ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

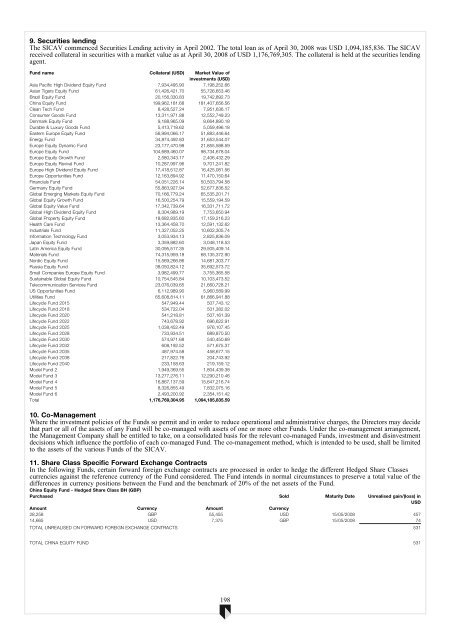

9. Securities lending<br />

The SICAV <strong>com</strong>menced Securities Lending activity in April 2002. The total loan as of April 30, 2008 was USD 1,094,185,836. The SICAV<br />

received collateral in securities with a market value as at April 30, 2008 of USD 1,176,769,305. The collateral is held at the securities lending<br />

agent.<br />

Fund name Collateral (USD) Market Value of<br />

investments (USD)<br />

Asia Pacific High Dividend Equity Fund 7,934,495.90 7,198,252.66<br />

Asian Tigers Equity Fund 61,426,421.70 55,726,653.46<br />

Brazil Equity Fund 20,156,330.83 19,742,892.73<br />

China Equity Fund 199,962,181.68 181,407,656.56<br />

Clean Tech Fund 8,428,527.24 7,951,636.17<br />

Consumer Goods Fund 13,311,971.88 12,552,749.23<br />

Denmark Equity Fund 9,188,965.09 8,664,890.18<br />

Durable & Luxury Goods Fund 5,413,718.62 5,059,496.18<br />

Eastern Europe Equity Fund 56,994,066.17 51,883,446.64<br />

Energy Fund 34,874,492.83 31,653,544.07<br />

Europe Equity Dynamic Fund 23,177,470.98 21,855,588.59<br />

Europe Equity Fund 104,689,460.07 98,734,678.04<br />

Europe Equity Growth Fund 2,580,343.17 2,406,432.29<br />

Europe Equity Revival Fund 10,287,997.96 9,701,241.82<br />

Europe High Dividend Equity Fund 17,418,512.87 16,425,081.56<br />

Europe Opportunities Fund 12,163,894.92 11,470,150.64<br />

Financials Fund 54,051,226.14 50,503,794.58<br />

Germany Equity Fund 55,863,927.94 52,677,836.52<br />

Global Emerging Markets Equity Fund 70,166,779.24 65,535,201.71<br />

Global Equity Growth Fund 16,500,254.79 15,559,194.59<br />

Global Equity Value Fund 17,342,739.64 16,331,711.72<br />

Global High Dividend Equity Fund 8,304,989.19 7,753,650.94<br />

Global Property Equity Fund 18,682,835.60 17,159,216.23<br />

Health Care Fund 13,364,458.70 12,591,132.62<br />

Industrials Fund 11,327,052.25 10,602,305.74<br />

Information Technology Fund 3,053,934.13 2,825,836.09<br />

Japan Equity Fund 3,359,882.60 3,048,118.53<br />

Latin America Equity Fund 30,095,517.35 29,505,409.14<br />

Materials Fund 74,315,959.18 68,135,372.90<br />

Nordic Equity Fund 15,569,266.86 14,681,303.77<br />

Russia Equity Fund 38,050,824.12 35,692,573.72<br />

Small Companies Europe Equity Fund 3,982,499.77 3,755,365.58<br />

Sustainable Global Equity Fund 10,754,545.84 10,103,473.52<br />

Tele<strong>com</strong>munication Services Fund 23,076,039.65 21,660,728.21<br />

US Opportunities Fund 6,112,989.90 5,960,589.99<br />

Utilities Fund 65,608,814.11 61,866,941.88<br />

Lifecycle Fund 2015 547,949.44 507,743.12<br />

Lifecycle Fund 2018 534,722.04 501,382.02<br />

Lifecycle Fund 2020 541,218.81 507,161.39<br />

Lifecycle Fund 2022 743,678.92 696,622.91<br />

Lifecycle Fund 2025 1,038,452.49 976,107.45<br />

Lifecycle Fund 2028 733,934.51 689,870.50<br />

Lifecycle Fund 2030 574,971.68 540,450.69<br />

Lifecycle Fund 2032 608,192.52 571,675.37<br />

Lifecycle Fund 2035 487,974.58 458,677.15<br />

Lifecycle Fund 2038 217,822.76 204,743.92<br />

Lifecycle Fund 2040 233,158.63 219,159.12<br />

Model Fund 2 1,949,369.55 1,804,439.38<br />

Model Fund 3 13,277,276.11 12,290,210.46<br />

Model Fund 4 16,867,137.59 15,647,216.74<br />

Model Fund 5 8,326,855.49 7,832,075.16<br />

Model Fund 6 2,493,200.92 2,354,151.42<br />

Total 1,176,769,304.95 1,094,185,835.59<br />

10. Co-Management<br />

Where the investment policies of the <strong>Funds</strong> so permit and in order to reduce operational and administrative charges, the Directors may decide<br />

that part or all of the assets of any Fund will be co-managed with assets of one or more other <strong>Funds</strong>. Under the co-management arrangement,<br />

the Management Company shall be entitled to take, on a consolidated basis for the relevant co-managed <strong>Funds</strong>, investment and disinvestment<br />

decisions which influence the portfolio of each co-managed Fund. The co-management method, which is intended to be used, shall be limited<br />

to the assets of the various <strong>Funds</strong> of the SICAV.<br />

11. Share Class Specific Forward Exchange Contracts<br />

In the following <strong>Funds</strong>, certain forward foreign exchange contracts are processed in order to hedge the different Hedged Share Classes<br />

currencies against the reference currency of the Fund considered. The Fund intends in normal circumstances to preserve a total value of the<br />

differences in currency positions between the Fund and the benchmark of 20% of the net assets of the Fund.<br />

China Equity Fund - Hedged Share Class BH (GBP)<br />

Purchased Sold Maturity Date Unrealised gain/(loss) in<br />

USD<br />

Amount Currency Amount Currency<br />

28,258 GBP 55,455 USD 15/05/2008 457<br />

14,665 USD 7,375 GBP 15/05/2008 74<br />

TOTAL UNREALISED ON FORWARD FOREIGN EXCHANGE CONTRACTS 531<br />

TOTAL CHINA EQUITY FUND 531<br />

198