ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

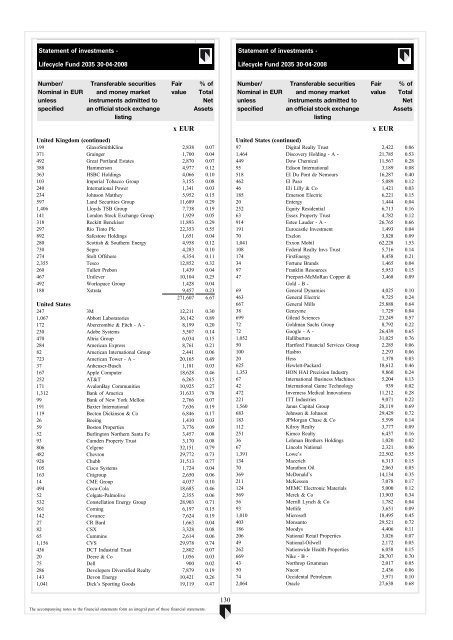

Statement of investments -<br />

Lifecycle Fund 2035 30-04-2008<br />

Statement of investments -<br />

Lifecycle Fund 2035 30-04-2008<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United Kingdom (continued)<br />

199 GlaxoSmithKline 2,838 0.07<br />

371 Grainger 1,700 0.04<br />

492 Great Portland Estates 2,870 0.07<br />

388 Hammerson 4,977 0.12<br />

363 HSBC Holdings 4,066 0.10<br />

103 Imperial Tobacco Group 3,155 0.08<br />

240 International Power 1,341 0.03<br />

234 Johnson Matthey 5,952 0.15<br />

597 Land Securities Group 11,689 0.29<br />

1,406 Lloyds TSB Group 7,738 0.19<br />

141 London Stock Exchange Group 1,929 0.05<br />

318 Reckitt Benckiser 11,893 0.29<br />

297 Rio Tinto Plc 22,353 0.55<br />

892 Safestore Holdings 1,651 0.04<br />

280 Scottish & Southern Energy 4,958 0.12<br />

730 Segro 4,283 0.10<br />

274 Stolt Offshore 4,354 0.11<br />

2,355 Tesco 12,852 0.32<br />

260 Tullett Prebon 1,439 0.04<br />

467 Unilever 10,104 0.25<br />

492 Workspace Group 1,428 0.04<br />

188 Xstrata 9,457 0.23<br />

271,607 6.67<br />

United States<br />

247 3M 12,211 0.30<br />

1,067 Abbott Laboratories 36,142 0.89<br />

172 Abercrombie & Fitch - A - 8,199 0.20<br />

230 Adobe Systems 5,507 0.14<br />

470 Altria Group 6,034 0.15<br />

284 American Express 8,761 0.21<br />

82 American International Group 2,441 0.06<br />

723 American Tower - A - 20,165 0.49<br />

37 Anheuser-Busch 1,181 0.03<br />

167 Apple Computer 18,628 0.46<br />

252 AT&T 6,265 0.15<br />

171 AvalonBay Communities 10,925 0.27<br />

1,312 Bank of America 31,633 0.78<br />

99 Bank of New York Mellon 2,766 0.07<br />

191 Baxter International 7,636 0.19<br />

119 Becton Dickinson & Co 6,846 0.17<br />

26 Boeing 1,410 0.03<br />

59 Boston Properties 3,776 0.09<br />

52 Burlington Northern Santa Fe 3,457 0.08<br />

93 Camden Property Trust 3,170 0.08<br />

806 Celgene 32,151 0.79<br />

482 Chevron 29,772 0.73<br />

926 Chubb 31,513 0.77<br />

105 Cisco Systems 1,724 0.04<br />

163 Citigroup 2,650 0.06<br />

14 CME Group 4,037 0.10<br />

494 Coca-Cola 18,685 0.46<br />

52 Colgate-Palmolive 2,355 0.06<br />

532 Constellation Energy Group 28,903 0.71<br />

361 Corning 6,197 0.15<br />

142 Covance 7,624 0.19<br />

27 CR Bard 1,663 0.04<br />

82 CSX 3,328 0.08<br />

65 Cummins 2,614 0.06<br />

1,156 CVS 29,978 0.74<br />

436 DCT Industrial Trust 2,802 0.07<br />

20 Deere & Co 1,056 0.03<br />

75 Dell 900 0.02<br />

286 Developers Diversified Realty 7,879 0.19<br />

143 Devon Energy 10,421 0.26<br />

1,041 Dick’s Sporting Goods 19,119 0.47<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

97 Digital Realty Trust 2,422 0.06<br />

1,464 Discovery Holding - A - 21,785 0.53<br />

449 Dow Chemical 11,567 0.28<br />

95 Edison International 3,189 0.08<br />

518 EI Du Pont de Nemours 16,287 0.40<br />

462 El Paso 5,089 0.12<br />

46 Eli Lilly & Co 1,421 0.03<br />

185 Emerson Electric 6,221 0.15<br />

20 Entergy 1,444 0.04<br />

252 Equity Residential 6,713 0.16<br />

63 Essex Property Trust 4,782 0.12<br />

914 Estee Lauder - A - 26,765 0.66<br />

191 Eurocastle Investment 1,493 0.04<br />

70 Exelon 3,828 0.09<br />

1,041 Exxon Mobil 62,228 1.53<br />

108 Federal Realty Invs Trust 5,716 0.14<br />

174 FirstEnergy 8,458 0.21<br />

34 Fortune Brands 1,465 0.04<br />

97 Franklin Resources 5,953 0.15<br />

47 Freeport-McMoRan Copper &<br />

3,468 0.09<br />

Gold - B -<br />

69 General Dynamics 4,025 0.10<br />

463 General Electric 9,725 0.24<br />

667 General Mills 25,888 0.64<br />

38 Genzyme 1,729 0.04<br />

699 Gilead Sciences 23,249 0.57<br />

72 Goldman Sachs Group 8,792 0.22<br />

72 Google - A - 26,439 0.65<br />

1,052 Halliburton 31,025 0.76<br />

50 Hartford Financial Services Group 2,285 0.06<br />

100 Hasbro 2,293 0.06<br />

20 Hess 1,378 0.03<br />

625 Hewlett-Packard 18,612 0.46<br />

1,353 HON HAI Precision Industry 9,860 0.24<br />

67 International Business Machines 5,204 0.13<br />

42 International Game Technology 939 0.02<br />

472 Inverness Medical Innovations 11,212 0.28<br />

221 ITT Industries 9,071 0.22<br />

1,560 Janus Capital Group 28,119 0.69<br />

683 Johnson & Johnson 29,429 0.72<br />

183 JPMorgan Chase & Co 5,599 0.14<br />

112 Kilroy Realty 3,777 0.09<br />

251 Kimco Realty 6,437 0.16<br />

36 Lehman Brothers Holdings 1,020 0.02<br />

67 Lincoln National 2,321 0.06<br />

1,391 Lowe’s 22,502 0.55<br />

134 Macerich 6,313 0.15<br />

70 Marathon Oil 2,063 0.05<br />

369 McDonald’s 14,134 0.35<br />

211 McKesson 7,078 0.17<br />

124 MEMC Electronic Materials 5,000 0.12<br />

569 Merck & Co 13,903 0.34<br />

56 Merrill Lynch & Co 1,782 0.04<br />

93 Metlife 3,651 0.09<br />

1,010 Microsoft 18,495 0.45<br />

403 Monsanto 29,521 0.72<br />

186 Moodys 4,406 0.11<br />

206 National Retail Properties 3,026 0.07<br />

49 National-Oilwell 2,172 0.05<br />

262 Nationwide Health Properties 6,058 0.15<br />

669 Nike - B - 28,707 0.70<br />

43 Northrop Grumman 2,017 0.05<br />

50 Nucor 2,436 0.06<br />

74 Occidental Petroleum 3,971 0.10<br />

2,064 Oracle 27,638 0.68<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

130