ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

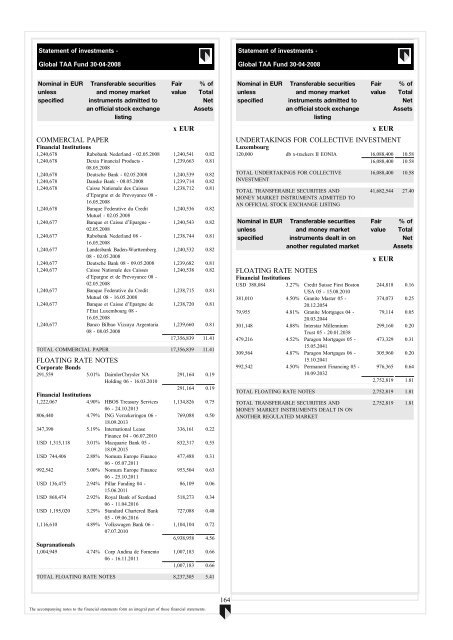

Statement of investments -<br />

Global TAA Fund 30-04-2008<br />

Statement of investments -<br />

Global TAA Fund 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

COMMERCIAL PAPER<br />

Financial Institutions<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

1,240,678 Rabobank Nederland - 02.05.2008 1,240,541 0.82<br />

1,240,678 Dexia Financial Products -<br />

1,239,663 0.81<br />

08.05.2008<br />

1,240,678 Deutsche Bank - 02.05.2008 1,240,539 0.82<br />

1,240,678 Danske Bank - 08.05.2008 1,239,714 0.82<br />

1,240,678 Caisse Nationale des Caisses 1,238,712 0.81<br />

d’Epargne et de Prevoyance 08 -<br />

16.05.2008<br />

1,240,678 Banque Federative du Credit 1,240,536 0.82<br />

Mutuel - 02.05.2008<br />

1,240,677 Banque et Caisse d’Epargne - 1,240,543 0.82<br />

02.05.2008<br />

1,240,677 Rabobank Nederland 08 -<br />

1,238,744 0.81<br />

16.05.2008<br />

1,240,677 Landesbank Baden-Wurttemberg 1,240,532 0.82<br />

08 - 02.05.2008<br />

1,240,677 Deutsche Bank 08 - 09.05.2008 1,239,682 0.81<br />

1,240,677 Caisse Nationale des Caisses 1,240,538 0.82<br />

d’Epargne et de Prevoyance 08 -<br />

02.05.2008<br />

1,240,677 Banque Federative du Credit 1,238,715 0.81<br />

Mutuel 08 - 16.05.2008<br />

1,240,677 Banque et Caisse d’Epargne de 1,238,720 0.81<br />

l’Etat Luxembourg 08 -<br />

16.05.2008<br />

1,240,677 Banco Bilbao Vizcaya Argentaria 1,239,660 0.81<br />

08 - 08.05.2008<br />

17,356,839 11.41<br />

TOTAL COMMERCIAL PAPER 17,356,839 11.41<br />

FLOATING RATE NOTES<br />

Corporate Bonds<br />

291,559 5.01% DaimlerChrysler NA<br />

Holding 06 - 16.03.2010<br />

Financial Institutions<br />

1,222,067 4.90% HBOS Treasury Services<br />

06 - 24.10.2013<br />

806,440 4.79% ING Verzekeringen 06 -<br />

18.09.2013<br />

347,390 5.19% International Lease<br />

Finance 04 - 06.07.2010<br />

USD 1,315,118 3.01% Macquarie Bank 05 -<br />

18.09.2015<br />

USD 744,406 2.88% Nomura Europe Finance<br />

06 - 05.07.2011<br />

992,542 5.00% Nomura Europe Finance<br />

06 - 25.10.2011<br />

USD 136,475 2.94% Pillar Funding 04 -<br />

15.06.2011<br />

USD 868,474 2.92% Royal Bank of Scotland<br />

06 - 11.04.2016<br />

USD 1,195,020 3.29% Standard Chartered Bank<br />

05 - 09.06.2016<br />

1,116,610 4.89% Volkswagen Bank 06 -<br />

07.07.2010<br />

Supranationals<br />

1,004,949 4.74% Corp Andina de Fomento<br />

06 - 16.11.2011<br />

291,164 0.19<br />

291,164 0.19<br />

1,134,826 0.75<br />

769,088 0.50<br />

336,161 0.22<br />

832,317 0.55<br />

477,488 0.31<br />

953,504 0.63<br />

86,109 0.06<br />

518,273 0.34<br />

727,088 0.48<br />

1,104,104 0.72<br />

6,938,958 4.56<br />

1,007,183 0.66<br />

1,007,183 0.66<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

% of<br />

Total<br />

Net<br />

Assets<br />

x EUR<br />

UNDERTAKINGS FOR COLLECTIVE INVESTMENT<br />

Luxembourg<br />

120,000 db x-trackers II EONIA 16,088,400 10.58<br />

16,088,400 10.58<br />

TOTAL UNDERTAKINGS FOR COLLECTIVE<br />

INVESTMENT<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments dealt in on<br />

another regulated market<br />

FLOATING RATE NOTES<br />

Financial Institutions<br />

USD 388,084 3.27% Credit Suisse First Boston<br />

USA 05 - 15.08.2010<br />

381,010 4.50% Granite Master 05 -<br />

20.12.2054<br />

79,955 4.81% Granite Mortgages 04 -<br />

20.03.2044<br />

301,148 4.88% Interstar Millennium<br />

Trust 05 - 20.01.2038<br />

479,216 4.52% Paragon Mortgages 05 -<br />

15.05.2041<br />

309,564 4.87% Paragon Mortgages 06 -<br />

15.10.2041<br />

992,542 4.50% Permanent Financing 05 -<br />

10.09.2032<br />

16,088,400 10.58<br />

41,682,544 27.40<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

244,818 0.16<br />

374,073 0.25<br />

79,114 0.05<br />

299,160 0.20<br />

473,329 0.31<br />

305,960 0.20<br />

976,365 0.64<br />

2,752,819 1.81<br />

TOTAL FLOATING RATE NOTES 2,752,819 1.81<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS DEALT IN ON<br />

ANOTHER REGULATED MARKET<br />

2,752,819 1.81<br />

TOTAL FLOATING RATE NOTES 8,237,305 5.41<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

164