ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

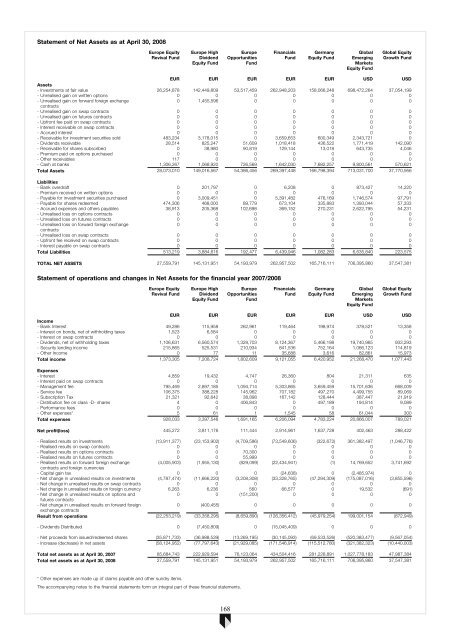

Statement of Net Assets as at April 30, 2008<br />

Europe Equity<br />

Revival Fund<br />

Europe High<br />

Dividend<br />

Equity Fund<br />

Europe<br />

Opportunities<br />

Fund<br />

Financials<br />

Fund<br />

Germany<br />

Equity Fund<br />

Global<br />

Emerging<br />

Markets<br />

Equity Fund<br />

Global Equity<br />

Growth Fund<br />

EUR EUR EUR EUR EUR USD USD<br />

Assets<br />

- Investments at fair value 26,254,878 142,449,809 53,517,459 262,948,203 158,066,248 698,472,264 37,054,199<br />

- Unrealised gain on written options 0 0 0 0 0 0 0<br />

- Unrealised gain on forward foreign exchange<br />

0 1,455,596 0 0 0 0 0<br />

contracts<br />

- Unrealised gain on swap contracts 0 0 0 0 0 0 0<br />

- Unrealised gain on futures contracts 0 0 0 0 0 0 0<br />

- Upfront fee paid on swap contracts 0 0 0 0 0 0 0<br />

- Interest receivable on swap contracts 0 0 0 0 0 0 0<br />

- Accrued interest 0 0 0 0 0 0 0<br />

- Receivable for investment securities sold 483,234 3,178,015 0 3,659,653 600,349 2,343,721 0<br />

- Dividends receivable 28,514 825,247 51,609 1,018,418 436,522 1,771,419 142,090<br />

- Receivable for shares subscribed 0 38,980 90,819 129,144 13,018 643,735 4,046<br />

- Premium paid on options purchased 0 0 0 0 0 0 0<br />

- Other receivables 117 0 0 0 0 0 0<br />

- Cash at banks 1,306,267 1,068,920 726,569 1,642,030 7,682,257 9,800,561 570,621<br />

Total Assets 28,073,010 149,016,567 54,386,456 269,397,448 166,798,394 713,031,700 37,770,956<br />

Liabilities<br />

- Bank overdraft 0 201,797 0 6,208 0 873,427 14,220<br />

- Premium received on written options 0 0 0 0 0 0 0<br />

- Payable for investment securities purchased 0 3,009,451 0 5,391,482 476,169 1,746,574 97,791<br />

- Payable for shares redeemed 474,306 468,000 89,779 673,104 335,883 1,393,044 57,333<br />

- Accrued expenses and others payables 38,913 205,368 102,698 369,152 270,231 2,622,795 54,231<br />

- Unrealised loss on options contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on futures contracts 0 0 0 0 0 0 0<br />

- Unrealised loss on forward foreign exchange<br />

0 0 0 0 0 0 0<br />

contracts<br />

- Unrealised loss on swap contracts 0 0 0 0 0 0 0<br />

- Upfront fee received on swap contracts 0 0 0 0 0 0 0<br />

- Interest payable on swap contracts 0 0 0 0 0 0 0<br />

Total Liabilities 513,219 3,884,616 192,477 6,439,946 1,082,283 6,635,840 223,575<br />

TOTAL NET ASSETS 27,559,791 145,131,951 54,193,979 262,957,502 165,716,111 706,395,860 37,547,381<br />

Statement of operations and changes in Net Assets for the financial year 2007/2008<br />

Europe Equity<br />

Revival Fund<br />

Europe High<br />

Dividend<br />

Equity Fund<br />

Europe<br />

Opportunities<br />

Fund<br />

Financials<br />

Fund<br />

Germany<br />

Equity Fund<br />

Global<br />

Emerging<br />

Markets<br />

Equity Fund<br />

Global Equity<br />

Growth Fund<br />

EUR EUR EUR EUR EUR USD USD<br />

In<strong>com</strong>e<br />

- Bank Interest 49,286 115,958 262,961 119,464 198,974 378,521 13,358<br />

- Interest on bonds, net of withholding taxes 1,523 6,584 0 0 0 0 0<br />

- Interest on swap contracts 0 0 0 0 0 0 0<br />

- Dividends, net of withholding taxes 1,106,631 6,560,574 1,328,703 8,124,367 5,466,198 19,740,965 933,293<br />

- Security lending in<strong>com</strong>e 215,865 525,531 210,934 841,536 752,164 1,066,123 114,819<br />

- Other In<strong>com</strong>e 0 77 11 35,688 3,616 82,861 15,973<br />

Total in<strong>com</strong>e 1,373,305 7,208,724 1,802,609 9,121,055 6,420,952 21,268,470 1,077,443<br />

Expenses<br />

- Interest 4,859 19,432 4,747 26,360 804 21,311 635<br />

- Interest paid on swap contracts 0 0 0 0 0 0 0<br />

- Management fee 795,469 2,897,185 1,094,714 5,303,865 3,659,459 15,701,636 668,009<br />

- Service fee 106,375 388,228 145,962 707,182 497,270 4,499,755 89,069<br />

- Subscription Tax 21,321 92,642 38,898 167,142 128,444 387,447 21,919<br />

- Distribution fee on class -D- shares 4 0 406,843 0 497,189 194,814 9,089<br />

- Performance fees 0 0 0 0 0 0 0<br />

- Other expenses* 5 61 1 1,545 58 61,044 300<br />

Total expenses 928,033 3,397,548 1,691,165 6,206,094 4,783,224 20,866,007 789,021<br />

Net profit(loss) 445,272 3,811,176 111,444 2,914,961 1,637,728 402,463 288,422<br />

- Realised results on investments (13,911,377) (23,153,902) (4,709,586) (73,549,606) (322,672) 361,382,497 (1,046,776)<br />

- Realised results on swap contracts 0 0 0 0 0 0 0<br />

- Realised results on options contracts 0 0 70,300 0 0 0 0<br />

- Realised results on futures contracts 0 0 55,999 0 0 0 0<br />

- Realised results on forward foreign exchange<br />

(4,005,903) (1,955,130) (829,099) (22,434,941) (1) 14,769,652 3,741,692<br />

contracts and foreign currencies<br />

- Capital gain tax 0 0 0 (24,638) 0 (2,485,974) 0<br />

- Net change in unrealised results on investments (4,787,474) (11,666,220) (3,208,308) (33,328,765) (47,294,309) (175,087,016) (3,855,596)<br />

- Net change in unrealised results on swap contracts 0 0 0 0 0 0 0<br />

- Net change in unrealised results on foreign currency 6,263 6,236 560 66,577 0 19,532 (691)<br />

- Net change in unrealised results on options and<br />

0 0 (151,200) 0 0 0 0<br />

futures contracts<br />

- Net change in unrealised results on forward foreign<br />

0 (400,455) 0 0 0 0 0<br />

exchange contracts<br />

Result from operations (22,253,219) (33,358,295) (8,659,890) (126,356,412) (45,979,254) 199,001,154 (872,949)<br />

- Dividends Distributed 0 (7,450,809) 0 (15,045,409) 0 0 0<br />

- Net proceeds from issued/redeemed shares (35,871,733) (36,988,539) (13,269,195) (30,145,093) (69,533,526) (520,383,477) (9,567,054)<br />

- Increase (decrease) in net assets (58,124,952) (77,797,643) (21,929,085) (171,546,914) (115,512,780) (321,382,323) (10,440,003)<br />

Total Exchange net assets Difference as at April 30, 2007 85,684,743 222,929,594 76,123,064 434,504,416 281,228,891 1,027,778,183 47,987,384<br />

Total net assets as at April 30, 2008 27,559,791 145,131,951 54,193,979 262,957,502 165,716,111 706,395,860 37,547,381<br />

* Other expenses are made up of claims payable and other sundry items.<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

168