ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

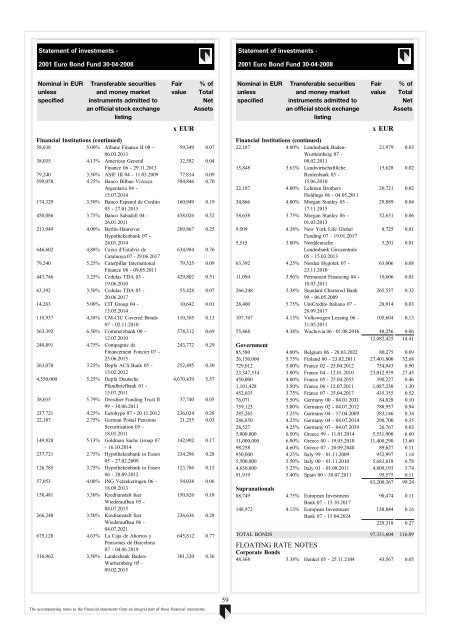

Statement of investments -<br />

2001 Euro Bond Fund 30-04-2008<br />

Statement of investments -<br />

2001 Euro Bond Fund 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

58,638 5.00% Allianz Finance II 08 - 59,349 0.07<br />

06.03.2013<br />

38,035 4.13% American General<br />

32,582 0.04<br />

Finance 06 - 29.11.2013<br />

79,240 3.50% ASIF III 04 - 11.03.2009 77,814 0.09<br />

599,058 4.25% Banco Bilbao Vizcaya 584,846 0.70<br />

Argentaria 04 -<br />

15.07.2014<br />

174,329 3.50% Banco Espanol de Credito 160,949 0.19<br />

05 - 27.01.2015<br />

450,086 3.75% Banco Sabadell 04 -<br />

438,026 0.52<br />

26.01.2011<br />

213,949 4.00% Berlin-Hannover<br />

209,867 0.25<br />

Hypothekenbank 07 -<br />

24.01.2014<br />

646,602 4.88% Caixa d’Estalvis de<br />

634,984 0.76<br />

Catalunya 07 - 29.06.2017<br />

79,240 5.25% Caterpillar International 79,525 0.09<br />

Finance 08 - 09.05.2011<br />

443,746 3.25% Cedulas TDA 03 -<br />

429,802 0.51<br />

19.06.2010<br />

63,392 3.50% Cedulas TDA 05 -<br />

55,428 0.07<br />

20.06.2017<br />

14,263 5.00% CIT Group 04 -<br />

10,642 0.01<br />

13.05.2014<br />

110,937 4.38% CM-CIC Covered Bonds 110,305 0.13<br />

07 - 02.11.2010<br />

563,392 6.50% Commerzbank 00 -<br />

578,312 0.69<br />

12.07.2010<br />

240,891 4.75% Compagnie de<br />

243,772 0.29<br />

Financement Foncier 07 -<br />

25.06.2015<br />

263,078 3.25% Depfa ACS Bank 05 - 252,495 0.30<br />

15.02.2012<br />

4,550,000 5.25% Depfa Deutsche<br />

4,670,439 5.57<br />

Pfandbriefbank 01 -<br />

15.07.2011<br />

38,035 5.79% Dresdner Funding Trust II 37,740 0.05<br />

99 - 30.06.2011<br />

237,721 4.25% Eurohypo 07 - 20.11.2012 236,024 0.28<br />

22,187 2.75% German Postal Pensions 21,255 0.03<br />

Securitisation 05 -<br />

18.01.2011<br />

149,828 5.13% Goldman Sachs Group 07 142,902 0.17<br />

- 16.10.2014<br />

237,721 2.75% Hypothekenbank in Essen 234,296 0.28<br />

05 - 27.02.2009<br />

126,785 3.75% Hypothekenbank in Essen 123,786 0.15<br />

06 - 28.09.2012<br />

57,053 4.00% ING Verzekeringen 06 - 54,038 0.06<br />

18.09.2013<br />

158,481 3.50% Kreditanstalt fuer<br />

150,826 0.18<br />

Wiederaufbau 05 -<br />

04.07.2015<br />

266,248 3.50% Kreditanstalt fuer<br />

236,636 0.28<br />

Wiederaufbau 06 -<br />

04.07.2021<br />

675,128 4.63% La Caja de Ahorros y 645,812 0.77<br />

Pensiones de Barcelona<br />

07 - 04.06.2019<br />

316,962 3.50% Landesbank Baden-<br />

Wurttemberg 05 -<br />

09.02.2015<br />

301,320 0.36<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

% of<br />

Total<br />

Net<br />

Assets<br />

x EUR<br />

Financial Institutions (continued)<br />

22,187 4.00% Landesbank Baden-<br />

21,979 0.03<br />

Wurttemberg 07 -<br />

08.02.2011<br />

15,848 3.63% Landwirtschaftliche<br />

15,628 0.02<br />

Rentenbank 03 -<br />

15.06.2010<br />

22,187 4.00% Lehman Brothers<br />

20,721 0.02<br />

Holdings 06 - 04.05.2011<br />

34,866 4.00% Morgan Stanley 05 -<br />

29,889 0.04<br />

17.11.2015<br />

58,638 3.75% Morgan Stanley 06 -<br />

52,631 0.06<br />

01.03.2013<br />

9,509 4.38% New York Life Global<br />

8,725 0.01<br />

Funding 07 - 19.01.2017<br />

5,515 3.00% Norddeutsche<br />

5,201 0.01<br />

Landesbank Girozentrale<br />

05 - 15.03.2013<br />

63,392 4.25% Nordea Hypotek 07 -<br />

63,006 0.08<br />

23.11.2010<br />

11,094 3.96% Permanent Financing 04 - 10,606 0.01<br />

10.03.2011<br />

266,248 5.38% Standard Chartered Bank 265,537 0.32<br />

99 - 06.05.2009<br />

28,400 5.75% UniCredito Italiano 07 - 28,914 0.03<br />

26.09.2017<br />

107,767 4.13% Volkswagen Leasing 06 - 105,604 0.13<br />

31.05.2011<br />

55,468 4.38% Wachovia 06 - 01.08.2016 48,256 0.06<br />

12,082,425 14.41<br />

Government<br />

85,580 4.00% Belgium 06 - 28.03.2022 80,275 0.09<br />

26,150,000 5.75% Finland 00 - 23.02.2011 27,401,800 32.68<br />

729,012 5.00% France 02 - 25.04.2012 754,943 0.90<br />

23,347,514 3.00% France 04 - 12.01.2010 23,012,939 27.45<br />

450,000 4.00% France 05 - 25.04.2055 390,227 0.46<br />

1,101,428 3.50% France 06 - 12.07.2011 1,087,230 1.30<br />

452,035 3.75% France 07 - 25.04.2017 435,355 0.52<br />

76,071 5.50% Germany 00 - 04.01.2031 84,828 0.10<br />

759,123 5.00% Germany 02 - 04.07.2012 788,957 0.94<br />

285,265 3.25% Germany 04 - 17.04.2009 283,146 0.34<br />

286,850 4.25% Germany 04 - 04.07.2014 290,700 0.35<br />

28,527 4.25% Germany 07 - 04.07.2039 26,767 0.03<br />

5,000,000 6.50% Greece 99 - 11.01.2014 5,531,900 6.60<br />

11,000,000 6.00% Greece 00 - 19.05.2010 11,400,290 13.60<br />

98,258 4.60% Greece 07 - 20.09.2040 89,627 0.11<br />

950,000 4.25% Italy 99 - 01.11.2009 952,997 1.14<br />

5,500,000 5.50% Italy 00 - 01.11.2010 5,683,618 6.78<br />

4,650,000 5.25% Italy 01 - 01.08.2011 4,809,193 5.74<br />

91,919 5.40% Spain 00 - 30.07.2011 95,575 0.11<br />

83,200,367 99.24<br />

Supranationals<br />

88,749 4.75% European Investment<br />

90,474 0.11<br />

Bank 07 - 15.10.2017<br />

148,972 4.13% European Investment<br />

138,844 0.16<br />

Bank 07 - 15.04.2024<br />

229,318 0.27<br />

TOTAL BONDS 97,331,604 116.09<br />

FLOATING RATE NOTES<br />

Corporate Bonds<br />

48,368 5.38% Henkel 05 - 25.11.2104 43,567 0.05<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

59