ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

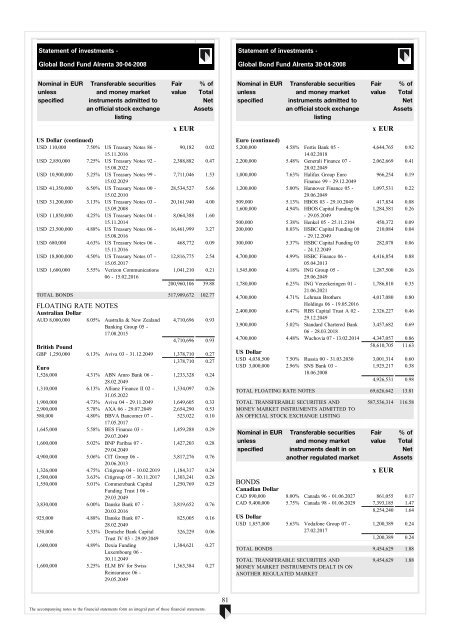

Statement of investments -<br />

Global Bond Fund Alrenta 30-04-2008<br />

Statement of investments -<br />

Global Bond Fund Alrenta 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

US Dollar (continued)<br />

USD 110,000 7.50% US Treasury Notes 86 -<br />

15.11.2016<br />

USD 2,850,000 7.25% US Treasury Notes 92 -<br />

15.08.2022<br />

USD 10,900,000 5.25% US Treasury Notes 99 -<br />

15.02.2029<br />

USD 41,350,000 6.50% US Treasury Notes 00 -<br />

15.02.2010<br />

USD 31,200,000 3.13% US Treasury Notes 03 -<br />

15.09.2008<br />

USD 11,850,000 4.25% US Treasury Notes 04 -<br />

15.11.2014<br />

USD 23,500,000 4.88% US Treasury Notes 06 -<br />

15.08.2016<br />

USD 680,000 4.63% US Treasury Notes 06 -<br />

15.11.2016<br />

USD 18,800,000 4.50% US Treasury Notes 07 -<br />

15.05.2017<br />

USD 1,600,000 5.55% Verizon Communications<br />

06 - 15.02.2016<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

90,182 0.02<br />

2,388,882 0.47<br />

7,711,046 1.53<br />

28,534,527 5.66<br />

20,161,940 4.00<br />

8,064,388 1.60<br />

16,461,999 3.27<br />

468,772 0.09<br />

12,816,775 2.54<br />

1,041,210 0.21<br />

200,960,106 39.88<br />

TOTAL BONDS 517,909,672 102.77<br />

FLOATING RATE NOTES<br />

Australian Dollar<br />

AUD 8,000,000 8.05% Australia & New Zealand<br />

Banking Group 05 -<br />

17.08.2015<br />

4,710,696 0.93<br />

4,710,696 0.93<br />

British Pound<br />

GBP 1,250,000 6.13% Aviva 03 - 31.12.2049 1,378,710 0.27<br />

1,378,710 0.27<br />

Euro<br />

1,526,000 4.31% <strong>ABN</strong> Amro Bank 06 - 1,233,328 0.24<br />

28.02.2049<br />

1,310,000 6.13% Allianz Finance II 02 - 1,334,097 0.26<br />

31.05.2022<br />

1,900,000 4.73% Aviva 04 - 29.11.2049 1,649,605 0.33<br />

2,900,000 5.78% AXA 06 - 29.07.2049 2,654,290 0.53<br />

580,000 4.80% BBVA Ban<strong>com</strong>er 07 - 523,022 0.10<br />

17.05.2017<br />

1,645,000 5.58% BES Finance 03 -<br />

1,459,288 0.29<br />

29.07.2049<br />

1,600,000 5.02% BNP Paribas 07 -<br />

1,427,203 0.28<br />

29.04.2049<br />

4,900,000 5.06% CIT Group 06 -<br />

3,817,276 0.76<br />

20.06.2013<br />

1,326,000 4.75% Citigroup 04 - 10.02.2019 1,184,317 0.24<br />

1,500,000 3.63% Citigroup 05 - 30.11.2017 1,303,241 0.26<br />

1,550,000 5.01% Commerzbank Capital 1,250,769 0.25<br />

Funding Trust I 06 -<br />

29.03.2049<br />

3,830,000 6.00% Danske Bank 07 -<br />

3,819,652 0.76<br />

20.03.2016<br />

925,000 4.88% Danske Bank 07 -<br />

825,005 0.16<br />

28.02.2049<br />

350,000 5.33% Deutsche Bank Capital 326,229 0.06<br />

Trust IV 03 - 29.09.2049<br />

1,600,000 4.89% Dexia Funding<br />

1,384,621 0.27<br />

Luxembourg 06 -<br />

30.11.2049<br />

1,600,000 5.25% ELM BV for Swiss<br />

Reinsurance 06 -<br />

29.05.2049<br />

1,363,384 0.27<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Euro (continued)<br />

5,200,000 4.58% Fortis Bank 05 -<br />

4,644,765 0.92<br />

14.02.2018<br />

2,200,000 5.48% Generali Finance 07 - 2,062,669 0.41<br />

28.02.2049<br />

1,000,000 7.63% Halifax Group Euro<br />

966,254 0.19<br />

Finance 99 - 29.12.2049<br />

1,200,000 5.00% Hannover Finance 05 - 1,097,531 0.22<br />

29.06.2049<br />

509,000 5.13% HBOS 03 - 29.10.2049 417,834 0.08<br />

1,600,000 4.94% HBOS Capital Funding 06 1,284,581 0.26<br />

- 29.05.2049<br />

500,000 5.38% Henkel 05 - 25.11.2104 450,372 0.09<br />

200,000 8.03% HSBC Capital Funding 00 210,084 0.04<br />

- 29.12.2049<br />

300,000 5.37% HSBC Capital Funding 03 282,078 0.06<br />

- 24.12.2049<br />

4,700,000 4.99% HSBC Finance 06 - 4,416,854 0.88<br />

05.04.2013<br />

1,545,000 4.18% ING Group 05 -<br />

1,287,500 0.26<br />

29.06.2049<br />

1,780,000 6.25% ING Verzekeringen 01 - 1,786,810 0.35<br />

21.06.2021<br />

4,700,000 4.71% Lehman Brothers<br />

4,017,080 0.80<br />

Holdings 06 - 19.05.2016<br />

2,400,000 6.47% RBS Capital Trust A 02 - 2,326,227 0.46<br />

29.12.2049<br />

3,900,000 5.02% Standard Chartered Bank 3,457,682 0.69<br />

06 - 28.03.2018<br />

4,700,000 4.48% Wachovia 07 - 13.02.2014 4,347,057 0.86<br />

58,610,705 11.63<br />

US Dollar<br />

USD 4,038,500 7.50% Russia 00 - 31.03.2030 3,001,314 0.60<br />

USD 3,000,000 2.96% SNS Bank 03 -<br />

1,925,217 0.38<br />

18.06.2008<br />

4,926,531 0.98<br />

TOTAL FLOATING RATE NOTES 69,626,642 13.81<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

587,536,314 116.58<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

BONDS<br />

Canadian Dollar<br />

CAD 890,000 8.00% Canada 96 - 01.06.2027 861,055 0.17<br />

CAD 9,400,000 5.75% Canada 98 - 01.06.2029 7,393,185 1.47<br />

8,254,240 1.64<br />

US Dollar<br />

USD 1,857,000 5.63% Vodafone Group 07 -<br />

27.02.2017<br />

1,200,389 0.24<br />

1,200,389 0.24<br />

TOTAL BONDS 9,454,629 1.88<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

9,454,629 1.88<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

81