ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

ABN AMRO Funds - Aia.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

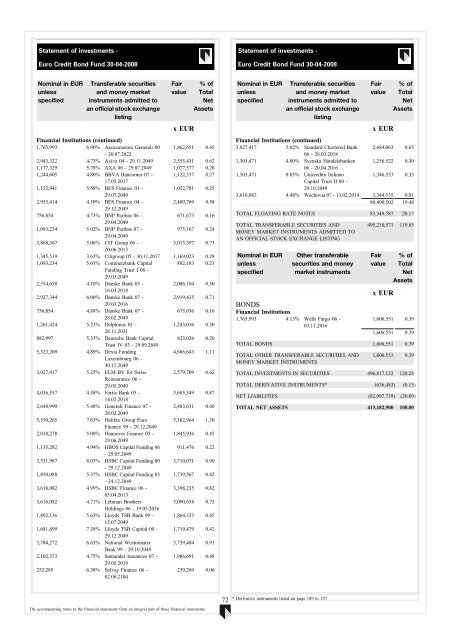

Statement of investments -<br />

Euro Credit Bond Fund 30-04-2008<br />

Statement of investments -<br />

Euro Credit Bond Fund 30-04-2008<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

1,765,993 6.90% Assicurazioni Generali 00 1,862,651 0.45<br />

- 20.07.2022<br />

2,943,322 4.73% Aviva 04 - 29.11.2049 2,555,431 0.62<br />

1,177,329 5.78% AXA 06 - 29.07.2049 1,077,577 0.26<br />

1,244,605 4.80% BBVA Ban<strong>com</strong>er 07 - 1,122,337 0.27<br />

17.05.2017<br />

1,152,941 5.58% BES Finance 03 -<br />

1,022,781 0.25<br />

29.07.2049<br />

2,953,414 4.50% BES Finance 04 -<br />

2,409,769 0.58<br />

29.12.2049<br />

756,854 4.73% BNP Paribas 06 -<br />

671,673 0.16<br />

29.04.2049<br />

1,093,234 5.02% BNP Paribas 07 -<br />

975,167 0.24<br />

29.04.2049<br />

3,868,367 5.06% CIT Group 06 -<br />

3,013,597 0.73<br />

20.06.2013<br />

1,345,519 3.63% Citigroup 05 - 30.11.2017 1,169,023 0.28<br />

1,093,234 5.01% Commerzbank Capital 882,183 0.21<br />

Funding Trust I 06 -<br />

29.03.2049<br />

2,354,658 4.10% Danske Bank 05 -<br />

2,086,104 0.50<br />

16.03.2018<br />

2,927,344 6.00% Danske Bank 07 -<br />

2,919,435 0.71<br />

20.03.2016<br />

756,854 4.88% Danske Bank 07 -<br />

675,036 0.16<br />

28.02.2049<br />

1,261,424 5.21% Delphinus 01 -<br />

1,243,016 0.30<br />

28.11.2031<br />

882,997 5.33% Deutsche Bank Capital 823,026 0.20<br />

Trust IV 03 - 29.09.2049<br />

5,323,209 4.89% Dexia Funding<br />

4,606,643 1.11<br />

Luxembourg 06 -<br />

30.11.2049<br />

3,027,417 5.25% ELM BV for Swiss<br />

2,579,709 0.62<br />

Reinsurance 06 -<br />

29.05.2049<br />

4,036,557 4.58% Fortis Bank 05 -<br />

3,605,549 0.87<br />

14.02.2018<br />

2,648,990 5.48% Generali Finance 07 - 2,483,631 0.60<br />

28.02.2049<br />

5,550,265 7.63% Halifax Group Euro 5,362,964 1.30<br />

Finance 99 - 29.12.2049<br />

2,018,278 5.00% Hannover Finance 05 - 1,845,936 0.45<br />

29.06.2049<br />

1,135,282 4.94% HBOS Capital Funding 06 911,476 0.22<br />

- 29.05.2049<br />

3,531,987 8.03% HSBC Capital Funding 00 3,710,071 0.90<br />

- 29.12.2049<br />

1,850,088 5.37% HSBC Capital Funding 03 1,739,567 0.42<br />

- 24.12.2049<br />

3,616,082 4.99% HSBC Finance 06 - 3,398,235 0.82<br />

05.04.2013<br />

3,616,082 4.71% Lehman Brothers<br />

3,090,658 0.75<br />

Holdings 06 - 19.05.2016<br />

1,892,136 5.63% Lloyds TSB Bank 99 - 1,864,323 0.45<br />

15.07.2049<br />

1,681,899 7.38% Lloyds TSB Capital 00 - 1,719,479 0.42<br />

29.12.2049<br />

3,784,272 6.63% National Westminster 3,739,484 0.91<br />

Bank 99 - 29.10.2049<br />

2,102,373 4.75% Santander Issuances 07 - 1,986,691 0.48<br />

29.05.2019<br />

252,285 6.38% Solvay Finance 06 -<br />

02.06.2104<br />

239,269 0.06<br />

Nominal in EUR<br />

unless<br />

specified<br />

Transferable securities<br />

and money market<br />

instruments admitted to<br />

an official stock exchange<br />

listing<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

Financial Institutions (continued)<br />

3,027,417 5.02% Standard Chartered Bank 2,684,063 0.65<br />

06 - 28.03.2018<br />

1,303,471 4.00% Svenska Handelsbanken 1,256,522 0.30<br />

06 - 20.04.2016<br />

1,303,471 8.05% Unicredito Italiano<br />

1,346,553 0.33<br />

Capital Trust II 00 -<br />

29.10.2049<br />

3,616,082 4.48% Wachovia 07 - 13.02.2014 3,344,535 0.81<br />

80,490,502 19.48<br />

TOTAL FLOATING RATE NOTES 83,349,787 20.17<br />

TOTAL TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS ADMITTED TO<br />

AN OFFICIAL STOCK EXCHANGE LISTING<br />

Nominal in EUR<br />

unless<br />

specified<br />

Other transferable<br />

securities and money<br />

market instruments<br />

BONDS<br />

Financial Institutions<br />

1,765,993 4.13% Wells Fargo 06 -<br />

03.11.2016<br />

495,210,571 119.85<br />

Fair<br />

value<br />

x EUR<br />

% of<br />

Total<br />

Net<br />

Assets<br />

1,606,551 0.39<br />

1,606,551 0.39<br />

TOTAL BONDS 1,606,551 0.39<br />

TOTAL OTHER TRANSFERABLE SECURITIES AND<br />

MONEY MARKET INSTRUMENTS<br />

1,606,551 0.39<br />

TOTAL INVESTMENTS IN SECURITIES 496,817,122 120.24<br />

TOTAL DERIVATIVE INSTRUMENTS* (636,483) (0.15)<br />

NET LIABILITIES (82,997,739) (20.09)<br />

TOTAL NET ASSETS 413,182,900 100.00<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements.<br />

72<br />

* Derivative instruments listed on page 189 to 197