ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

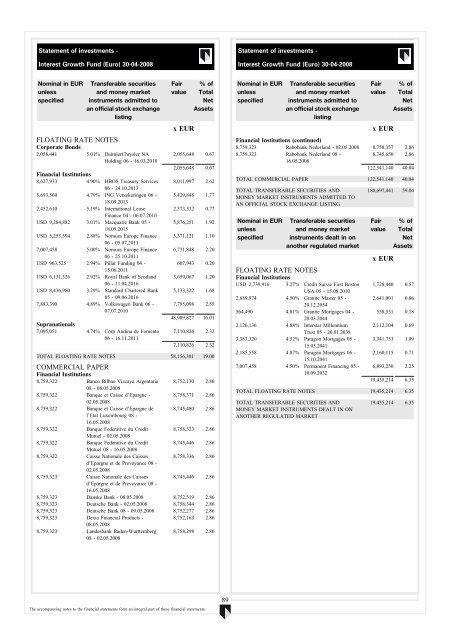

Statement of investments -<br />

Interest Growth Fund (Euro) 30-04-2008<br />

Statement of investments -<br />

Interest Growth Fund (Euro) 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

FLOATING RATE NOTES<br />

Corporate Bonds<br />

2,058,441 5.01% DaimlerChrysler NA<br />

Holding 06 - 16.03.2010<br />

Financial Institutions<br />

8,627,933 4.90% HBOS Treasury Services<br />

06 - 24.10.2013<br />

5,693,560 4.79% ING Verzekeringen 06 -<br />

18.09.2013<br />

2,452,610 5.19% International Lease<br />

Finance 04 - 06.07.2010<br />

USD 9,284,882 3.01% Macquarie Bank 05 -<br />

18.09.2015<br />

USD 5,255,594 2.88% Nomura Europe Finance<br />

06 - 05.07.2011<br />

7,007,458 5.00% Nomura Europe Finance<br />

06 - 25.10.2011<br />

USD 963,525 2.94% Pillar Funding 04 -<br />

15.06.2011<br />

USD 6,131,526 2.92% Royal Bank of Scotland<br />

06 - 11.04.2016<br />

USD 8,436,980 3.29% Standard Chartered Bank<br />

05 - 09.06.2016<br />

7,883,390 4.89% Volkswagen Bank 06 -<br />

07.07.2010<br />

Supranationals<br />

7,095,051 4.74% Corp Andina de Fomento<br />

06 - 16.11.2011<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

2,055,648 0.67<br />

2,055,648 0.67<br />

8,011,997 2.62<br />

5,429,848 1.77<br />

2,373,332 0.77<br />

5,876,251 1.92<br />

3,371,121 1.10<br />

6,731,848 2.20<br />

607,943 0.20<br />

3,659,067 1.20<br />

5,133,322 1.68<br />

7,795,098 2.55<br />

48,989,827 16.01<br />

7,110,826 2.32<br />

7,110,826 2.32<br />

TOTAL FLOATING RATE NOTES 58,156,301 19.00<br />

COMMERCIAL PAPER<br />

Financial Institutions<br />

8,759,322 Banco Bilbao Vizcaya Argentaria<br />

8,752,130 2.86<br />

08 - 08.05.2008<br />

8,759,322 Banque et Caisse d’Epargne - 8,758,371 2.86<br />

02.05.2008<br />

8,759,322 Banque et Caisse d’Epargne de 8,745,480 2.86<br />

l’Etat Luxembourg 08 -<br />

16.05.2008<br />

8,759,322 Banque Federative du Credit 8,758,323 2.86<br />

Mutuel - 02.05.2008<br />

8,759,322 Banque Federative du Credit 8,745,446 2.86<br />

Mutuel 08 - 16.05.2008<br />

8,759,322 Caisse Nationale des Caisses 8,758,336 2.86<br />

d’Epargne et de Prevoyance 08 -<br />

02.05.2008<br />

8,759,323 Caisse Nationale des Caisses 8,745,446 2.86<br />

d’Epargne et de Prevoyance 08 -<br />

16.05.2008<br />

8,759,323 Danske Bank - 08.05.2008 8,752,519 2.86<br />

8,759,323 Deutsche Bank - 02.05.2008 8,758,344 2.86<br />

8,759,323 Deutsche Bank 08 - 09.05.2008 8,752,277 2.86<br />

8,759,323 Dexia Financial Products -<br />

8,752,163 2.86<br />

08.05.2008<br />

8,759,323 Landesbank Baden-Wurttemberg<br />

08 - 02.05.2008<br />

8,758,298 2.86<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

8,759,323 Rabobank Nederland - 02.05.2008 8,758,357 2.86<br />

8,759,323 Rabobank Nederland 08 -<br />

8,745,650 2.86<br />

16.05.2008<br />

122,541,140 40.04<br />

TOTAL COMMERCIAL PAPER 122,541,140 40.04<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

USD 2,739,916 3.27% Credit Suisse First Boston<br />

USA 05 - 15.08.2010<br />

2,689,974 4.50% Granite Master 05 -<br />

20.12.2054<br />

564,490 4.81% Granite Mortgages 04 -<br />

20.03.2044<br />

2,126,136 4.88% Interstar Millennium<br />

Trust 05 - 20.01.2038<br />

3,383,320 4.52% Paragon Mortgages 05 -<br />

15.05.2041<br />

2,185,558 4.87% Paragon Mortgages 06 -<br />

15.10.2041<br />

7,007,458 4.50% Permanent Financing 05 -<br />

10.09.2032<br />

180,697,441 59.04<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

1,728,440 0.57<br />

2,641,001 0.86<br />

558,551 0.18<br />

2,112,104 0.69<br />

3,341,753 1.09<br />

2,160,115 0.71<br />

6,893,250 2.25<br />

19,435,214 6.35<br />

TOTAL FLOATING RATE NOTES 19,435,214 6.35<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

19,435,214 6.35<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

89