ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

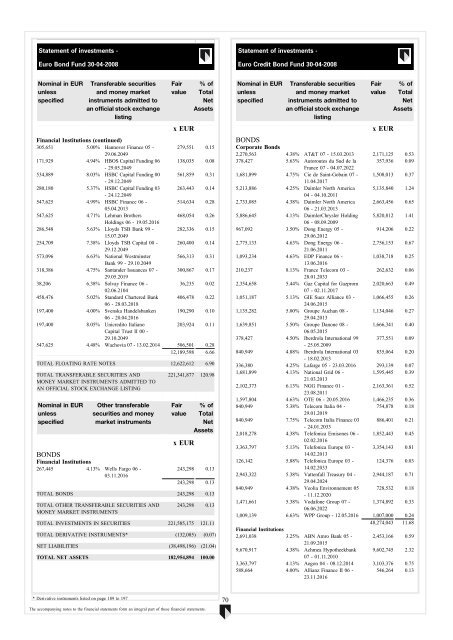

Statement of investments -<br />

Euro Bond Fund 30-04-2008<br />

Statement of investments -<br />

Euro Credit Bond Fund 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

305,651 5.00% Hannover Finance 05 - 279,551 0.15<br />

29.06.2049<br />

171,929 4.94% HBOS Capital Funding 06 138,035 0.08<br />

- 29.05.2049<br />

534,889 8.03% HSBC Capital Funding 00 561,859 0.31<br />

- 29.12.2049<br />

280,180 5.37% HSBC Capital Funding 03 263,443 0.14<br />

- 24.12.2049<br />

547,625 4.99% HSBC Finance 06 -<br />

514,634 0.28<br />

05.04.2013<br />

547,625 4.71% Lehman Brothers<br />

468,054 0.26<br />

Holdings 06 - 19.05.2016<br />

286,548 5.63% Lloyds TSB Bank 99 - 282,336 0.15<br />

15.07.2049<br />

254,709 7.38% Lloyds TSB Capital 00 - 260,400 0.14<br />

29.12.2049<br />

573,096 6.63% National Westminster 566,313 0.31<br />

Bank 99 - 29.10.2049<br />

318,386 4.75% Santander Issuances 07 - 300,867 0.17<br />

29.05.2019<br />

38,206 6.38% Solvay Finance 06 -<br />

36,235 0.02<br />

02.06.2104<br />

458,476 5.02% Standard Chartered Bank 406,478 0.22<br />

06 - 28.03.2018<br />

197,400 4.00% Svenska Handelsbanken 190,290 0.10<br />

06 - 20.04.2016<br />

197,400 8.05% Unicredito Italiano<br />

203,924 0.11<br />

Capital Trust II 00 -<br />

29.10.2049<br />

547,625 4.48% Wachovia 07 - 13.02.2014 506,501 0.28<br />

12,189,598 6.66<br />

TOTAL FLOATING RATE NOTES 12,622,612 6.90<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Other transferable<br />

securities and money<br />

market instruments<br />

BONDS<br />

Financial Institutions<br />

267,445 4.13% Wells Fargo 06 -<br />

03.11.2016<br />

221,341,877 120.98<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

243,298 0.13<br />

243,298 0.13<br />

TOTAL BONDS 243,298 0.13<br />

TOTAL OTHER TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS<br />

243,298 0.13<br />

TOTAL INVESTMENTS IN SECURITIES 221,585,175 121.11<br />

TOTAL DERIVATIVE INSTRUMENTS* (132,085) (0.07)<br />

NET LIABILITIES (38,498,196) (21.04)<br />

TOTAL NET ASSETS 182,954,894 100.00<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

% of<br />

Total<br />

Net<br />

Assets<br />

x EUR<br />

BONDS<br />

Corporate Bonds<br />

2,270,563 4.38% AT&T 07 - 15.03.2013 2,171,125 0.53<br />

378,427 5.63% Autoroutes du Sud de la 357,936 0.09<br />

France 07 - 04.07.2022<br />

1,681,899 4.75% Cie de Saint-Gobain 07 - 1,508,013 0.37<br />

11.04.2017<br />

5,213,886 4.25% Daimler North America 5,135,840 1.24<br />

04 - 04.10.2011<br />

2,733,085 4.38% Daimler North America 2,663,456 0.65<br />

06 - 21.03.2013<br />

5,886,645 4.13% DaimlerChrysler Holding 5,820,812 1.41<br />

06 - 08.09.2009<br />

967,092 3.50% Dong Energy 05 -<br />

914,206 0.22<br />

29.06.2012<br />

2,775,133 4.63% Dong Energy 06 -<br />

2,756,153 0.67<br />

21.06.2011<br />

1,093,234 4.63% EDP Finance 06 -<br />

1,038,718 0.25<br />

13.06.2016<br />

210,237 8.13% France Tele<strong>com</strong> 03 -<br />

262,632 0.06<br />

28.01.2033<br />

2,354,658 5.44% Gaz Capital for Gazprom 2,020,663 0.49<br />

07 - 02.11.2017<br />

1,051,187 5.13% GIE Suez Alliance 03 - 1,066,455 0.26<br />

24.06.2015<br />

1,135,282 5.00% Groupe Auchan 08 - 1,134,046 0.27<br />

29.04.2013<br />

1,639,851 5.50% Groupe Danone 08 - 1,666,341 0.40<br />

06.05.2015<br />

378,427 4.50% Iberdrola International 99 377,551 0.09<br />

- 25.05.2009<br />

840,949 4.88% Iberdrola International 03 835,064 0.20<br />

- 18.02.2013<br />

336,380 4.25% Lafarge 05 - 23.03.2016 293,139 0.07<br />

1,681,899 4.13% National Grid 06 -<br />

1,595,445 0.39<br />

21.03.2013<br />

2,102,373 6.13% NGG Finance 01 -<br />

2,163,361 0.52<br />

23.08.2011<br />

1,597,804 4.63% OTE 06 - 20.05.2016 1,466,235 0.36<br />

840,949 5.38% Tele<strong>com</strong> Italia 04 -<br />

754,878 0.18<br />

29.01.2019<br />

840,949 7.75% Tele<strong>com</strong> Italia Finance 03 886,401 0.21<br />

- 24.01.2033<br />

2,018,278 4.38% Telefonica Emisones 06 - 1,852,443 0.45<br />

02.02.2016<br />

3,363,797 5.13% Telefonica Europe 03 - 3,354,143 0.81<br />

14.02.2013<br />

126,142 5.88% Telefonica Europe 03 - 124,376 0.03<br />

14.02.2033<br />

2,943,322 5.38% Vattenfall Treasury 04 - 2,944,187 0.71<br />

29.04.2024<br />

840,949 4.38% Veolia Environnement 05 728,532 0.18<br />

- 11.12.2020<br />

1,471,661 5.38% Vodafone Group 07 - 1,374,892 0.33<br />

06.06.2022<br />

1,009,139 6.63% WPP Group - 12.05.2016 1,007,000 0.24<br />

48,274,043 11.68<br />

Financial Institutions<br />

2,691,038 3.25% <strong>ABN</strong> Amro Bank 05 - 2,453,166 0.59<br />

21.09.2015<br />

9,670,917 4.38% Achmea Hypotheekbank 9,602,745 2.32<br />

07 - 01.11.2010<br />

3,363,797 4.13% Aegon 04 - 08.12.2014 3,103,376 0.75<br />

588,664 4.00% Allianz Finance II 06 -<br />

23.11.2016<br />

546,264 0.13<br />

* Derivative instruments listed on page 189 to 197<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

70