ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

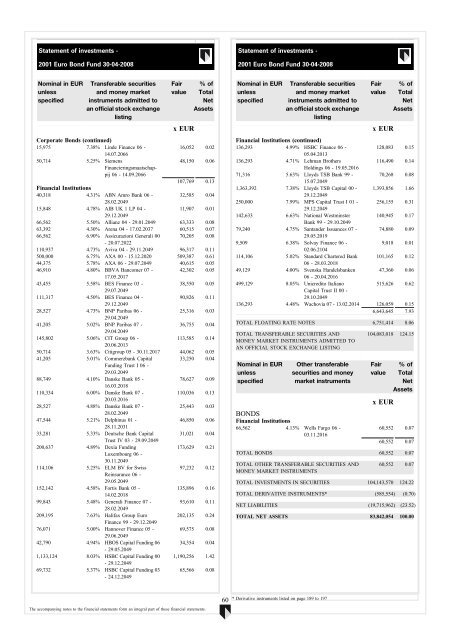

Statement of investments -<br />

2001 Euro Bond Fund 30-04-2008<br />

Statement of investments -<br />

2001 Euro Bond Fund 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Corporate Bonds (continued)<br />

15,975 7.38% Linde Finance 06 -<br />

16,052 0.02<br />

14.07.2066<br />

50,714 5.25% Siemens<br />

48,150 0.06<br />

Financieringsmaatschappij<br />

06 - 14.09.2066<br />

107,769 0.13<br />

Financial Institutions<br />

40,318 4.31% <strong>ABN</strong> Amro Bank 06 -<br />

32,585 0.04<br />

28.02.2049<br />

15,848 4.78% AIB UK 1 LP 04 -<br />

11,907 0.01<br />

29.12.2049<br />

66,562 5.50% Allianz 04 - 29.01.2049 63,333 0.08<br />

63,392 4.30% Arena 04 - 17.02.2037 60,515 0.07<br />

66,562 6.90% Assicurazioni Generali 00 70,205 0.08<br />

- 20.07.2022<br />

110,937 4.73% Aviva 04 - 29.11.2049 96,317 0.11<br />

500,000 6.75% AXA 00 - 15.12.2020 509,387 0.61<br />

44,375 5.78% AXA 06 - 29.07.2049 40,615 0.05<br />

46,910 4.80% BBVA Ban<strong>com</strong>er 07 -<br />

42,302 0.05<br />

17.05.2017<br />

43,455 5.58% BES Finance 03 -<br />

38,550 0.05<br />

29.07.2049<br />

111,317 4.50% BES Finance 04 -<br />

90,826 0.11<br />

29.12.2049<br />

28,527 4.73% BNP Paribas 06 -<br />

25,316 0.03<br />

29.04.2049<br />

41,205 5.02% BNP Paribas 07 -<br />

36,755 0.04<br />

29.04.2049<br />

145,802 5.06% CIT Group 06 -<br />

113,585 0.14<br />

20.06.2013<br />

50,714 3.63% Citigroup 05 - 30.11.2017 44,062 0.05<br />

41,205 5.01% Commerzbank Capital<br />

33,250 0.04<br />

Funding Trust I 06 -<br />

29.03.2049<br />

88,749 4.10% Danske Bank 05 -<br />

78,627 0.09<br />

16.03.2018<br />

110,334 6.00% Danske Bank 07 -<br />

110,036 0.13<br />

20.03.2016<br />

28,527 4.88% Danske Bank 07 -<br />

25,443 0.03<br />

28.02.2049<br />

47,544 5.21% Delphinus 01 -<br />

46,850 0.06<br />

28.11.2031<br />

33,281 5.33% Deutsche Bank Capital 31,021 0.04<br />

Trust IV 03 - 29.09.2049<br />

200,637 4.89% Dexia Funding<br />

173,629 0.21<br />

Luxembourg 06 -<br />

30.11.2049<br />

114,106 5.25% ELM BV for Swiss<br />

97,232 0.12<br />

Reinsurance 06 -<br />

29.05.2049<br />

152,142 4.58% Fortis Bank 05 -<br />

135,896 0.16<br />

14.02.2018<br />

99,843 5.48% Generali Finance 07 -<br />

93,610 0.11<br />

28.02.2049<br />

209,195 7.63% Halifax Group Euro<br />

202,135 0.24<br />

Finance 99 - 29.12.2049<br />

76,071 5.00% Hannover Finance 05 - 69,575 0.08<br />

29.06.2049<br />

42,790 4.94% HBOS Capital Funding 06 34,354 0.04<br />

- 29.05.2049<br />

1,133,124 8.03% HSBC Capital Funding 00 1,190,256 1.42<br />

- 29.12.2049<br />

69,732 5.37% HSBC Capital Funding 03<br />

- 24.12.2049<br />

65,566 0.08<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

136,293 4.99% HSBC Finance 06 -<br />

128,083 0.15<br />

05.04.2013<br />

136,293 4.71% Lehman Brothers<br />

116,490 0.14<br />

Holdings 06 - 19.05.2016<br />

71,316 5.63% Lloyds TSB Bank 99 - 70,268 0.08<br />

15.07.2049<br />

1,363,392 7.38% Lloyds TSB Capital 00 - 1,393,856 1.66<br />

29.12.2049<br />

250,000 7.99% MPS Capital Trust I 01 - 256,155 0.31<br />

29.12.2049<br />

142,633 6.63% National Westminster 140,945 0.17<br />

Bank 99 - 29.10.2049<br />

79,240 4.75% Santander Issuances 07 - 74,880 0.09<br />

29.05.2019<br />

9,509 6.38% Solvay Finance 06 -<br />

9,018 0.01<br />

02.06.2104<br />

114,106 5.02% Standard Chartered Bank 101,165 0.12<br />

06 - 28.03.2018<br />

49,129 4.00% Svenska Handelsbanken 47,360 0.06<br />

06 - 20.04.2016<br />

499,129 8.05% Unicredito Italiano<br />

515,626 0.62<br />

Capital Trust II 00 -<br />

29.10.2049<br />

136,293 4.48% Wachovia 07 - 13.02.2014 126,059 0.15<br />

6,643,645 7.93<br />

TOTAL FLOATING RATE NOTES 6,751,414 8.06<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Other transferable<br />

securities and money<br />

market instruments<br />

BONDS<br />

Financial Institutions<br />

66,562 4.13% Wells Fargo 06 -<br />

03.11.2016<br />

104,083,018 124.15<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

60,552 0.07<br />

60,552 0.07<br />

TOTAL BONDS 60,552 0.07<br />

TOTAL OTHER TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS<br />

60,552 0.07<br />

TOTAL INVESTMENTS IN SECURITIES 104,143,570 124.22<br />

TOTAL DERIVATIVE INSTRUMENTS* (585,554) (0.70)<br />

NET LIABILITIES (19,715,962) (23.52)<br />

TOTAL NET ASSETS 83,842,054 100.00<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

60<br />

* Derivative instruments listed on page 189 to 197