ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

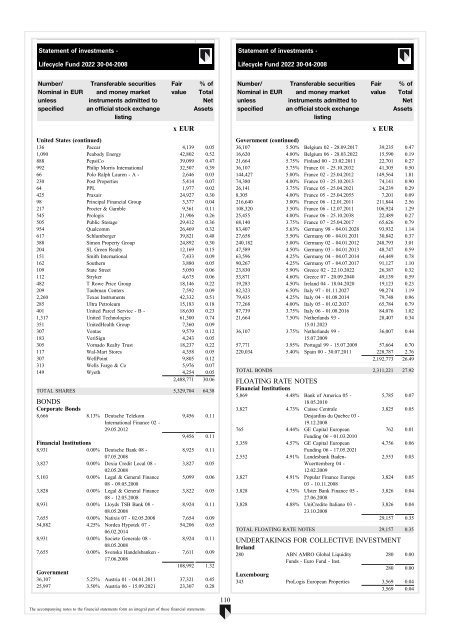

Statement of investments -<br />

Lifecycle Fund 2022 30-04-2008<br />

Statement of investments -<br />

Lifecycle Fund 2022 30-04-2008<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

United States (continued)<br />

136 Paccar 4,139 0.05<br />

1,090 Peabody Energy 42,802 0.52<br />

888 PepsiCo 39,099 0.47<br />

992 Philip Morris International 32,507 0.39<br />

66 Polo Ralph Lauren - A - 2,646 0.03<br />

230 Post Properties 5,414 0.07<br />

64 PPL 1,977 0.02<br />

425 Praxair 24,927 0.30<br />

98 Principal Financial Group 3,377 0.04<br />

217 Procter & Gamble 9,361 0.11<br />

545 Prologis 21,906 0.26<br />

505 Public Storage 29,412 0.36<br />

954 Qual<strong>com</strong>m 26,469 0.32<br />

617 Schlumberger 39,821 0.48<br />

388 Simon Property Group 24,892 0.30<br />

204 SL Green Realty 12,169 0.15<br />

151 Smith International 7,433 0.09<br />

162 Southern 3,880 0.05<br />

109 State Street 5,050 0.06<br />

112 Stryker 4,675 0.06<br />

482 T Rowe Price Group 18,146 0.22<br />

209 Taubman Centers 7,592 0.09<br />

2,260 Texas Instruments 42,332 0.51<br />

285 Ultra Petroleum 15,183 0.18<br />

401 United Parcel Service - B - 18,630 0.23<br />

1,317 United Technologies 61,300 0.74<br />

351 UnitedHealth Group 7,360 0.09<br />

307 Ventas 9,579 0.12<br />

183 VeriSign 4,243 0.05<br />

305 Vornado Realty Trust 18,237 0.22<br />

117 Wal-Mart Stores 4,358 0.05<br />

307 WellPoint 9,805 0.12<br />

313 Wells Fargo & Co 5,976 0.07<br />

149 Wyeth 4,254 0.05<br />

2,488,771 30.06<br />

TOTAL SHARES 5,329,704 64.38<br />

BONDS<br />

Corporate Bonds<br />

8,666 8.13% Deutsche Telekom<br />

9,456 0.11<br />

International Finance 02 -<br />

29.05.2012<br />

9,456 0.11<br />

Financial Institutions<br />

8,931 0.00% Deutsche Bank 08 -<br />

8,925 0.11<br />

07.05.2008<br />

3,827 0.00% Dexia Credit Local 08 - 3,827 0.05<br />

02.05.2008<br />

5,103 0.00% Legal & General Finance 5,099 0.06<br />

08 - 09.05.2008<br />

3,828 0.00% Legal & General Finance 3,822 0.05<br />

08 - 12.05.2008<br />

8,931 0.00% Lloyds TSB Bank 08 -<br />

8,924 0.11<br />

08.05.2008<br />

7,655 0.00% Natixis 07 - 02.05.2008 7,654 0.09<br />

54,882 4.25% Nordea Hypotek 07 -<br />

54,206 0.65<br />

06.02.2014<br />

8,931 0.00% Societe Generale 08 -<br />

8,924 0.11<br />

08.05.2008<br />

7,655 0.00% Svenska Handelsbanken - 7,611 0.09<br />

17.06.2008<br />

108,992 1.32<br />

Government<br />

36,107 5.25% Austria 01 - 04.01.2011 37,321 0.45<br />

25,997 3.50% Austria 06 - 15.09.2021 23,307 0.28<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

Number/<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Government (continued)<br />

36,107 5.50% Belgium 02 - 28.09.2017 39,235 0.47<br />

16,620 4.00% Belgium 06 - 28.03.2022 15,590 0.19<br />

21,664 5.75% Finland 00 - 23.02.2011 22,701 0.27<br />

36,107 5.75% France 01 - 25.10.2032 41,305 0.50<br />

144,427 5.00% France 02 - 25.04.2012 149,564 1.81<br />

74,380 4.00% France 03 - 25.10.2013 74,141 0.90<br />

26,141 3.75% France 05 - 25.04.2021 24,239 0.29<br />

8,305 4.00% France 05 - 25.04.2055 7,201 0.09<br />

216,640 3.00% France 06 - 12.01.2011 211,844 2.56<br />

108,320 3.50% France 06 - 12.07.2011 106,924 1.29<br />

25,455 4.00% France 06 - 25.10.2038 22,489 0.27<br />

68,140 3.75% France 07 - 25.04.2017 65,626 0.79<br />

83,407 5.63% Germany 98 - 04.01.2028 93,932 1.14<br />

27,658 5.50% Germany 00 - 04.01.2031 30,842 0.37<br />

240,182 5.00% Germany 02 - 04.01.2012 248,793 3.01<br />

47,589 4.50% Germany 03 - 04.01.2013 48,747 0.59<br />

63,596 4.25% Germany 04 - 04.07.2014 64,449 0.78<br />

90,267 4.25% Germany 07 - 04.07.2017 91,127 1.10<br />

23,830 5.90% Greece 02 - 22.10.2022 26,387 0.32<br />

53,871 4.60% Greece 07 - 20.09.2040 49,139 0.59<br />

19,283 4.50% Ireland 04 - 18.04.2020 19,123 0.23<br />

82,323 6.50% Italy 97 - 01.11.2027 98,274 1.19<br />

79,435 4.25% Italy 04 - 01.08.2014 79,748 0.96<br />

77,268 4.00% Italy 05 - 01.02.2037 65,784 0.79<br />

87,739 3.75% Italy 06 - 01.08.2016 84,076 1.02<br />

21,664 7.50% Netherlands 93 -<br />

28,407 0.34<br />

15.01.2023<br />

36,107 3.75% Netherlands 99 -<br />

36,007 0.44<br />

15.07.2009<br />

57,771 3.95% Portugal 99 - 15.07.2009 57,664 0.70<br />

220,034 5.40% Spain 00 - 30.07.2011 228,787 2.76<br />

2,192,773 26.49<br />

TOTAL BONDS 2,311,221 27.92<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

5,869 4.48% Bank of America 05 -<br />

18.05.2010<br />

3,827 4.73% Caisse Centrale<br />

Desjardins du Quebec 03 -<br />

19.12.2008<br />

765 4.44% GE Capital European<br />

Funding 06 - 01.03.2010<br />

5,359 4.57% GE Capital European<br />

Funding 06 - 17.05.2021<br />

2,552 4.91% Landesbank Baden-<br />

Wuerttemberg 04 -<br />

12.02.2009<br />

3,827 4.91% Popular Finance Europe<br />

03 - 10.11.2008<br />

3,828 4.75% Ulster Bank Finance 05 -<br />

27.06.2008<br />

3,828 4.88% UniCredito Italiano 03 -<br />

23.10.2008<br />

5,785 0.07<br />

3,825 0.05<br />

762 0.01<br />

4,756 0.06<br />

2,553 0.03<br />

3,824 0.05<br />

3,826 0.04<br />

3,826 0.04<br />

29,157 0.35<br />

TOTAL FLOATING RATE NOTES 29,157 0.35<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Ireland<br />

280 <strong>ABN</strong> <strong>AMRO</strong> Global Liquidity<br />

280 0.00<br />

<strong>Funds</strong> - Euro Fund - Inst.<br />

280 0.00<br />

Luxembourg<br />

343 ProLogis European Properties 3,569 0.04<br />

3,569 0.04<br />

110