br />

700,000 3.63% United Kingdom 04 - 713,562 1.74<br />

15.07.2009<br />

300,000 5.25% US Treasury Notes 99 - 330,422 0.81<br />

15.02.2029<br />

900,000 4.38% US Treasury Notes 02 - 957,375 2.34<br />

15.08.2012<br />

500,000 3.13% US Treasury Notes 03 - 503,047 1.23<br />

15.09.2008<br />

1,600,000 4.88% US Treasury Notes 06 - 1,745,000 4.26<br />

15.08.2016<br />

1,300,000 4.63% US Treasury Notes 06 - 1,395,266 3.40<br />

15.11.2016<br />

120,000 5.55% Verizon Communications 121,579 0.30<br />

06 - 15.02.2016<br />

12,186,194 29.75<br />

TOTAL BONDS 41,850,030 102.18<br />

FLOATING RATE NOTES<br />

British Pound<br />

GBP 100,000 6.13% Aviva 03 - 31.12.2049 171,721 0.42<br />

171,721 0.42<br />

Euro<br />

EUR 77,000 4.31% <strong>ABN</strong> Amro Bank 06 -<br />

28.02.2049<br />

96,889 0.24<br />

EUR 100,000 5.78% AXA 06 - 29.07.2049 142,499 0.35<br />

EUR 83,000 5.58% BES Finance 03 -<br />

114,634 0.28<br />

29.07.2049<br />

EUR 100,000 5.02% BNP Paribas 07 -<br />

138,876 0.34<br />

29.04.2049<br />

EUR 100,000 5.01% Commerzbank Capital 125,634 0.31<br />

Funding Trust I 06 -<br />

29.03.2049<br />

EUR 100,000 4.89% Dexia Funding<br />

134,732 0.33<br />

Luxembourg 06 -<br />

30.11.2049<br />

EUR 50,000 5.25% ELM BV for Swiss<br />

66,333 0.16<br />

Reinsurance 06 -<br />

29.05.2049<br />

EUR 100,000 5.48% Generali Finance 07 - 145,971 0.36<br />

28.02.2049<br />

EUR 100,000 4.94% HBOS Capital Funding 06 124,998 0.30<br />

- 29.05.2049<br />

EUR 500,000 6.25% ING Verzekeringen 01 -<br />

21.06.2021<br />

781,428 1.91<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Euro (continued)<br />

EUR 50,000 5.63% Lloyds TSB Bank 08 - 77,864 0.19<br />

05.03.2018<br />

EUR 500,000 6.47% RBS Capital Trust A 02 - 754,521 1.84<br />

29.12.2049<br />

EUR 100,000 7.09% Royal Bank of Scotland 150,051 0.36<br />

07 - 29.10.2049<br />

2,854,430 6.97<br />

US Dollar<br />

418,625 7.50% Russia 00 - 31.03.2030 484,370 1.18<br />

484,370 1.18<br />

TOTAL FLOATING RATE NOTES 3,510,521 8.57<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Ireland<br />

318 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

<strong>Funds</strong> - Euro Fund - Inst.<br />

39,719 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

<strong>Funds</strong> - Sterling Fund - Inst.<br />

8,449 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

<strong>Funds</strong> - US Dollar Fund - Inst.<br />

TOTAL UNDERTAKINGS FOR COLLECTIVE<br />

INVESTMENT<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

496 0.00<br />

78,664 0.19<br />

8,449 0.02<br />

87,609 0.21<br />

87,609 0.21<br />

45,448,160 110.96<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

BONDS<br />

Canadian Dollar<br />

CAD 600,000 5.75% Canada 98 - 01.06.2029 734,710 1.79<br />

734,710 1.79<br />

US Dollar<br />

116,000 5.63% Vodafone Group 07 -<br />

27.02.2017<br />

116,742 0.29<br />

116,742 0.29<br />

TOTAL BONDS 851,452 2.08<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

851,452 2.08<br />

TOTAL INVESTMENTS IN SECURITIES 46,299,612 113.04<br />

TOTAL DERIVATIVE INSTRUMENTS* (247,776) (0.60)<br />

NET LIABILITIES (5,094,927) (12.44)<br />

TOTAL NET ASSETS 40,956,909 100.00<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

79<br />

* Derivative instruments listed on page 189 to 197