ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

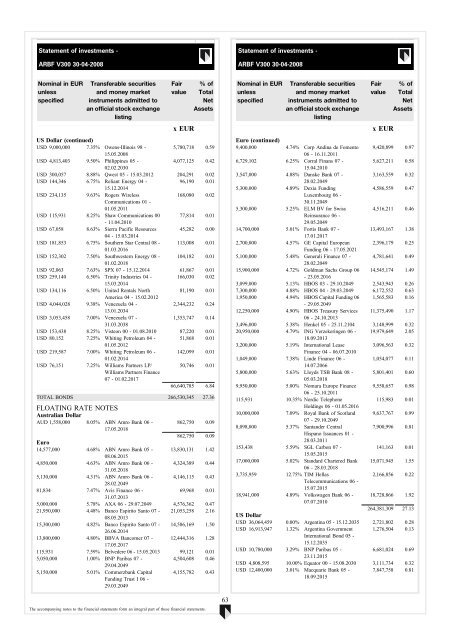

Statement of investments -<br />

ARBF V300 30-04-2008<br />

Statement of investments -<br />

ARBF V300 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

US Dollar (continued)<br />

USD 9,000,000 7.35% Owens-Illinois 98 -<br />

5,780,718 0.59<br />

15.05.2008<br />

USD 4,813,403 9.50% Philippines 05 -<br />

4,077,125 0.42<br />

02.02.2030<br />

USD 300,057 8.88% Qwest 05 - 15.03.2012 204,291 0.02<br />

USD 144,346 6.75% Reliant Energy 04 -<br />

96,190 0.01<br />

15.12.2014<br />

USD 234,135 9.63% Rogers Wireless<br />

168,080 0.02<br />

Communications 01 -<br />

01.05.2011<br />

USD 115,931 8.25% Shaw Communications 00 77,814 0.01<br />

- 11.04.2010<br />

USD 67,058 8.63% Sierra Pacific Resources 45,282 0.00<br />

04 - 15.03.2014<br />

USD 181,853 6.75% Southern Star Central 08 - 113,008 0.01<br />

01.03.2016<br />

USD 152,302 7.50% Southwestern Energy 08 - 104,182 0.01<br />

01.02.2018<br />

USD 92,063 7.63% SPX 07 - 15.12.2014 61,867 0.01<br />

USD 259,140 6.50% Trinity Industries 04 - 166,030 0.02<br />

15.03.2014<br />

USD 134,116 6.50% United Rentals North<br />

81,190 0.01<br />

America 04 - 15.02.2012<br />

USD 4,044,028 9.38% Venezuela 04 -<br />

2,344,232 0.24<br />

13.01.2034<br />

USD 3,053,458 7.00% Venezuela 07 -<br />

1,353,747 0.14<br />

31.03.2038<br />

USD 153,438 8.25% Visteon 00 - 01.08.2010 87,220 0.01<br />

USD 80,152 7.25% Whiting Petroleum 04 - 51,868 0.01<br />

01.05.2012<br />

USD 219,587 7.00% Whiting Petroleum 06 - 142,099 0.01<br />

01.02.2014<br />

USD 76,151 7.25% Williams Partners LP/<br />

50,746 0.01<br />

Williams Partners Finance<br />

07 - 01.02.2017<br />

66,640,785 6.84<br />

TOTAL BONDS 266,530,345 27.36<br />

FLOATING RATE NOTES<br />

Australian Dollar<br />

AUD 1,558,000 8.05% <strong>ABN</strong> Amro Bank 06 -<br />

17.05.2018<br />

862,750 0.09<br />

862,750 0.09<br />

Euro<br />

14,577,000 4.68% <strong>ABN</strong> Amro Bank 05 - 13,830,131 1.42<br />

08.06.2015<br />

4,850,000 4.63% <strong>ABN</strong> Amro Bank 06 - 4,324,389 0.44<br />

31.05.2018<br />

5,130,000 4.31% <strong>ABN</strong> Amro Bank 06 - 4,146,115 0.43<br />

28.02.2049<br />

81,834 7.47% Avis Finance 06 -<br />

69,968 0.01<br />

31.07.2013<br />

5,000,000 5.78% AXA 06 - 29.07.2049 4,576,362 0.47<br />

21,950,000 4.48% Banco Espirito Santo 07 - 21,053,258 2.16<br />

08.05.2013<br />

15,300,000 4.82% Banco Espirito Santo 07 - 14,586,169 1.50<br />

26.06.2014<br />

13,800,000 4.80% BBVA Ban<strong>com</strong>er 07 - 12,444,316 1.28<br />

17.05.2017<br />

115,931 7.59% Belvedere 06 - 15.05.2013 99,121 0.01<br />

5,050,000 1.00% BNP Paribas 07 -<br />

4,504,608 0.46<br />

29.04.2049<br />

5,150,000 5.01% Commerzbank Capital<br />

Funding Trust I 06 -<br />

29.03.2049<br />

4,155,782 0.43<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Euro (continued)<br />

9,400,000 4.74% Corp Andina de Fomento 9,420,899 0.97<br />

06 - 16.11.2011<br />

6,729,102 6.25% Corral Finans 07 -<br />

5,627,211 0.58<br />

15.04.2010<br />

3,547,000 4.88% Danske Bank 07 -<br />

3,163,559 0.32<br />

28.02.2049<br />

5,300,000 4.89% Dexia Funding<br />

4,586,559 0.47<br />

Luxembourg 06 -<br />

30.11.2049<br />

5,300,000 5.25% ELM BV for Swiss<br />

4,516,211 0.46<br />

Reinsurance 06 -<br />

29.05.2049<br />

14,700,000 5.01% Fortis Bank 07 -<br />

13,493,167 1.38<br />

17.01.2017<br />

2,700,000 4.57% GE Capital European 2,396,179 0.25<br />

Funding 06 - 17.05.2021<br />

5,100,000 5.48% Generali Finance 07 - 4,781,641 0.49<br />

28.02.2049<br />

15,900,000 4.72% Goldman Sachs Group 06 14,545,174 1.49<br />

- 23.05.2016<br />

3,099,000 5.13% HBOS 03 - 29.10.2049 2,543,943 0.26<br />

7,300,000 4.88% HBOS 04 - 29.03.2049 6,172,552 0.63<br />

1,950,000 4.94% HBOS Capital Funding 06 1,565,583 0.16<br />

- 29.05.2049<br />

12,250,000 4.90% HBOS Treasury Services 11,375,490 1.17<br />

06 - 24.10.2013<br />

3,496,000 5.38% Henkel 05 - 25.11.2104 3,148,999 0.32<br />

20,950,000 4.79% ING Verzekeringen 06 - 19,979,649 2.05<br />

18.09.2013<br />

3,200,000 5.19% International Lease<br />

3,096,563 0.32<br />

Finance 04 - 06.07.2010<br />

1,049,000 7.38% Linde Finance 06 -<br />

1,054,077 0.11<br />

14.07.2066<br />

5,800,000 5.63% Lloyds TSB Bank 08 - 5,801,401 0.60<br />

05.03.2018<br />

9,950,000 5.00% Nomura Europe Finance 9,558,657 0.98<br />

06 - 25.10.2011<br />

115,931 10.35% Nordic Telephone<br />

115,983 0.01<br />

Holdings 06 - 01.05.2016<br />

10,000,000 7.09% Royal Bank of Scotland 9,637,767 0.99<br />

07 - 29.10.2049<br />

8,098,000 5.37% Santander Central<br />

7,900,996 0.81<br />

Hispano Issuances 01 -<br />

28.03.2011<br />

153,438 5.59% SGL Carbon 07 -<br />

141,163 0.01<br />

15.05.2015<br />

17,000,000 5.02% Standard Chartered Bank 15,071,945 1.55<br />

06 - 28.03.2018<br />

3,735,959 12.75% TIM Hellas<br />

2,166,856 0.22<br />

Tele<strong>com</strong>munications 06 -<br />

15.07.2015<br />

18,941,000 4.89% Volkswagen Bank 06 - 18,728,866 1.92<br />

07.07.2010<br />

264,381,309 27.13<br />

US Dollar<br />

USD 36,064,459 0.00% Argentina 05 - 15.12.2035 2,721,802 0.28<br />

USD 16,913,947 1.32% Argentina Government 1,276,504 0.13<br />

International Bond 05 -<br />

15.12.2035<br />

USD 10,780,000 3.29% BNP Paribas 05 -<br />

6,681,024 0.69<br />

23.11.2015<br />

USD 4,808,595 10.00% Equator 00 - 15.08.2030 3,111,734 0.32<br />

USD 12,400,000 3.01% Macquarie Bank 05 -<br />

18.09.2015<br />

7,847,758 0.81<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

63