ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

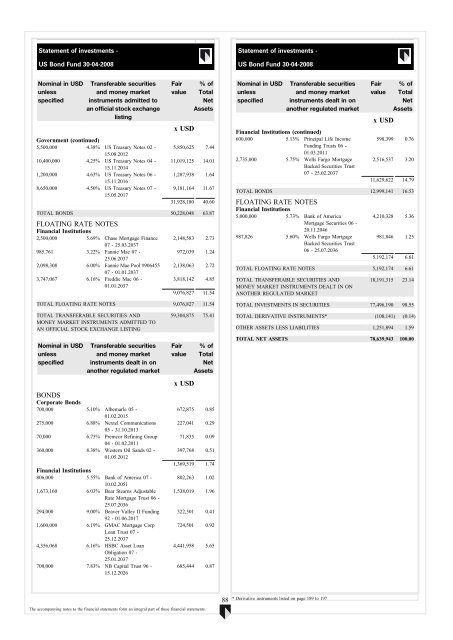

Statement of investments -<br />

US Bond Fund 30-04-2008<br />

Statement of investments -<br />

US Bond Fund 30-04-2008<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Government (continued)<br />

5,500,000 4.38% US Treasury Notes 02 -<br />

15.08.2012<br />

10,400,000 4.25% US Treasury Notes 04 -<br />

15.11.2014<br />

1,200,000 4.63% US Treasury Notes 06 -<br />

15.11.2016<br />

8,650,000 4.50% US Treasury Notes 07 -<br />

15.05.2017<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

5,850,625 7.44<br />

11,019,125 14.01<br />

1,287,938 1.64<br />

9,181,164 11.67<br />

31,928,180 40.60<br />

TOTAL BONDS 50,228,048 63.87<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

2,500,000 5.69% Chase Mortgage Finance<br />

07 - 25.03.2037<br />

985,761 3.22% Fannie Mae 07 -<br />

25.06.2037<br />

2,098,308 6.00% Fannie Mae Pool #906455<br />

07 - 01.01.2037<br />

3,747,067 6.16% Freddie Mac 06 -<br />

01.01.2037<br />

2,148,583 2.73<br />

972,039 1.24<br />

2,138,063 2.72<br />

3,818,142 4.85<br />

9,076,827 11.54<br />

TOTAL FLOATING RATE NOTES 9,076,827 11.54<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

BONDS<br />

Corporate Bonds<br />

700,000 5.10% Albemarle 05 -<br />

01.02.2015<br />

275,000 6.88% Nextel Communications<br />

05 - 31.10.2013<br />

70,000 6.75% Premcor Refining Group<br />

04 - 01.02.2011<br />

360,000 8.38% Western Oil Sands 02 -<br />

01.05.2012<br />

Financial Institutions<br />

806,000 5.55% Bank of America 07 -<br />

10.02.2051<br />

1,673,160 6.03% Bear Stearns Adjustable<br />

Rate Mortgage Trust 06 -<br />

25.07.2036<br />

294,000 9.00% Beaver Valley II Funding<br />

92 - 01.06.2017<br />

1,600,000 6.19% GMAC Mortgage Corp<br />

Loan Trust 07 -<br />

25.12.2037<br />

4,356,068 6.16% HSBC Asset Loan<br />

Obligation 07 -<br />

25.01.2037<br />

700,000 7.83% NB Capital Trust 96 -<br />

15.12.2026<br />

59,304,875 75.41<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

672,875 0.85<br />

227,041 0.29<br />

71,835 0.09<br />

397,768 0.51<br />

1,369,519 1.74<br />

802,263 1.02<br />

1,538,019 1.96<br />

322,501 0.41<br />

724,501 0.92<br />

4,441,958 5.65<br />

685,444 0.87<br />

Nominal in USD<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

Financial Institutions (continued)<br />

600,000 5.13% Principal Life In<strong>com</strong>e<br />

Funding Trusts 06 -<br />

01.03.2011<br />

2,735,000 5.75% Wells Fargo Mortgage<br />

Backed Securities Trust<br />

07 - 25.02.2037<br />

Fair<br />

value<br />

x USD<br />

% of<br />

Total<br />

Net<br />

Assets<br />

598,399 0.76<br />

2,516,537 3.20<br />

11,629,622 14.79<br />

TOTAL BONDS 12,999,141 16.53<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

5,000,000 5.73% Bank of America<br />

Mortgage Securities 06 -<br />

20.11.2046<br />

987,826 5.60% Wells Fargo Mortgage<br />

Backed Securities Trust<br />

06 - 25.07.2036<br />

4,210,328 5.36<br />

981,846 1.25<br />

5,192,174 6.61<br />

TOTAL FLOATING RATE NOTES 5,192,174 6.61<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

18,191,315 23.14<br />

TOTAL INVESTMENTS IN SECURITIES 77,496,190 98.55<br />

TOTAL DERIVATIVE INSTRUMENTS* (108,141) (0.14)<br />

OTHER ASSETS LESS LIABILITIES 1,251,894 1.59<br />

TOTAL NET ASSETS 78,639,943 100.00<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

88<br />

* Derivative instruments listed on page 189 to 197